The essence of the problem on the part of banks

The current legislation of the Russian Federation does not prohibit the execution of several mortgage loans at the same time. Neither 102-FZ nor the Civil Code says anything about this. Therefore, the final decision on the advisability of double lending rests solely with banks.

Most credit institutions adhere to an unspoken rule according to which no more than 2 products of the same type are allowed for one borrower. That is, no more than 2 consumer or car loans.

Mortgage here is an exception for many banks due to its characteristics. A long repayment period and a significant monthly payment are factors that increase the risk of non-repayment or delays. Two existing mortgage loans from one borrower can ultimately become an unbearable burden and lead to an irreversible process - default (the inability to service one’s obligations).

Therefore, the possibility of simultaneously obtaining 2 mortgages at once is discussed with a specific bank on an individual basis. A positive decision can be made for an almost ideal client who meets the following requirements:

- permanent official income sufficient to comfortably service two loans;

- stable employment (preferably with a long period of experience in one place of work);

- excellent credit history;

- highly liquid collateral;

- conclusion of a full insurance contract;

- Full compliance with age and registration restrictions.

An additional advantage will be the provision of guarantors who also meet all the requirements of the lender.

CONCLUSION: If the client manages to convince the bank of his reliability and creditworthiness, then there is a high probability of approval of two mortgage applications at once.

Availability of a second mortgage and requirements for the borrower

Banks do not want to suffer losses, and therefore strive to minimize all possible risks that may be associated with a mortgage. To be sure that the funds issued to the client will not be lost, but will generate income, bank employees carefully check each applicant who applies for a mortgage for the second time. This is why the processing time for a second loan is much longer (if you compare it with the first application).

The main feature of a mortgage is that it is issued for a long term. During this time, any circumstances in the family may change. In particular, families are growing, and this means the need for more spacious and comfortable housing. This means you will need to apply for a mortgage again. This is exactly how a question arises that interests many families: is it possible to take out a second mortgage loan from Sberbank without waiting for the existing one to be repaid?

The requirements that the bank imposes on a borrower who wants to get a second home loan without waiting for the current one to be repaid are quite serious. Situations where a client fully complies with them are rare, but it is still quite possible. The process of paperwork in this case is very complex and somewhat confusing, and therefore this work is entrusted only to those employees who have significant experience in such matters.

In principle, a second mortgage is a reality for every client. If only he was able to make a down payment, had a good income and did not make late payments. If the family as a whole has a good income, then the chances increase greatly.

Here are the main criteria that a client wishing to apply for a second loan must meet:

- Solvency. To assess it, the bank requires the provision of documents confirming the amount of all income. These figures must be presented in special papers, endorsed with seals and signatures. The main thing is that the amount of available income should be enough for contributions. And this is the most important condition for approval of the application.

- Good credit history. For the bank, the seriousness and integrity of the client who wants to get a second mortgage is important. A history of late payments, violations and fines during the period of use of the current mortgage is the most common reason for refusal.

- Presence of dependents in the family. The possible size of the monthly payment depends on this, and therefore the amount that the applicant can count on.

- The balance of the first debt. The second loan will be given only if the first one is repaid by at least 70%.

- An initial fee. If the borrower has 10-15% equity, then a second mortgage can be obtained.

- Possibility of providing collateral. Insurance of collateral is mandatory, and its value must be sufficient to completely cover the debt in the event of an unpleasant situation.

These criteria are a priority for the bank if the client applies for a new mortgage without having yet paid off the previous debt.

What are the requirements for borrowers?

- Availability of Russian citizenship for the borrower and his children. The minimum age does not exceed 25 years, and registration must be at the place of residence or stay.

- The maximum possible age for participation in the program corresponds to the age limit for military service. The loan must be repaid before this point.

- Military mortgages with state support are issued to NIS participants who have the appropriate certificate of benefits. You can receive it 3 years after joining NIS ().

- A second child must be born in the family between 01/01/2018 and 12/31/2022. The spouse does not have the right to be the title owner of the property or a co-borrower. Solidarity borrowers under this program are completely excluded.

Recommended article: When is the best time to take out a mortgage in 2021

Which bank to get a second mortgage from?

Practice shows that the likelihood of approval of a second mortgage loan is much higher when applying to the same bank where the first one was issued. But this rule applies only if the borrower is conscientious and fulfills its financial obligations in full and on time. In such a situation, many banks accommodate the client halfway, not only approving the issuance of a loan, but also providing preferential and favorable conditions for its processing.

