The insurance amount, with the consent of the payer, can be added to the total. Personal data in the payment for housing and communal services. Personal data in the receipt is the indication of the full name of the owner or tenant, the address of the home. This is very important information, because it is the owner who is the payer, and he will be responsible for the debt if payment does not go through or is lost. The decrypted full name is, together with the address, confidential information that is not subject to disclosure. Water disposal - what is this utility payment in the housing and communal services receipt? Although you spend the same amount of resource as it came in, the same amount went out, the tariffs in housing and communal services for sewerage and water supply are different.

Several owners of an apartment building decided to install video cameras, radio security and a concierge. And the management company added a new line for the target fee to the receipts,” based on the protocol of the owners’ decision 2 years ago. How legal is this and how is it regulated? In 2 years, the percentage of owners has already changed, some have moved out, and others have changed their minds in 2 years. Should the cost and quantity of installed equipment, as well as services for its further maintenance, be agreed upon by all owners?

What is a target fee in a housing and communal services receipt?

How to decipher a payment receipt? An approximate form of a receipt is recommended by the Order dated December 29. Late payment may result in debt. Targeted contributions If your home is managed by a management organization, then no additional contributions can be approved without a general decision of the owners at a meeting! However, it is possible if, for example, at one of the meetings the owners vested such powers in the chairman of the house council or members of the house council, etc.

MKD collection of targeted contributions from owners

Homeowners' association founders often ask whether a cash register is needed to make targeted contributions, as well as other voluntary payments? Despite the fact that the Homeowners Association is a legal entity that accepts cash payments, it is not at all necessary to use cash register systems for such calculations.

If the general meeting of home owners makes a decision to pay remuneration to the chairman of the board of the MKD by the management organization at the expense of funds received into the account of this organization, then in this case the management organization acts as the person paying the remuneration to the chairman of the board of MKD.

Let's look at a specific example. For example, the partnership has decided to lay a gas pipeline, but you do not plan to supply gas to your site. In this case, you can refuse payments by notifying other members of the partnership. Later you can pay the amount and install a gas pipeline.

- Entry fees. They are mandatory for everyone who wants to join SNT. Without paying this fee, you will not be accepted into the partnership.

- Membership fee. These are regular payments made by all SNT members. The money goes to maintaining roads, cleaning the area, etc.

- Targeted contributions. They go towards creating public facilities. For example, for laying a new road or laying a gas pipeline. These kinds of payments can be considered optional, but one must understand that if a person plans to use the options that SNT offers, then he is obliged to make a payment for them. If you do not need certain services, you have the right to refuse to pay the fee.

More to read —> Characteristics of a student to the guardianship authorities, sample from school

Target fee in housing and communal services receipt

Housing and communal services news:. In Russia there are about thousand. During a meeting in prefecture 3 On what basis can a management company add an additional line “Target fee”? Several owners of an apartment building decided to install video cameras, radio security and a concierge. And the management company added a new line “target collection” to the receipts, based on the protocol of the owners’ decision 2 years ago. How legal is this and how is it regulated? In 2 years, the percentage of owners has already changed, some have moved out, and others have changed their minds in 2 years. Should the cost and quantity of installed equipment, as well as services for its further maintenance, be agreed upon by all owners? Hello, Lilia! The decision of the general meeting of MKD owners, hereinafter referred to as

I have a non-residential premises with a separate entrance, of course. The house is new, only 10 years old, they want to do some serious renovations - almost Venetian plaster. Naturally, we pay monthly receipts both for complete repairs and for routine repairs.

Who is required to contribute money?

In accordance with the legislative norms of the Russian Federation, the following categories of persons are required to make payments for the maintenance of the HOA:

- members of the partnership;

- apartment owners who are not members of the HOA, but have existing contractual obligations to provide services;

- other residents who are not apartment owners, but use services paid for from the organization’s funds.

The HOA has every right to demand payment for consumed services and utilities. Citizens who are not members of the partnership pay contributions according to the concluded agreement.

Is it possible to calculate the size and how to do it?

You can calculate contributions yourself if you have data on the initial indicators:

- The total number of apartments in the MKD.

- How many members are admitted to the partnership?

- Statutory calculation indicators.

- Current expenses that form the amount of payments.

The region of location also affects the size of payments. In the Far North, contributions are higher than in central Russia.

It is unlikely that it will be possible to calculate the exact amount even with all the data, but the approximate amount of contributions will help determine the correctness of the payments required by the HOA board.

Example

You can understand how the calculation is made by looking at a specific example:

- The MKD has 250 apartments with a total area of 20,388.8 m2.

- All owners are members of the partnership.

- According to the estimate for each month of 2021, the following expenditure indicators are planned (RUB):

- maintenance of common property 372,503.37 (m2 – 18.27);

- current repairs of common property 103,575.10 (m2 – 5.08);

- cleaning of the local area 26,301.55 (m2 – 1.29);

- elevator 44,855.36 (m2 – 2.20);

- cleaning the garbage chute 22,223.79 (m2 – 1.09);

- intercom 5,000 (sq. – 20);

- antenna 12 500 (kv – 50).

The estimate specifies which indicators are calculated based on the square footage of the apartments, and which are established based on other criteria.

Let's make a calculation for an apartment with an area of 76 m2:

- For the maintenance of common property 18.27*76=1,388.52.

