Agreement for donating a share of an apartment to children

The parties to the agreement may terminate the gift agreement voluntarily or compulsorily.

If one of the parties to the transaction is a young child, then voluntary termination of the contractual relationship is excluded. The guardianship authority will not consent to a deal that infringes on the rights of the child. However, you can challenge the agreement in court without any problems. The initiator of legal proceedings can be not only the donor, but also the beneficiary. The reasons for termination of the transaction are failure to comply with the established form, careless attitude of the recipient to the property, significant deterioration in the property status of the donor. One of the ways to alienate property is a gift agreement. Usually such transactions are concluded between relatives. The main advantage of a gift agreement is the exemption from income tax. However, citizens will have to pay a state fee. The reason is that transactions involving young children require notarization. In addition, the transfer of ownership is subject to state registration.

Additional nuances

The initiators of the transaction are often grandparents who plan to transfer their property to their grandchildren during their lifetime. And in this case, the agreement is signed by the parents or other persons legally representing the interests of the minor.

Only children aged 14-18 years can refuse the gift..

In what cases is a challenge possible?

A deed of gift can be challenged not only by the donor, but also by other persons legally endowed with the corresponding rights. The donor can do this if the following conditions are met:

- the actions of the donee cause damage to property, or may lead to the complete loss of the object.

- When registering a deed of gift, actions of a criminal nature are carried out.

- After the transaction, living conditions worsen or health deteriorates.

Legal heirs can challenge the transaction if the donor has already died . But they also need to comply with certain conditions.

- If at the time of the transaction at least one of the parties did not have the official right to perform such actions.

- If the actions committed by the donee are criminal in nature.

Some state and municipal authorities may also challenge the legality of the transaction . This also applies to other representatives appointed by law.

The recipients also have the right to refuse the gift given to them. It is enough to put the refusal in writing and register it.

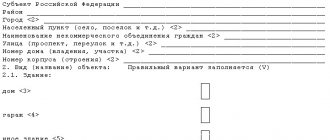

Agreement for the donation of a share of an apartment to minor children - rules for registration

- Russian passport of the person who is the donor;

- certificate of birth of the child receiving the share;

- official cadastral passport issued by BTI;

- an official certificate received from the BTI informing about the assessment of the share in the apartment;

- a certificate confirming the donor’s right at the time of the transaction of ownership of the apartment that became the location of the share;

- a detailed extract made from the official house register;

- if there are co-owners, notarized consent to donate a share in the apartment;

- consent of the child’s parents, guardians and guardians that he can receive a share in the apartment as a gift;

- authorization issued to the child's legal representative to complete all procedures regarding the signing of the deed of gift;

- receipt of payment of state duty;

- a statement from the donor himself, in which he indicates the fact of registration of the transfer of rights to the donated square meters;

- an application issued by a minor who unexpectedly or expectedly received a gift to carry out the property registration procedure;

- the contract itself;

To register the fact of such a transfer of a share in the property, the presence of an official representative of the future young owner will be required. These can be both parents and guardians. They are important to guarantee the ability to pay utility bills and control the technical condition of the gift.

Step-by-step instructions: transaction algorithm

There are not as many steps in this procedure as it seems at first glance.

- It all starts with preparing documents .

Ownership of the gift and identification are standard. A written agreement is also required for the minor to participate in the transaction, permission from the guardianship authorities for certain actions, confirmation of representation, and so on. - After this, they move on to drawing up a draft agreement .

This is the most important stage in the transaction. The validity and legal force of the transaction depend on how well the draft document is drawn up. The main requirement is to specify the subject of the agreement along with information about each of the parties. It is necessary to take into account all the features associated with representing the interests of a minor. - Applying signatures .

The contract is signed by the legal representative, if he is the one who takes part in the transaction. The donee can sign the document himself if he is allowed to perform the appropriate actions. A notary must be present at signing if he needs to further certify the document. - Transfer of the gift itself .

A contract usually fixes the order in which a particular object is transferred. This can take place simultaneously with the signing of the document, or in the future. The transfer is formalized in a separate act. The very fact of the procedure indicates the final transfer of ownership from one person to another. - State registration is required in a situation where a child receives a property .