The second criterion when choosing a bank is the stability of the financial condition of the credit institution. After two large private banks from the top 10 of the Russian rating, namely Otkritie and B&N Bank, were subjected to a reorganization procedure by the Central Bank of the Russian Federation in the second half of 2021, a significant part of clients began to more actively use the services of banking organizations with state participation.

Fact. More than three-quarters of the mortgage lending market is accounted for by the three largest state-owned banks, namely Sberbank, Rosselkhozbank and VTB.

The largest of them include Sberbank, VTB and Rosselkhozbank. An additional argument in favor of the listed financial structures is their active participation in various government programs for preferential mortgages.

What are the situations?

There is probably no single list of those for whom it is possible to get an apartment again. In many ways, this question depends on the current life circumstances.

Therefore, speaking about getting an apartment a second time, we cannot talk about any enrichment, but only about ways out of their current life situation:

- Divorce in a military family

- Other unintentional alienation of living space,

- Increase in living space due to the birth of children.

Who can apply

- Firstly, given the current situation, as a result of which the military personnel did not intend to alienate the housing they had already received from the state, he can re-receive a second one, but only if he is recognized as in need of housing.

In this situation, the key word is “not intentionally.” This is confirmed, as a rule, through the court, since housing commissions usually refuse to re-register the serviceman. This is motivated by the fact that, according to current legislation, they are provided with housing once for the entire period of their service.

At the same time, the non-intentionality of these actions is confirmed by filing a statement of claim with the court for division of property, etc. actions.

In addition, it is necessary to take into account that registration as a person in need of housing, after the alienation of existing real estate, can only be done after 5 years from the date of alienation.

However, it is quite possible for a military man to receive housing again if he re-registers. Provision is made on a first-come, first-served basis.

- Secondly, the repeated receipt of an apartment for military personnel is not limited when implementing the “military mortgage” program. In this case, it does not matter whether the serviceman received an apartment from the state or not.

In addition, participation in the NIS is not a reason for excluding the Defender of the Fatherland from the lists of those in need of housing on the waiting list.

Therefore, the officer should first wait for the apartment to be provided in kind or security in the form of EDV (housing subsidy), and only then apply for a military mortgage.

- Thirdly, the military can improve their living conditions thanks to the Government’s “Military Mortgage” program. But this right can be exercised by him only after the full repayment of the mortgage loan on the first loan.

Participation in the military mortgage program has nothing to do with the provision of official housing, and vice versa. That is, having official housing, a serviceman can participate in the NIS, and being a participant in the NIS, he can count on receiving official living space.

Options for re-acquiring housing for military personnel

- The provision of residential premises to military personnel for the second time under a social lease agreement, ownership or in the form of a cash subsidy for its acquisition can be realized only after the officer is re-included in the lists of those in need of housing.

In order to re-register, it is necessary that 5 years have passed since he completed a transaction that entailed the alienation of real estate received from the state. In addition, according to the Housing Law, a person must prove that the apartment was alienated not by his will, but due to circumstances.

But, unfortunately, even this does not guarantee re-provision of real estate. Since judicial practice shows that decisions are made completely different, and practically under the same circumstances.

This is interesting: How much do banks give for military mortgages in 2021?

In case of refusal to satisfy the application, the judges refer to the fact that military personnel are provided with real estate only once, and for the entire period of service. However, in this case it is necessary to distinguish between actions aimed at worsening living conditions and actions that led to the same result.

That is, the court must take into account the intentionality and unintentionality of the soldier’s actions, and, starting from his intentions, make the right decision.

In this context, it must be understood that if the Defender of the Fatherland makes a transaction that entails the alienation of already received state residential real estate (sale, donation, etc.) for the purpose of re-receiving housing from the state, this will be regarded as a deliberate deterioration of housing conditions.

If the alienation occurred as a result of divorce and division of property by court (in the absence of a marriage contract), with the subsequent leaving of the apartment to the spouse with minors and children, then this should be regarded as an unintentional action.

- A more realistic option is to buy a second apartment under the military mortgage program for the second time. When exercising the right to receive an apartment on a preferential loan, it does not matter whether the officer has housing or not, as well as in what form it was provided to him.

In addition, given the possibility of participation in the NIS without exclusion from the waiting list, this gives the right to wait for the living space allocated by the state. At the same time, during the entire waiting period, the amount necessary for the purchase of a second apartment will be collected in the officer’s personal account.

- Another equally real possibility is to apply for a second preferential loan. This is not prohibited by law. In addition, a special program was created that allows you to reuse a military mortgage in case of moving or improving your living conditions.

To exercise his right, the officer will need to sell the apartment he has already purchased. In order to do this, it is necessary to remove the burden from her. However, the problem is that the encumbrance is legally removed after the loan is fully repaid.