- For current repairs 5.08*76=386.08.

- For cleaning 1.29*76=98.04.

- For using the elevator 2.20*76=167.20.

- For cleaning the garbage chute 1.09*76=82.84.

- For intercom 20.

- 50 per antenna.

The total monthly contribution will be 2,192.68 rubles.

What is the target fee in the housing and communal services receipt?

If previously the majority of residents of apartment complexes did not particularly delve into the decoding of payments, then thanks to regular increases in prices for utility bills, the situation has changed dramatically.

Now it is important to understand what exactly this or that line means. Well, the greatest bewilderment is caused by nothing more than the targeted fee in the housing and communal services receipt - what is it and is it possible to refuse to pay it? Let's figure this out together!

Features of targeted collection of housing and communal services

The housing and communal services target fee is a HOA membership fee paid by the participants of the partnership to cover certain financial needs.

Most often they are:

- Cosmetic or major repairs of common areas.

- Purchase of new equipment (general building meters, new entrance doors, elevators, water pumps, etc.).

- Maintenance and examination of elevators.

- Renovation of common areas.

- Home management.

- Keeping stairs, corridors, entrances and other common areas clean.

- Cleaning and removal of household waste and garbage.

- Reconstruction of a residential building.

- Restoring order on the territory belonging to the MKD.

You will say that each of these services is already listed in the first line of the housing and communal services receipt, known as “Housing Maintenance,” and you will be absolutely right. So why then does the HOA add another clause to it?

The fact is that the maintenance tariff does not contain a complete list of management company services that residents may need. It follows from this that as soon as a particular house needs to do something that is not included in the tariff, the management company then resorts to collecting a target payment.

In addition, a targeted fee may be charged to pay off the house’s debts for utility bills (if not completely, then at least partially) and to repair old communications. True, this happens quite rarely and is more an exception to the rule than a pattern.

Is the entrance fee to a homeowners' association - housing and communal services legal?

A homeowners' association (HOA) is a non-profit organization that is created for the purpose of uniting owners of residential premises for general management and conduct of business activities in such houses. This is a kind of Russian version of a condominium. Russian housing legislation establishes a certain procedure for creating an HOA.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

Hide content

Let's talk about the estimate

Nowadays, many apartment buildings are transferred to the management of HOAs, for which a HOA agreement is concluded with the homeowners. This raises questions about the maintenance of residential premises, as well as considerable repair costs. The answer to them will be a cost estimate. It allows you to provide for all the nuances associated with economic work, so as not to disturb apartment owners once again.

qualified lawyers prepare estimates of income and expenses . They are also employees of the HOA. The estimate is counted at a general meeting led by the chairman of the HOA meeting.

Each of the owners of residential premises has the right to receive this or that information regarding the compiled cost estimate. It is also approved at the general meeting of residents.

One of the main purposes of budgeting is to determine the amount of HOA dues. When drawing it up, you should take into account the budget for the last 3 years, the technical characteristics of the house, the preferential category of citizens who do not pay the full contribution, etc. A sample estimate can be found on the World Wide Web on the Internet pages of the HOA.

Sample

- target revenues;

- cash contributions from residents for routine repairs and maintenance of their home;

- membership fees for utility bills;

- membership fees for the maintenance or repair of the boiler room;

- membership fees for public lighting;

- payment for services provided by the security service;

- removal of solid waste;

- income from business activities;

- income from payment for placement of advertising spaces;

- income received as a result of payments to Internet providers;

- expenses;

- repair and maintenance of communal plumbing and other equipment;

- improvement and landscaping of the local area;

- expenses for performing labor functions of HOA employees;

- maintenance and repair of elevators.

To monitor the activities of the partnership, there is reporting. The main one is the financial report for the year, compiled by the HOA accounting department. To create a partnership, you must indicate the OKVED activity code: 70.32 – Real estate management. A sample estimate of income and expenses for the year is available here.

OKVED

- 70.32 Real estate management;

- 70.32.1 Management of the operation of the housing stock. The following types of activities are understood here: supervision of the quality, condition and rules of operation of the housing stock;

- collection of rental payments provided for the operation of the housing stock.

- supervision over the quality, condition and rules of operation of non-residential assets;

Special account and reserve fund

In accordance with the civil and housing legislation of Russia, a special account is opened in a bank . The fact is that all funds collected for major repairs of buildings are collected in one fund. By law, the owner of a special account can be a partnership, housing cooperative or regional operator.

The following operations can be carried out on a special account:

- Write-off of funds for payments for services and major repairs in the building.

- Write-off of money to repay loans provided to pay for services and major repairs.

- When changing the special account, funds are transferred to another account in accordance with the consent of the homeowners.

- Crediting money for major repairs, as well as accruing interest in case of improper performance of duties.

- Accrual of interest related to the use of money and write-off of commissions.

In addition to the special account, the HOA has the right to create a reserve fund.

The law does not give a precise definition of this concept, but existing legal norms show that it is necessary to cover losses and other expenses. These funds are intended for use in force majeure circumstances that, one way or another, occur during the implementation of the HOA’s activities.

Public utilities

The amount of utilities is calculated depending on the volume of services consumed , which are determined by metering devices. In the absence of such devices, the amount of payment for these services is established by local governments.