The procedure for this procedure is also regulated by the text of the agreement. And this part of the transaction involves a legal representative, without whom the interests of the child cannot be protected.

We talked about the stages of completing a standard gift transaction between relatives here.

About the required set of documents

Depending on the item of donation itself, as well as other nuances, the list of required papers differs.

But there is a basic set that is almost always required.

- Certificates and other documents from the BTI.

- Report on the evaluation of the gift.

- Permissions for donations from other owners, if present.

- Documents of title for the gift.

- Written permission from the parents for the child to participate in the transaction.

- Power of attorney from a representative of the guardianship authorities.

- Permission from guardianship authorities, if necessary.

- Documents to verify the identities of each party and those representing interests.

Read about the standard list of documents for completing a gift transaction between relatives in this material.

How much will a real estate deed for a child cost?

Recent changes in legislation have led to the fact that expenses in connection with notary registration have become mandatory for everyone. The fee for these services is 7-1 thousand rubles. An additional 0.5 percent of the total transaction value will be required.

The donee also pays a state fee equal to two thousand rubles . When registering the contract, he submits the corresponding receipt. The total cost for an average apartment will be approximately 20-30 thousand rubles. Even if only close relatives are parties to the transaction. And given that such agreements are not subject to taxation.

How much it might cost to issue a deed of gift to close relatives, taking into account payment of state fees and notary services, we described in a separate article.

About the terms of receipt

The parties have the right to expect to receive title documents within ten days maximum after all papers have been submitted to register the transaction. But the government authority may suspend the procedure if there are legal grounds for doing so. The most common mistake is inconsistency with existing and current samples.

A viable solution is to track the solution process . And timely correction of any identified deficiencies.

Agreement for donating a share of an apartment to children

Other people's children grow up quickly, but their own children are in no way inferior to them in growth. The older generation is starting to wonder if it’s time to give younger family members a share of the apartment? Registration of a deed of gift is a popular and convenient way to re-register property in favor of children.

- The process of transferring part of the housing is gratuitous (free) in nature (clause 1 of Article 572 of the Civil Code of the Russian Federation).

- The donor (owner) and the recipient (child) must express a personal desire to participate in the transaction.

- The gift agreement is drawn up during the lifetime of the child’s relatives, and if they have already died, the gift is not allowed.

- Entry into ownership is registered with a notary and in Rosreestr.

- Part of the housing jointly owned by the spouses is transferred to the child with the consent of the husband and wife (clause 2 of Article 576 of the Civil Code of the Russian Federation).

- Consent is not required if the apartment is classified as common shared ownership.

- Participants in the transaction can be not only close relatives, but also third parties.

Paying taxes on a gift

Ownership of an apartment arises from the moment state registration is completed. When a deed of gift is issued, the recipient is exempt from any tax contributions.

If it turns out that the parties to the transaction are not close relatives, then you will have to pay a tax in the amount of 13 percent of the total cost.

Then it will be more profitable to register not a donation, but a regular purchase and sale of real estate.

The state fee for registration must be paid if the document is certified by a notary . The amount of this fee depends on how much the housing itself costs.

Since 2000, the requirement to register deeds of gift has been abolished. But it is necessary to register the fact that ownership has passed from one person to another. The contract will not be considered legal if the participants bypassed this procedure.

We talked in more detail about the nuances of taxation when making gifts to close relatives here.

Form of agreement for donating a share of an apartment to a minor child: sample deed of gift for children

But the donor has every right to state some of his demands , which are provided for by law. Such requirements include, for example, the wish that the donee enter into ownership upon reaching adulthood, wedding, entering college, and so on.

We recommend reading: Find out about the house at St. Petersburg address

First, the printed text is easy to read. Secondly, this text, which is typed on a computer, can be easily corrected . Thirdly, it is not necessary to type the entire text yourself; you can easily find a suitable contract form on the Internet, download it and insert your data into it.

Where can I make up, where to apply

There are three options for drawing up a preliminary agreement.