To do this, the officer will need to use personal savings or loan funds issued for these purposes. The funds received from the sale of the home will be used to repay the loan.

And the remaining money, which will be raised by increasing the value of real estate, can be used to purchase a more spacious apartment using preferential lending.

- In addition, in the event of full early repayment of the central mortgage loan, the law does not prohibit the re-issuance of a military mortgage for the purchase of a second property with a larger area.

However, given the fact that funds in the NIS personal account will be received only after the loan has been fully repaid, and when applying for a military mortgage, the loan term depends on the maximum possible service life of the officer himself. The term of the second military mortgage will be very limited, which means that the funds provided under it will be significantly less than when receiving the first loan.

To better understand the mechanism of participation in the program, it is recommended to download the Federal Law on Military Mortgage in any of the legal systems (Garant, Consultant+) and study the application of the legislation.

An important point that should not be forgotten is the 13% income tax refund when purchasing a first home; a military mortgage implies the use of the serviceman’s own funds. A tax deduction is made from this documented amount.

How to take out 2 mortgages at the same time

Life situations can be very different. Some cases may require you to take out multiple mortgages at the same time. This can be done in two cases: with full compliance with all bank requirements and high income, and also with the simultaneous submission of a second application to another bank, hiding this fact from the first. Let's consider both situations in more detail.

If income allows

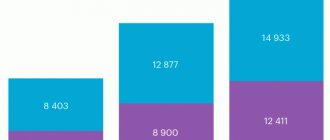

The credit policy of the leading banks of the Russian Federation provides for a maximum burden of monthly payments of no more than 40% of the total family income. If the load on the mortgage application submitted is higher, then a negative decision will be made against such a client, since the risk for the bank will be increased.

A borrower for whom the credit burden on both loans is feasible (monthly payments account for no more than 40% of the family budget) will be considered solvent. Confirmation of this fact by providing official documents and certificates in most banks will be mandatory.

In addition to the level of solvency, the lender will pay attention to the length of service and job stability. If your salary allows you to apply for several mortgages, but your experience is not sufficient, the bank will recommend applying for a loan later.

Credit specialists study and analyze in detail the data provided by the client. In particular, based on documents on the level of income and information specified in the application form, the bank will take into account the current level of expenses of a particular family, the number of dependents, and the share of payments on current and future obligations. Based on this information, a conclusion will be made about whether income is sufficient or insufficient to cover payments on all loans.

There are two ways to apply for a mortgage:

- One mortgage is issued for two collateral items (one agreement will stipulate the purchase of two real estate items and both of them will be used as collateral).

- Two mortgages are issued for each of the objects (two applications can be submitted at once, and with a Sberbank mortgage strictly in turn, the first mortgage is completed first, and then the second).

If your income is not enough for two mortgages

If the total income in the family is not sufficient to service several mortgage loans, then any bank will immediately refuse cooperation. No one wants to get involved with a borrower who can violate the terms of the contract at any time.

An option that allows you to count on a positive outcome is to simultaneously submit loan applications to several banks at once. Once the bank approves the issuance of a mortgage, promptly proceed with registration at the second bank. This will only be possible if the information in the BKI does not have time to be uploaded.

It all depends on the lending bank. Some banks have automatic programs for submitting data to the BKI (any transactions regarding a specific client begin to be displayed from the moment they are recorded in this program), while in others, this is done by ordinary bank employees.

In the latter case, the procedure for submitting data to the BKI is not carried out every day, but with some delay. Therefore, a client applying for two mortgages at once can only be lucky in such a bank.

It is also worth understanding that only the fact of issuing money is considered the basis for transmitting data to the BKI that the loan has been issued. If you have only been approved for a property, then the BKI will not contain information that you already have an existing mortgage.

So, if you apply for one of the mortgages at Sberbank, then you should know that after your property is approved, you will no longer have your credit history checked. An exception is various rollbacks of an application when changing an apartment or other parameters. You can safely go to another bank and apply for a mortgage until registration has passed and Sberbank has issued money to your account.

The application mechanism is as follows:

- An application is submitted to several banks for the required amounts at once;

- We receive approval;

- We prepare packages of documents for collateral;

- We submit one package of documents to the bank and wait for approval;

- After approval, we submit documents for real estate for the second object;

- We receive approval and go to register the transaction;

- After registration, we issue a mortgage and transfer money to the seller.

It is important to know that if you have a letter of credit form of payment and the mortgage money is transferred to the account before registering the transaction, then in such a bank you need to apply for a mortgage for the second property, and not for the first one. You will have information in the BKI immediately after transferring money to your account.