You can make rent payments online. Many sites now provide such services. Rent calculation services include:

- The amount of utilities, taking into account the payment method established by the partnership.

- Meter readings.

- Benefits and subsidies.

- Peni.

- Recalculation of payments for previous periods.

- Establishing and printing payment receipts.

- Accounting for funds and their distribution among personal accounts, services and payment periods.

- Debt control.

- Exchange of information with GCHS.

- Setting up analytics reports.

Debts, fines and bankruptcy

By law, members of an HOA are not responsible for its debts . They only participate in the management of the partnership and decision-making, including making contributions. Moreover, if it is impossible to assign responsibility for paying debts to the HOA due to legal or factual circumstances, then the apartment owners must pay them.

For example, in the event of bankruptcy or recognition of an HOA as invalid due to certain circumstances, the obligations associated with repaying debts to other companies fall on the shoulders of the home owners.

And yet, if the homeowners made payments to the partnership, in accordance with existing regulations, but the funds did not arrive or were spent on other purposes, who is responsible?

Again, the owners of these houses, since in accordance with civil law, persons receiving operational services (in this case, apartment owners) must require evidence from the HOA confirming that the provider has performed its services.

According to the law, it does not matter whether there is an actual agreement between the HOA and the service providers (heat and energy saving companies). If residents consume these services, they are required to pay for them.

In turn, apartment owners can request these funds from representatives of the HOA, since they were not used to pay for established services.

For more information on how to win a lawsuit against an HOA or how to liquidate an HOA, read the links.

Targeted contributions

According to the norms of housing legislation, a target contribution is made by members of the partnership aimed at additional financing of its work. Payments are directed towards the maintenance and repair of elements of an apartment building.

Unlike the membership fee, targeted payments are not made constantly.

As a rule, a targeted contribution is aimed at solving a problem not related to current expenses. Such tasks include, for example, the repair of a certain part of the building or the reconstruction of the property of the partnership.

According to housing legislation, apartment owners are responsible for failure to fulfill their obligations to pay for housing and utilities. In case of late or incomplete payment, the debtor is obliged to pay the creditor as a penalty.

Regardless of the execution of the contract, the law provides for the right to recover from the debtor the amount of losses actually incurred and utilities. At the same time, a fine can be collected only if the debtor agrees with the terms, i.e., has signed the agreement. Consequently, the law comes to protect the consumer.

In the absence of an agreement, the creditor has the right to demand that the debtor pay interest for the use of other people's money. This also includes the amount of overdue payments for services rendered. The calculation of penalties depends on the refinancing rate of the Central Bank of Russia - 1/300 for each day of delay.

Rates

To formulate a tariff, it is necessary to calculate it, agree on it and officially approve it. The tariff is the amount of payment for the maintenance and repair of housing. To calculate them, the list of works provided and their frequency, technical and economic information about the MKD, the cost of materials, fuel, tax rates and fees, etc. are taken into account.

How not to pay?

Citizens who are owners of premises in an apartment building have the right to refuse to join the partnership . Although the HOA is a voluntary organization, there are some nuances that are associated with those persons who have not joined it. For example, payment of utilities by citizens who are not members of the HOA.

Most people want to independently enter into an agreement with a service organization, however, this right is not provided for by law.

Owners of housing in apartment buildings who are not members of the HOA are required to pay for utilities, just like its members, on the basis of an agreement with the partnership.

By law, the owner of a residential property does not have the right to enter into an agreement with a service organization if the house has an HOA.

Even when carrying out repairs or providing services to protect the territory of the house, a fee is charged to all citizens of the apartment building.

Taxes and benefits

If the responsibility for maintaining the house and its territory is assigned to the partnership in accordance with its charter and requires the conclusion of an agreement with other organizations, then the HOA acts as an intermediary. In this case, income tax is levied only on the part of the intermediary remuneration of the HOA.

As for VAT, the legislation does not provide for a special procedure for HOAs . In addition, the partnership pays social tax and property tax. But there is also a simplified payment system, which is calculated based on the results of the partnership’s economic activities and the deduction of certain percentages from the salaries of employees.

The law provides for VAT tax breaks for homeowners' associations. In order to use them, utilities should be provided to citizens for the amount they are purchased from the service company.

Source: https://gradpk.ru/zakonodatelstvo/zakonen-li-vstupitelnyj-vznos-v-tszh.html

Membership and target fees - what's the difference?

How do membership fees differ from target fees in an HOA? Being aimed at achieving a specific goal, a targeted contribution is a one-time payment intended to solve a specific task that does not fit into the framework of current expenses and requires additional funds.

This means that the presence of this column on a permanent basis is considered illegal . Another important difference between membership and target fees is the objectively necessary nature of such payments.

In this case, it is necessary to take into account not only the final cost of the proposed work, but also other income of the partnership, through which it is possible to pay off the needs that have arisen.

How should the target fee be charged?

According to the Housing and Civil Code, targeted contributions to the HOA can be negotiated and accrued only at a general meeting of citizens living in a particular house.

And in order for such actions to have a legal basis, the same general meeting must not only adopt the Regulations on targeted fees, but also stipulate the final amount, as well as set the deadlines during which these funds must be contributed.

This is important to know: Requirements for housing and communal services receipts

There must be at least 2/3 “For” votes in the general vote of residents, and the result of the vote, along with the established amount of contributions, must be stated in the relevant section of the HOA Charter.