Option one

The parties draw up the text of the agreement independently. For example, parents decided to transfer part of the living space to their minor child and keep the remaining shares in joint ownership. The main thing in this case is to write the text of the agreement according to all the canons of drawing up a legal document. The draft (sample) document can be downloaded on our website.

It must be remembered that the sample document may differ, sometimes significantly, from the one you want to draw up. For example, the donor, in addition to the standard conditions, wants to include in the text of the document a condition under which the recipient will be able to receive part of the property into ownership. This could be graduation from school, or admission to a higher educational institution, or the incurrence by his legal representatives of the costs of completing the transaction.

If you are not sure that you can draw up a document legally, then it is better to entrust the drafting of the document to professionals.

Option two

You can contact a notary office and ask a notary for help with drawing up a pre-contract. The specialist will listen to your wishes, tell you which of them can be included in the text of the document, and which should be omitted.

If you have already drafted a document yourself, but are not sure of its legal correctness, you can also contact a notary who will check the pre-contract and make the necessary corrections to it. However, usually the notary performs such actions to check and correct the text of the document at the time of concluding the preliminary agreement, therefore, if you are not yet ready to sign the document, it would be better to use the third option.

Option three

Seeking legal advice for help. The specialist will check the document, correct it if necessary, and, if necessary, suggest some new clauses of the contract. Of course, the services of a lawyer are not free, you will have to pay some amount, however, if you agree on a draft agreement in a legal consultation, then you will not have to do it in a notary’s office: you will come to the notary with a ready-made document, which will only need to be certified.

Agreement of gift (donation) of a share in an apartment (form, sample)

If the owner of a share in the apartment is a minor, then the donor will need to formalize consent to donate a share in the residential premises with the guardianship and trusteeship authorities. If a minor is the donee, then permission from the guardianship authorities is not required. An agreement for donating a share of an apartment to minor children (a sample can also be found on our website) is concluded between the donor and the legal representative of a child under 14 years of age, or between the donor and a teenager aged 14 to 18 years, who acts with the written permission of the legal representative. An agreement on donating a share of an apartment to minor children is drawn up according to the same rules as when donating to an adult.

- date and place of drawing up the agreement;

- Full name, birth information, passport details, address details of the donor and recipient;

- the name of the subject of the deed of gift indicating the size of the share in the apartment, the address of the house, the location of the apartment, the size of the living space and the number of rooms in the apartment;

- inventory value of the donated share;

- rights, duties and responsibilities of the parties to the contract;

- information about persons registered in the apartment;

- the moment of transfer of ownership of a share in a residential premises;

- the procedure for incurring expenses associated with the registration of a deed of gift;

- details of title documents for property rights transferred as a gift.

Categories of donees

Within the framework of agreements on donating an apartment to minors, two groups of recipients are distinguished - those under the age of 14 years and those between the ages of 14 and 18. Both groups have different powers within the same legal relationship - donation.

So, in accordance with Art. 28 of the Civil Code of the Russian Federation, children under the age of 14 years, that is, belonging to the category of minors, cannot independently carry out transactions that require notarization or state registration. That is, children cannot:

- sign donation agreements for apartments, houses, operating enterprises, vehicles and land, since each of these types of donation requires state registration:

- sign agreements for the donation of shares, authorized capital and parts thereof, since these types of donations require notarization.

In relation to the topic of this article, this means that the agreement for donating an apartment on behalf of the minor recipient is signed by his parents, adoptive parents or guardians.

After reaching the age of 14, the child transfers to a different legal status and receives the right to independently sign apartment donation agreements as a donee, but on the condition that his legal representatives (parents, guardians, adoptive parents) will be present at the signing of the agreement.

The fact of the presence of legal representatives during the transaction is notified in the text of the agreement. The consent of legal representatives to the transaction can be either recorded in the contract itself or formalized through a separate written permission.

The gift of an apartment to a child under the age of 14 by his parent implies the simultaneous participation of a legal representative in the agreement, which means that the agreement on both the part of the donor and the child can be signed by the donor himself.