What to do if you don’t have enough income for a second mortgage

If the borrower does not have the opportunity to officially confirm the adequacy of his income to obtain a second mortgage, then the following may be a way out of this situation:

- Applying for a mortgage loan using two documents (such loans are characterized by increased interest rates, but there is no need to provide multiple certificates and papers confirming income).

- Confirmation of income according to a Bank certificate (information certified by the employer on the amount of the client’s income can be drawn up on a special form according to the bank’s form, which allows taking into account “gray” income and increasing the amount of approval).

- Providing co-borrowers (their income will be taken into account when determining the maximum loan amount).

- Confirmation of receipt of additional income (pension, passive income and other regular payments).

- Monitoring data in the BKI to submit an application to the right bank at the right time (the borrower can check which BKI his credit history is in and contact the bank that does not use this BKI to analyze the borrower’s credit history).

It will also be a big plus to provide documents confirming the availability of liquid movable and immovable property in the borrower’s ownership, as a fact of confirmation of solvency.

What rates can you expect?

After combining the programs, family military mortgages at 4.9 percent are available in the companies Gazprombank JSC and Dom.rf.

- When purchasing housing through Dom.rf, borrowers can count on preferential terms - 5.25% per annum. Residents of the Far Eastern Federal District will receive a loan at 5%. If you have previously taken out a loan under one of the programs, but fall under the conditions of the unified system, refinancing is allowed at 5.25%. But the rate starts at 4.9% - it will be received by clients who meet all the conditions of the program and the company’s requirements.

- offers at the same 4.9% per annum. This is the minimum rate that the most loyal and eligible borrowers will receive. The exact values can be found out by submitting an application at the company’s office.

- The lowest rate in is 6% per annum. This is the maximum possible value for both programs. Even though a family military mortgage from Zenith will cost more, it’s worth familiarizing yourself with the lender’s other terms and conditions. It offers higher maximum amounts.

Recommended article: Online military mortgage calculator - how to calculate, apply and pay

When other market representatives join in, perhaps the situation with rates will change. The main thing is that they will not exceed 6% established at the legislative level.

Second mortgage terms

In most cases, the second mortgage is arranged as a separate loan agreement under standard terms.

Something to keep in mind! Preferential categories of borrowers, for example, those who signed up for the first mortgage agreement under the state program for young families, will not be able to take advantage of state support a second time.

Documents for registration:

- Passport or other identification document (mortgages are available to citizens of the Russian Federation and foreign citizens working in the country);

- application form, which indicates the basic data of the potential borrower, information about family composition, monthly income level and other essential data;

- proof of income (2NFDL or a certificate issued in the bank’s form - you can print it on the official website or take a sample at the territorial branch of a banking institution).

- confirmation of the availability of a down payment;

- a certified copy of the work book with a note indicating that the employee is currently working;

- in some cases, the bank may require a certificate of no arrears on an existing loan, but, as a rule, most banks verify this information by sending the client’s data to the credit history bureau.

Something to keep in mind! Some banks put forward a requirement for the maximum amount of the client’s current obligations; these conditions should be clarified with the credit institution itself.

The application can be filled out at any territorial branch of the bank or a preliminary application can be completed online on the official website. A bank specialist checks the received documentation and contacts the client and employer to clarify the data. Then a preliminary decision is made.

Sberbank PJSC offers an additional service for submitting an electronic application, which allows you to receive approval remotely and upload documents to evaluate the selected property without visiting the office.

Probability of approval

All incoming applications are considered by the banking institution on an individual basis; in some cases, to minimize risks, the bank may approve a second mortgage at higher interest rates or a shorter loan term. In conditions of high competition among banks to attract clients, if the borrower has sufficient own funds to make a down payment and confirm high levels of income, there are fairly high chances of approval of a second mortgage without repaying the existing loan obligation.

How to increase?

In order to increase the chances of approval for a second loan agreement if you have existing obligations to the bank, you can provide documentary evidence of additional income, for example, a lease agreement for your own real estate (not pledged by the bank) or additionally attract co-borrowers: in this case, the bank will estimate total income.

In addition, to reduce the bank’s risks, the client can additionally provide his own property as collateral.

What to do if you refuse?

When receiving a refusal to issue a second mortgage agreement, a potential borrower has several options:

- submitting a repeated application after a certain time (re-application is available no earlier than after 2 months);

- contacting third-party banks;

- sale of the first property. Since it is pledged to the bank, written permission will be required. You can agree with the buyer to contribute part of the funds to fully repay the obligations to the bank, remove the encumbrance on the property and complete a standard purchase and sale transaction;

- applying for a consumer loan to repay an existing mortgage: a high-risk method of repaying obligations, since the rates on consumer loans are higher than on mortgages.