During voting, you should not allow quarrels and the imposition of your opinion on those whose interests may suffer as a result of the inclusion of an additional clause in the housing and communal services receipt.

Of course, it will be quite difficult to challenge such behavior of opponents in court, but its adoption may provoke the emergence of serious internal problems in the HOA, which will have to be resolved exclusively in the courts.

It is worth noting one more important nuance. The fact is that residents at such meetings vote not with their hands, but with square meters . This means that during voting the share of each apartment in the total area of the apartment building is taken into account.

From this it turns out that the voice of a person who owns a 4-room apartment has much more weight than the voice of his neighbor living in a modest one-room apartment.

It should also be taken into account that the general meeting of residents can be held both in person and in absentia . In the latter case, a representative of the management company simply sends out paper or electronic ballots to all residents, in which they must answer 1 or more questions. Naturally, the same ballot should also contain a detailed explanation of the issue being put to the vote.

Once you receive a receipt with a target fee that you have never heard of until now, contact your house manager or send a written request directly to the management company.

If, after some time, they still haven’t explained to you what this point means and on what basis it is charged, you can file a complaint against the HOA with the prosecutor’s office . The same algorithm of action should be followed if it turns out that no meetings were held in your house at all.

Target contribution (fee) by decision of the meeting of HOA members – Canova – Lawyers in housing and communal services

Have you ever seen an additional target contribution or fee on a receipt?

In ordinary life, we encounter situations where legal uncertainties affect us directly. This, for example, happens when an HOA is created in your house, and you are or are not a member of it. And the competencies of the general meeting of HOA members and the general meeting of owners of premises in an apartment building often in life clash with each other.

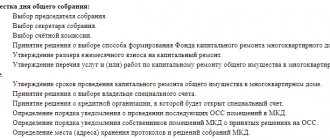

Let me remind you that the competence of the general meeting of owners of premises in an apartment building is defined in Part 2 of Article 44 of the Housing Code of the Russian Federation. The competence of the general meeting of HOA members in accordance with Part 2 of Article 145 of the Housing Code of the Russian Federation.

Common property of an apartment building and additional target contribution

Especially if the decision being made concerns money - fees, fees, and so on. In practice, it happens that the general meeting of HOA members makes a decision regarding the disposal of common property in an apartment building. And in this case, you need to understand whether this or that decision should be made by a meeting of HOA members or a meeting of owners of all premises.

So, the general meeting of the HOA members decided to determine the amount of the target fee for the installation of a children's sandbox. Who is obliged to pay in this case and for what?

Firstly, let’s start with the fact that a children’s sandbox is a common building property and the decision to install (that is, build) a children’s sandbox in accordance with paragraph 1 of part 2 of article 44 of the RF Housing Code must be made by a general meeting of owners of premises in an apartment building with a majority less than two thirds of the total number of owners of premises in an apartment building.

Secondly, in accordance with paragraph 5 of Part 2 of Article 145 of the Housing Code of the Russian Federation, the competence of HOA members includes establishing the amount of mandatory payments and contributions of members of the partnership.

Thus, if the general meeting of HOA members makes a decision, according to which it determines that the amount of the target contribution for the installation of a sandbox is, for example, 15 kopecks per square meter per month, then it is the HOA members! must transfer money for the construction of a sandbox. But in order to build a sandbox, it is still necessary to convene a general meeting of all owners of the premises and make a decision for them, and by a qualified majority.

common property – it’s not that simple!

In accordance with Part 5 of Article 155 of the Housing Code of the Russian Federation, members of the homeowners' association make mandatory payments and contributions related to the payment of expenses for the maintenance and current repairs of common property in an apartment building, as well as the payment of utilities.

According to Part 6 of Article 155 of the Housing Code of the Russian Federation, owners of premises in an apartment building in which a homeowners’ association is not a member of a homeowners’ association pay fees for the maintenance of residential premises and fees for utilities in accordance with agreements concluded with the homeowners’ association, including including paying contributions for major repairs in accordance with Article 171 of the Housing Code of the Russian Federation.

According to Art. 158 of the Housing Code of the Russian Federation, the owner of premises in an apartment building is obliged to bear the costs of maintaining the premises belonging to him, as well as to participate in the costs of maintaining common property in an apartment building in proportion to his share in the right of common ownership of this property by making payments for the maintenance of residential premises, contributions to capital repair.

If our sandbox already existed , it would be a common property. Consequently, its maintenance and repairs should be carried out not at the expense of additional “targeted contributions”, but at the expense of maintenance fees.

In addition, in accordance with paragraphs. 2.

Part 1, Part 2, Article 44 of the Housing Code of the Russian Federation, making decisions on the improvement of the land plot on which the apartment building is located and which belongs to the common property of the owners of the premises in the apartment building, including the placement, maintenance and operation of landscaping and landscaping elements on the specified land plot applies within the competence of the general meeting of premises owners.

So, dear owners, before you worry about this or that issue, please refer to the legislation once again, this will help you avoid unnecessary costs - both for holding meetings and unnecessary financial contributions.

Source: https://kanova.ru/otvety-na-voprosy/2018/01/11/celevoy-vznos-tsg/

How to avoid payment?