Agreement of Donation of Shares in an Apartment for Children Sample

In Russia, citizens can receive residential square meters or any real estate in exchange for the maintenance and care of another citizen. The transaction involves the conclusion of a rental agreement. Let's consider what an annuity agreement is, what rights and obligations the parties to the transaction will have, and outline all the conditions for concluding an agreement.

Russians often end up buying goods of poor quality. Some people go to Rospotrebnadzor or to court, while others leave the issue closed, without even trying to return the funds spent. We will tell you how and by whom the examination is carried out, who can be its initiator, and also indicate what the expert’s conclusion should look like, and how long to wait for the document to be ready.

We recommend reading: Sanitary and Epidemiological Requirements for the Operation of Residential Premises

Preparation of contract

The specifics of drawing up an agreement to donate an apartment to a minor child are spelled out in Articles No. 26 and No. 28 of the Civil Code of the Russian Federation. In addition to the details and conditions generally accepted for an act of gift, which include the subject of the agreement, the conditions for transferring the gift, rights and obligations, when drawing up a gift agreement in favor of a child, the legal representatives and employees of the guardianship authorities participating in the transaction should be indicated.

When giving an apartment to a child, it is also required to mention the consent of the parents to accept the gift. It is worth keeping in mind that the legal consequences for the parties to the transaction depend on the correctness of the contract. When drawing up a gift agreement, it would be a good idea to seek the help of an experienced lawyer.

The finished text of the contract must contain the following information :

- Full name of the donor, the minor child, as well as the child’s parents or guardians;

- Description of the legal essence of the agreement: “The donor gave a gift free of charge, and the donee accepted the following property”;

- Indication of the share size;

- Description of the apartment with address, area, cadastral number and other characteristics;

- Signatures of the parties with transcripts.

Additional conditions are included in the contract at the request of the parties. Most often, these are guarantees from the donor about the absence of persons registered in the apartment, as well as about the absence of debt on utility and tax payments.

Let's figure out how to draw up an agreement for donating a share of an apartment to children: a sample and all the nuances

- Date and place of signing (written in words).

- In the case where the recipient is a minor, his rights are represented by his mother and/or father and guardians. In this case, all information about the child and those who perform this procedure on his behalf is recorded. In this case, the full details of the child and who performs these actions on his behalf are indicated.

- Next comes the subject of the contract. The remark about gratuitousness must be included here. All shares in the residential premises must be described. Indicate the address, number of storeys of the house and floor of the apartment, total and donated area, number of registered people, information about the encumbrance.

- A document of title on the basis of which the apartment belongs to the owner(s), indicating the number and series, the date of issue of the document and the authorities that issued it.

- Rights and obligations of the parties. The donor undertakes to transfer the share and notifies about the shortcomings of the gift. The donee expresses his consent to accept the gift and, in case of cancellation of the deed of gift, to return the gift to the previous owner. The refusal of the donee is regulated by Article 573 of the Civil Code of the Russian Federation, which is also indicated in the contract.

If, upon allocation, the property is in common shared ownership or in common joint ownership, then the deed of gift for the share has legal force only if it is drawn up in accordance with the letter of the law and notarized. If the property has only one owner, then the procedure can be carried out independently by drawing up a standard agreement.

Basic principles of giving

A person can give his property to someone only if it belongs to him personally. It is not necessary in every case to obtain the consent of all owners, even if there are actually several of them .

The gratuitous transfer of real estate and any objects is the main feature of such agreements.

The contract should not contain any conditions related to the exchange. Or reporting that one of the parties plans to benefit. Such transactions are called sham transactions.

The contract for the transfer of a gift can be concluded orally or in writing. Written form becomes mandatory when the following conditions are met.

- If the object becomes the property of the donee not immediately, but after some time.

- Registration is required for the object of the transaction.

- The donor is a legal entity that transfers an item whose value is more than three thousand rubles.

It’s easy to draw up an agreement for donating shares to children

Recent changes in the law “On State Registration of Real Estate” and the Family Code of the Russian Federation have greatly “confusing” the situation with the allocation of shares from property rights. Therefore, before you receive information directly on drawing up a gift agreement, you need to figure out in what case you cannot do without a notary.