Is it possible to take out a military mortgage a second time?

Today, for a large number of military personnel who have already taken advantage of the savings mortgage system, the question of whether it is allowed to take out a military mortgage a second time has become a serious issue. Current legislation does not prohibit such a transaction, however, for its implementation several conditions must be met, in particular:

- Removing the encumbrance from an apartment already purchased under the military mortgage program. This is necessary, since the housing is pledged not only to the bank, but also to Rosvoenipoteka, which represents the interests of the Ministry of Defense;

- Removal of the encumbrance from the credit institution that issued the mortgage;

- Repeated application to receive financial resources provided for a participant in a military mortgage.

Fact. The number of NIS participants for military personnel currently exceeds 350 thousand people. Moreover, approximately 10% of the participants have already received housing under this program.

To successfully fulfill the requirements described above, the borrower must have sufficiently serious resources. Therefore, military personnel are often forced to take out a consumer loan and service it until they receive a second mortgage loan. This is one of the main reasons for the rare use of military mortgages for the second time.

Buy two apartments with a military mortgage

A serviceman has the right to take out a mortgage on housing without waiting for the entire amount to be collected for a one-time purchase of real estate. To do this, it is necessary to conclude an agreement with the bank that gives the loan, with the state, through the head of the unit where the service takes place. The longer money accumulates, the more expensive an apartment a serviceman can afford. He also has the right to invest his own funds to purchase real estate, in this case there are also no restrictions.

If for some reason a serviceman does not want to buy ready-made housing or participate in shared construction, he has the right to spend payments provided by the state on independent housing construction.

The mortgage is paid off until the age of 45, and the soldier is required to serve 20 years. If he was fired earlier, then the remaining amount must be repaid independently. If the dismissal occurred for a good reason or for health reasons, then the serviceman is entitled to payments that will be sufficient to repay the entire loan amount. If the term is less than 10 years, then the money allocated for the military mortgage for the apartment will have to be returned back to the state.

If there are two military personnel in a family, that is, a husband and wife, both spouses have the right to purchase two apartments under the same program. The option of purchasing one living space for two is excluded.

In addition, the law does not prohibit the purchase of 2 or more apartments under one mortgage. There is one caveat: although there is no such prohibition in the law, not a single bank will undertake a one-time loan for 2 or more apartments. This option is considered if one property has already been fully paid for or there is enough money for 2 apartments.

Any military member can re-qualify for a military mortgage. There are 2 options:

- Sell your property. Over time, housing becomes more expensive, so you can earn good money to purchase 2 small apartments or to buy one, but more spacious one. This option is considered if the serviceman has not reached the age of 45 and has at least 3 years left until the end of his service.

- The second option is suitable for a young family and is appropriate if the family has children and the parents intend to spend maternity capital to pay off the mortgage for their first property or have personal savings. The possibility of purchasing real estate directly depends on the region in which a serviceman wants to buy two apartments for himself; if he would like to acquire an apartment in St. Petersburg, then he is unlikely to have enough funds to achieve his goal.

Based on all the factors, we can say that it is possible to buy 2 apartments with a military mortgage, but not at the same time and if the chosen property is inexpensive or the end of its service life is still far away. A serviceman who has many children can also combine savings from military benefits and maternity capital to buy two apartments. This option is very profitable: while the children are growing up, parents can rent out the second home they purchased.

There are enough options to improve living conditions

Before making a decision, it is very important to consult with a specialist in this field, who will take into account all the nuances of the relevant laws and amendments.

Conclusion

In 2021, you can easily obtain a second mortgage if the potential borrower has the ability to fulfill obligations on both debts. The financial institution carefully checks compliance with the requirements and makes a decision based on the specifics of the situation.

The family must remain able to repay the debt and provide for its own needs. It is recommended to prepare for contacting the bank by collecting a sufficient amount of funds for a down payment and attracting guarantors. Having additional property in your property and receiving wages into the organization’s account will be additional advantages.

Additional payments

Additional payments upon dismissal can only be received when leaving the army on “preferential” terms. Funds are provided to those military personnel who are in need of improved housing conditions, that is, the military man should not own any real estate.

The additional amount is calculated from the number of years that the military man should have served to reach 20 years of service, but for certain reasons was unable to do so. Funds are provided once after submitting a report within 3 months.

This is interesting: Additional payments for a military mortgage upon dismissal in 2021