If you do not know how to refuse to make targeted contributions, contact the management company with a written request to remove this item from your housing and communal services receipt . To be on the safe side, put your appeal on legal ground and enlist the support of a professional lawyer.

You can, of course, simply not pay, but in this case the management company will still transfer these charges to the utility bill.

Among other things, it should be noted that in accordance with Art. 7 of the Civil Code of the Russian Federation, the management company must sign an agreement on targeted fees with each owner or tenant. In the absence of such an agreement, including the line “Target fee” in the receipt is considered illegal, and therefore you can easily refuse to pay it.

How to avoid paying a target fee to the HOA? Another option is to file a claim in a civil court.

According to Art. 46 of the Housing Code of the Russian Federation, the owner of the premises in the apartment building has the right to appeal the decision of the general meeting of residents if it was made in clear violations of Russian legislation (for example, if the plaintiff did not take part in the general voting at all, spoke out against the adoption of this decision, or these actions led to a violation of his rights ).

The application can be submitted within 6 months from the moment the applicant learned or should have learned about the voting results . The court can accept either a positive or negative verdict - it all depends on the existing circumstances.

Thus, if the plaintiff’s vote could not influence the overall voting results, the decision made did not cause material losses to the applicant, and the existing violations are not significant, the inclusion of the target fee in the housing and communal services receipt will remain in force (and vice versa).

Online cash register and taxation

Homeowners' association founders often ask whether a cash register is needed to make targeted contributions, as well as other voluntary payments? Despite the fact that the Homeowners Association is a legal entity that accepts cash payments, it is not at all necessary to use cash register systems for such calculations.

This exception to the rules is explained by the fact that neither membership nor target fees are payment for services, work or goods provided. According to Federal Law No. 54, these funds must be used to implement the goals of the HOA, and therefore cannot fall under the concept of “settlement”.

As for whether targeted contributions to the HOA are taxable, the answer is also clear . According to the legislation in force in Russia in 2021, targeted revenues from enterprises and individuals intended for the maintenance of non-profit organizations and the implementation of their statutory activities are not subject to taxation.

Because of this, any voluntary payments spent in accordance with the income and expense scheme should be excluded from the income tax base.

Now you know what the target contribution is on the receipt and you can easily refuse to accrue it if you feel an urgent need for it.

What are contributions and what are they?

Maintenance of an apartment building requires constant financial investment. In HOAs, most of the cash receipts come from apartment owners. Owners of residential premises pay for the maintenance of common property in full or in part.

The money is paid by the owners in the form of contributions, each of which has its own purpose. The amount of contributions, as well as the order of payment, is different and directly depends on the purpose of the payment.

There are membership, target, entrance, insurance and additional fees.

Membership

Membership payments are paid by members of the partnership and go towards internal expenses of the HOA:

- payments to full-time employees;

- chairman's remuneration;

- additional service.

Membership payments may include expenses for the formation of a reserve fund, landscaping of the territory and organization of economic activities.

The amount of membership fees is fixed in the organization’s Charter and depends on the number of members of the partnership. The amount of payments is influenced by the fundraising goals.

Users of the listed services who have not joined the HOA do not pay membership fees, but compensate for current expenses in proportion to the space they occupy.

Target

Targeted contributions are regular payments for:

- replenishment of the reserve fund;

- seasonal repairs;

- major renovation.

Target payments are paid by all residents of the house, regardless of whether they are members of the partnership. The amount of contributions is determined:

- A meeting of owners when it comes to replenishing the reserve fund and paying for seasonal repairs. In accordance with Part 5, Clause 2, Article 145 of the RF Housing Code, the amount of payments is approved by voting.

- Regional authorities in relation to contributions paid for major repairs. Members of the partnership may increase the established minimum, but do not have the right to reduce the established amount.

Average target contributions in the Russian Federation range from 1 to 10 thousand rubles.

Opening

When joining a homeowners' association, each new member of the organization pays a one-time fee. It is called introductory, and its size is established by the HOA board based on the needs of the organization. On average, entrance fees vary from 500 to 1,500 rubles.

The funds contributed upon joining go to cover the expenses that were incurred during the creation of the partnership - registration of documents, organization of founding activities, etc.

Insurance

Full-time employees of the HOA receive a monthly salary for performing their immediate duties. Labor costs are reimbursed from membership dues. In addition, insurance premiums are paid for each employee on the payroll.

The amount of insurance payments is compensated from the current account funds. The HOA, being the employer of such employees, is obliged to bear the costs of insurance payments.

Additional

Additional fees may apply if losses are identified in the partnership. These are one-time payments that are paid when necessary to cover the losses of the HOA. If the negative balance of the organization appears again, then additional charges are assigned again.

Additional payments are accrued only if the company does not have a cash reserve. The amount of additional payments is calculated based on the resulting debt in proportion to the size of the property owned.

Target fee in housing and communal services receipt

I have a non-residential premises with a separate entrance, of course. The house is new, only 10 years old, they want to do some serious renovations - almost Venetian plaster. Naturally, we pay monthly receipts both for complete repairs and for routine repairs. Thank you, Kirill Kirill, May 21 Lawyer's response: According to the norms of the housing legislation of the Russian Federation, the owners of premises in an apartment building bear the burden of expenses for maintaining common property in an apartment building. The share of mandatory expenses for maintaining common property in an apartment building, the burden of which is borne by the owner of the premises in such a house is determined by the share in the right of common ownership of common property in such a house. The legislator does not distinguish between the owners of residential and non-residential premises.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website. It's fast and free!