- the residential premises were purchased in legal marriage and are jointly acquired property

- the residential premises were purchased in the name of the children’s mother, who is not in a legal marital relationship

- the residential premises were purchased by the father/mother of the children on a mortgage before marriage and the loan or part of it was paid for using Maternal (family) capital or other government subsidies allocated to improve housing conditions for families with children

Information about the form of the contract

There are several situations when a contract must be drawn up in writing, regardless of the accompanying conditions.

- Promise of giving.

In this case, the written requirements are aimed at protecting the donee. Both parties may refuse to transfer the gift before the contract is finalized. But the recipients bear financial responsibility for such refusal. But the donors are not. - An agreement that is drawn up by a notary.

- Usual agreements. For them, written form is required if state registration is required.

- Documents describing a gift whose value exceeds three thousand rubles.

We discussed the nuances of drawing up a gift agreement for children in this material, and you can find out how to correctly draw up a gift agreement for an adult son and see its sample here.

How to draw up an agreement to donate a share to children using maternity capital

- All details of the apartment owners. Usually there are two of them - the mother and father of the children.

- In the future they are indicated as donors.

- Birth certificate of all children, indicating their recipients.

- The city where the act of donation takes place.

- Day month Year.

- Full passport details.

- It is necessary to write that the act of donation occurs independently and in sound mind.

- Indicate how and with what funds the property was purchased.

- Document the specified data.

- Fully describe the condition of the property.

- Apartment or house number.

- Confirm that the property has no liens or has not previously been donated by previous owners.

- Registration records of all persons participating in the process

- Data indicating all shares that are registered by Rosreestr.

- Specify the number of copies of the agreement

- Signatures of all participants.

- Through a notary office, where you will need to conclude and approve the final point of transfer. It is worth preparing a certificate about the amount of housing in advance.

- Draw up a contract yourself. By dividing all property in equal parts among all children. Submit the document to Rosreestor.

Registration of ownership

Property transactions are subject to state registration. Rosreestr handles the re-registration and initial registration of property rights. Papers are submitted to any territorial office or MFC. Data is entered into the state register of rights at the request of the copyright holder. Sample documents are posted on the Rosreestr website. Additionally you will need to prepare:

- gift agreement;

- documents for the premises;

- identification card of the child's representative;

- beneficiary's birth certificate;

- confirmation of tax payment.

An application to Rosreestr is submitted by a representative of the recipient entity. After 14 years of age, children submit documents independently. However, the written consent of the legal representative will be required.

The procedure for registering property rights takes from 5 to 12 days . Usually an extract from the Unified State Register is issued within a week. After receiving it, the minor child becomes the owner of the premises.

Sample gift agreement for a minor child

Full entry into ownership of the transferred property after receiving a document on state registration may be postponed for a specified period or until the occurrence of a certain circumstance. In this case, the corresponding mark on the encumbrance is placed in the certificate.

- statement of the parties to the agreement;

- document confirming payment of state duty;

- documents confirming authority (power of attorney for representation of interests; certificate of guardian/trustee);

- confirmation of the identity of the parties to the transaction (identification cards, passports, for minors a birth certificate will be required);

- the donor's title documents for the subject of the donation (purchase agreement, vehicle registration certificate);

Cost, expenses

When developing and agreeing on a draft gift agreement, the parties do not bear any costs. Maximum for copies of documents required by the notary.

When notarizing the transaction, 0.5% of the cost of part of the apartment is withheld. The minimum state duty is 300 rubles. The maximum tax amount should not exceed 20 thousand rubles.

Notary services are subject to separate payment. On average, citizens will have to pay 5 thousand rubles. Details can be obtained from the notary office.

Additional costs arise during state registration of property rights. Citizens pay 2 thousand rubles for entering data into the Unified State Register about the new owner of the apartment. If ownership is registered in relation to part of an apartment in an apartment building, then the tax rate is 200 rubles.

Income tax is withheld from citizens who are not relatives of the donor. The tax rate is 13%. It must be paid by April 30 of the following year. At the same time, taxpayers must submit a tax return to the Federal Tax Service. If the payer is not a resident of the Russian Federation, then the tax amount increases to 30%.