Income from business activities

To achieve its statutory goals, the HOA is allowed to conduct business activities.

Thus, an HOA can carry out the following types of activities:

- renting out part of the common property (for example, basements, attics, walls for advertising signs);

- maintenance, operation and repair of real estate in an apartment building;

- construction of additional premises and common property of an apartment building.

The HOA must spend the profit received from the listed types of business activities for the purposes specified in the charter, or for the purposes specified in the decision of the general meeting of the HOA members.

This is stated in Article 152 of the Housing Code of the Russian Federation.

Target collection

VIDEO ON THE TOPIC: Everyone watch it urgently! Housing and communal services receipts.

This is the basis of the receipt form, but each management company, HOA or other service company can add the names of payments if this is required by a regional act or if residents at a general meeting approved it with their votes. There is nothing superfluous in the receipt; on the contrary, the form is designed in such a way as to bring to the attention of payers as much as possible a detailed list of components from which the final figure is obtained.

Download a receipt template for payment of housing and communal services in Excel. The maintenance of housing in the housing and communal services receipt is a check and inspection by a specialist building caretaker: the maintenance of residential premises, building structures - walls, ceilings, basement, etc. Seasonal work should also be carried out: Cleaning drainpipes and gutters. Clearing canals and wells from branches and leaves. Removing snow, chipping ice, sprinkling sand on paths. Painting of wooden and metal small forms and platform equipment.

Planting flowers and shrubs, watering, weeding, etc. If cracks, damage to the plaster or paint, whitewash are detected, repairs are carried out in separate places, windows and doors in the entrances, and the roof are repaired in separate places. This is the current repair. What is a targeted housing and communal services fee? A targeted fee can be charged only when the issue of raising funds specifically for a specific purpose - for example, the purchase of new equipment for a pumping station, boiler room, or other, was raised at the next general meeting of Art.

This is important to know: License for water supply and sanitation

But in order to be able to legally collect money under such names, it is necessary that the general meeting fundamentally decide to adopt the Regulations on targeted collections. Owners and tenants can decide, again by voting, whether this fee will be fixed for each residential premises, or will be tied to the area. This is the target fee in the housing and communal services receipt. Also, this Regulation stipulates the deadlines for collecting these funds, which means only one thing: if the residents agreed to purchase something with additionally collected funds, then this targeted collection has a final figure and deadline.

How to refuse a targeted fee if it is stated in the housing and communal services receipt? Conclusion: the management company must draw up an agreement on targeted fees with each owner or tenant.

If this is in the contract or in additional But it is better not to hush up this problem, so as not to become one warrior in the field, you should, by written request from a group of owners, notify the organization serving the house about the refusal to pay the target fee and lay the legal groundwork, enlisting the support of a qualified lawyer specializing in this area of jurisprudence.

This HOA or management company offers to pay for hot water, which was spent last month for maintenance of common property: cleaning entrances, stairs, corridors; maintaining elevators in proper sanitary condition; cleaning and sanitary treatment of areas near garbage chutes, waste unloading rooms, etc.

This number of cubic meters of hot water is determined as follows: they take readings from the general building meter, subtract the actual consumption from apartment meters, subtract those volumes that can be billed to residents whose apartments do not have meters, and the remaining cubic meters are distributed among all users. Only now the service company does not have the right to completely throw away the remaining unpaid water, but only by comparing it with the standard consumption established at the government level for general household needs.

If the cubic meters are distributed without exceeding the standards, great, but if not, then the service company should think about why there is an imbalance in hot water consumption, and how to pay for this excess consumption. In fact, the receipt is created in a way that is understandable to every consumer; you just need to figure out what the abbreviations mean and where the expense comes from.

Tariffs are easy to check - they are published in the press, on stands and at the accountant of the management company. Understanding the essence of a housing and communal services receipt makes it possible to control the correctness of charges. Similar articles:.

The owners themselves approve these estimates with fees at meetings. This is a herd effect and has been well studied. When the owners, members of the HOA, gather for a meeting, including absentee voting, their minds turn off, they vote for what the chairman says. The owners, members of the HOA, are not tormented by such questions, they like it, as the chairman milks money out of them. And in the HOA, like in a black hole, money disappears without a trace.

Mandatory and voluntary payments to HOAs

Residents of apartment buildings often belong to a homeowners association (HOA). On the one hand, participation in it allows you not to solve many problems personally, on the other hand, it obliges you to make certain payments - mandatory and optional. With this last point, citizens often have questions that cannot be resolved without specific knowledge.

In the article we will tell you why HOAs collect payments, what they are, and what threatens a negligent member of the partnership for late payment or failure to pay. Information about calculations will allow you to avoid unnecessary overpayments and competently manage your family budget.

What are membership fees?

According to Russian legislation, HOA membership fees are amounts paid aimed at covering certain financial needs and contributed by the participants of the partnership.

According to Art. 145 clause 2 of the Housing Code of the Russian Federation, the purpose and amount of a certain payment must be established at a general meeting of residents. In addition, they must be clearly stated in the relevant section of the HOA Charter.

At the same time, expenses for electricity, gas and other utility bills are not covered by membership fees or are partially covered.

As for the payment of debts or repair of communications, the allocation of membership fees for these needs is possible based on the results of a general house meeting and only in exceptional cases. The primary purpose of statutory payments is completely different.

Types of payments collected

The purpose and amount of payments in favor of the HOA are regulated by the general meeting of residents and must be recorded in the Charter. Depending on the purpose, contributions may be:

- introductory;

- one-time;

- regular.

The amount of some periodic (one-time) contributions depends on need and is established at a meeting of homeowners. As a rule, such fees arise in the event of unplanned expenses, emergencies or communications breakdowns. The entrance fee has a different purpose - to compensate for the costs of registering an HOA, so it is charged only once.

Also, the HOA may collect regular fees, which are spent on needs not directly related to maintaining the house in proper condition. These include:

- bonuses for managers and employees;

- improvement of the surrounding area;

- creation of a reserve fund, etc.

Such contributions are not required, but it is better not to ignore them. For example, the reserve fund can cover the costs of eliminating the consequences of accidents, so the larger it is, the better. Let's look at each contribution to the HOA in more detail.

Opening

As soon as a tenant decides to join the HOA, he will be required to pay an entrance fee. This is a one-time payment, the purpose of which is to compensate for the costs associated with the formation of a partnership and its registration with the relevant authorities.

At the same time, entrance fees cannot reimburse the costs of maintaining the house, repairing it or eliminating accidents in utilities.

Membership

As soon as a citizen has purchased real estate that is part of the HOA, he automatically becomes a member and is required to pay membership fees. This obligation arises at the time of registration of ownership of an apartment or other real estate object.

Through membership fees, the owners' association can pay:

- rewards for workers who fixed communication problems;

- payment to the HOA manager;

- payments to members of the controlling group.

Since membership fees are regular, their amount is insignificant and does not exceed payments for other purposes. Otherwise, payment failures and associated consequences may occur.

Target

A targeted fee is aimed at a specific purpose, therefore it refers to a one-time payment. Most often, the need for such a payment arises in the case of cosmetic or major repairs of the HOA premises or part thereof, the need for which arose unexpectedly. Targeted payments can be sent to:

- for renovation of common areas;

- redecoration of the entrance;

- for the purchase of new equipment.

The amount of the payment is directly proportional to the share in the common property of each HOA participant, and the final cost of the proposed work must be taken into account, as well as other income of the partnership, from which it is possible to pay off the needs that have arisen. However, the costs of completely restoring the house cannot be offset by the collection of this contribution.

Insurance

This type of contributions is collected once a quarter or at other intervals specified in the Charter and is mandatory. The distribution of shares in this case is as follows:

- 2.9% for the Social Insurance Fund;

- 5.1% for the Compulsory Medical Insurance Fund;

- 22% in the Pension Fund of the Russian Federation.

The total amount of the insurance premium must be distributed equally among the members of the HOA.

Additional

If a problem arises during the activities of the HOA that cannot be solved using the reserve fund, a one-time additional contribution may be introduced. In a particularly severe case, you will have to make another contribution, and the partnership must bring the reserve fund into a solvent state as quickly as possible.

The amount of the additional fee is set individually and calculated according to the plan approved by the Charter. Thus, the size of shares of each participant, the required amount or other parameters can be taken into account.

Briefly about the reserve fund

Residents have the most questions about the reserve fund. It would seem that if part of the needs are covered by a targeted contribution, and there are also membership payments, why save money for anything else? However, it is impossible to do without such security; it is from this that the HOA management takes funds to eliminate the consequences:

- emergency situations;

- failures of utility networks in common areas;

- errors of service workers.

The reserve fund also covers penalties arising as a result of an unexpected jump in tariffs for electricity, gas supply and similar services.

The amount of payments to the reserve fund is determined individually in each HOA, but does not exceed 5-10% of the total monthly expenses. Such a distribution is sufficient to promptly solve problems that arise, as well as compensate for the effects of inflation. If the HOA management had to take part of the reserve fund, residents must restore its original size through contributions.

According to Art. 145 clause 2, part 5 of the Housing Code of the Russian Federation, the procedure and situations in which it is possible to use funds from the reserve fund are determined at a general meeting of homeowners. Only in case of an emergency, in conditions of time shortage, management will be able to give an order to connect the fund without convening a meeting of homeowners.

The reserve fund is replenished by:

- Contributions from HOA members.

- Charitable contributions.

- Government subsidies.

- Income from rental of unoccupied premises.

- Funds received as a result of reducing planned expenses.

The reserve fund funds are kept in a separate bank account, this allows you to control expenses and protects you from accidental expenses caused by mistake.

With proper management, the reserve fund does not need to be replenished for a long time from the funds of homeowners. However, in the event of a sharp decrease in the saved amount, it is necessary to quickly restore its amount, which under certain circumstances is possible only through an additional contribution established by the meeting.

Who is required to make payments?

This issue also poses difficulties for certain categories of citizens. For example, a person can rent an apartment under a lease agreement, but not be the owner of the living space. Is it legal to demand payment of a contribution to the HOA in his case?

According to the Housing Code of the Russian Federation, the following citizens have the obligation to make payments established in the HOA:

- residents living in the house and using services that are paid for by the HOA;

- HOA members;

- apartment owners who are not members of the HOA, but have signed an agreement with it for the provision of services.

According to Art. 154 clause 2 of the Housing Code of the Russian Federation, transfers for the maintenance of the house in proper condition consist, among other things, of regular contributions from the participants of the partnership. For this reason, the HOA has the legal right to collect funds within the limits of the fees established by the Bylaws. As for citizens who do not want to join an HOA for some reason, they pay for services according to the concluded agreement.

Persons who are not members of the HOA have the right to refuse contributions, the purpose of which is not to reimburse utility resources and part of the services.

Is it possible to calculate the contribution amount?

It is impossible to accurately calculate the amount of each contribution collected as part of the activities of the HOA. However, residents and property owners can figure it out on their own if they know what factors influence the final amount. This indicator is influenced by:

- number of apartments in the building;

- number of HOA members;

- features of the region;

- list of current expenses;

- nuances of the Charter.

So, if the house is located in the Far North, the amount of contributions will be higher than in a similar house in the Middle Zone. Sometimes contributions are distributed in proportion to the area owned by a member of the partnership, and sometimes they are divided in equal parts between each apartment owner.

For HOA members, the amount of each contribution is determined by the Charter and the general meeting of owners. For citizens who are not members of the partnership, but have signed an agreement with it, the cost is calculated based on the amount of all services and actions performed within the framework of the signed document. Detailed information can be found in the receipt for payment of services.

Receipts for regular payments arrive monthly or quarterly, and one-time fees are paid in the period between receipt of the receipt and the deadline established by the HOA.

What happens for non-payment

Some citizens, due to certain circumstances, cannot pay their HOA fees on time or refuse to pay completely. However, such an attitude can provoke a number of troubles:

- growth of debts;

- complete or partial restriction of the supply of utilities;

- lawsuits.

The severity of the consequences depends on the amount generated as a result of failure to fulfill payment obligations.

If a citizen is not a member of the HOA, but uses electricity, an elevator, gas, takes out garbage into a common bin or uses a garbage chute, he is obliged to pay for these services within the framework of the agreement concluded with the HOA. Lack of payments threatens the same consequences as for members of the partnership.

Can it be returned after leaving the partnership?

Due to various circumstances, a person may leave the HOA. The question arises: is it possible to somehow return the amount of contributions or part of it? For example, if funds were paid to replenish the reserve fund, but the funds were not spent. The answer to such questions is simple. After leaving the HOA, a citizen does not have to pay fees, but he will not be able to get the money back.

The exceptions are:

- identifying violations during payment collection;

- the service was not provided;

- Misuse of funds was discovered.

In such situations, you can file a claim and get the money spent back in court. To win the case, a citizen must take an extract from the HOA accounting office and a copy of the estimate. Approved at the next meeting of homeowners. There is no other way to solve the problem.

According to Art. 143 of the Housing Code of the Russian Federation, the owner of a residential space has the right to demand from the accounting department documents on the movement of funds if he has suspicions of their misuse. Refusal to provide the necessary papers is illegal; in this case, you need to contact housing supervision with a correctly drawn up complaint.

If you have any difficulties with your HOA contributions, you think that the funds are being used incorrectly and you want to return them, please contact our lawyers. You can sign up for a consultation in the appropriate section of the website.

All HOA payments, mandatory and optional, are specified in the Charter or agreed upon at a meeting of owners. Therefore, evasion of payment may be considered illegal with all the ensuing consequences. If you have any suspicions about the legitimacy of the receipts sent to the HOA, you need to contact housing supervision or the court.

Source: https://estatelegal.ru/zhkx/upravlenie-i-tszh/platezhi-tszh/

target fee for the repair of entrances

Several owners of an apartment building decided to install video cameras, radio security and a concierge. And the management company added a new line “target collection” to the receipts, based on the protocol of the owners’ decision 2 years ago. How legal is this and how is it regulated? In 2 years, the percentage of owners has already changed, some have moved out, and others have changed their minds in 2 years.

Article The homeowners' association has the right to: 2 determine the estimate of income and expenses for the year, including the necessary expenses for the maintenance and repair of common property in an apartment building, the costs of major repairs and reconstruction of an apartment building, special contributions and deductions to the reserve fund, as well as expenses for other purposes established by this chapter and the charter of the partnership; 3 to establish, on the basis of the accepted estimate of income and expenses for the year of the partnership, the amounts of payments and contributions for each owner of premises in an apartment building in accordance with his share in the right of common ownership of common property in the apartment building; mr. But I warn you that if at the general meeting the majority voted for a fixed payment, then this decision is considered legal. Talk to the chairman, you can try to challenge his actions through the State Housing Housing Inspectorate. The state housing commission is located on Lunacharsky 3. It is quite possible that you will succeed. Anarchist, calculations are not always made with m2. If the general meeting decided to pay, for example, for garbage removal based on the number of people registered, then the payment bill will include not the m2, but the number of people. The same is possible for payment for ODPU.

Is it possible to return it when leaving the organization?

Monetary contributions from members of the organization are not returned, even if the person leaves the Partnership.

After a person leaves the organization, the obligation to pay various fees is removed, but previously made contributions (including the initial one) are not returned .

You can find out about changes in the Federal Law on Homeowners' Associations, as well as in what cases inspections are carried out by regulatory authorities on our website.