The Russian Agricultural Bank is one of the largest representatives of credit institutions in Russia. Its peculiarity is that the entire block of shares is in the hands of the state, which orients the bank’s activities towards the implementation of the main directions of state social and financial policy. This fact allows us to call Rosselkhozbank a completely reliable institution, which is not characterized by unexpected changes in lending conditions.

Mortgage lending is the most popular among the population, which is why this bank offers this service to individuals, despite the fact that it is mainly engaged in servicing legal entities. In view of this, questions among clients about what documents are needed for a mortgage at Rosselkhozbank and under what conditions such a loan is issued become relevant.

Mortgage for purchasing housing on the primary housing market

Rosselkhozbank offers clients to obtain a mortgage for a new building under favorable conditions and flexible rates. Preliminary calculation is carried out using a mortgage calculator (online service). Apartments in a new building have a number of advantages, the main one being a relatively low price.

When purchasing an apartment in a new building, a borrower faces some risks. Unscrupulous developers may be late with the delivery of the house, so experts recommend signing an agreement only with Rosselkhozbank partners. The apartments are sold with rough finishing.

Before visiting the official website and using the mortgage calculator, you need to find out in advance the exact cost of the property.

Offered Interest Rates

The interest rate for this lending program is from 10. Clients of Rosselkhozbank can count on preferential conditions and purchase real estate with a mortgage at 9% per annum.

For how many years is the loan issued?

Loan terms are up to 30 years. At the time of full repayment of the mortgage, the age of the borrower must not exceed 65 years.

conclusions

The publication talks about what documents need to be collected to obtain a mortgage from Rosselkhozbank. Main conclusions:

- preparation is planned taking into account the characteristics of a specific loan product;

- To clarify current requirements, you can visit the nearest branch or make a written request;

- real estate insurance is a standard requirement when applying for a mortgage;

- documents are provided in good condition (without marks, corrections, or other defects);

- if damage prevents unambiguous identification of data, it is necessary to restore the text using an archive copy;

- if necessary, the responsible bank employee may request additional documents;

- If filling out is difficult, please contact the information support service.

Life (health) insurance should not be neglected. In addition to reducing interest costs, these guarantees minimize financial losses in difficult situations. Policies are issued in favor of the lender as the first beneficiary.

The necessary additional information about documentary support for loans is presented in the materials on our website. To solve complex problems, contact the duty lawyer. Don't forget to like, repost, and leave comments. Use the subscription to quickly receive topical news.

Money for the purchase of secondary housing

After obtaining a mortgage for secondary housing at Rosselkhozbank, the client has the opportunity to purchase a separate apartment with already registered ownership. Real estate of this type has a number of advantages: the borrower independently selects housing that meets his wishes in all respects.

Before signing a contract, you must check the apartment for fines, debts and other encumbrances. It is best to purchase secondary housing in houses whose service life does not exceed 20 years.

Using the Rosselkhozbank mortgage calculator, the borrower independently calculates the amount of monthly payments. Starting from 2021, you can take out a targeted loan from the bank to purchase a plot of land and build your own residential building. The bank allows the allocated funds to be spent on the construction of a cottage or townhouse.

Interest rates

The interest rate on a mortgage at Rosselkhozbank for the purchase of secondary housing is 10%. Certain categories of citizens can count on a rate reduction.

For which clients interest rates can be reduced?

Salary clients can get a mortgage at 9% per annum.

Conditions for young families

For young families, Rosselkhozbank has developed a special mortgage program with which you can purchase secondary or primary real estate. The main condition is the birth of a second or third child between 2008 and 2021. Rosselkhozbank transfers funds for a house or apartment to the client’s account or issues them in cash.

The main difference of the program is the bank’s low annual remuneration (4.7%). If the client voluntarily refuses to conclude a property insurance contract, the rate increases to 6%. Intended use of funds:

- acquisition of secondary real estate located in rural districts (for residents of the Far East);

- purchasing an apartment in a new building (from a partner of Rosselkhozbank);

- payment of the purchase and sale agreement.

Basic conditions:

- possibility of attracting co-borrowers (up to 3 people);

- monthly annuity payments;

- one-time loan provision;

- consideration of the application within 3-5 days;

- collateral;

- Availability of a down payment (at least 20% of the total cost of the property).

The borrower can take out a loan for 30 years. The mortgage amount directly depends on the region:

- for Moscow and St. Petersburg – up to 12 million;

- for other cities – up to 6 million.

The mortgage calculator, located on the official website, will help Rosselkhozbank clients calculate the loan term. A personal account must be created in advance. The borrower can apply for a loan without a down payment if he has a maternal certificate. In this case, you must submit an application in advance. The amount of maternity capital is 450 thousand, which should be at least 20% of the total value of the property.

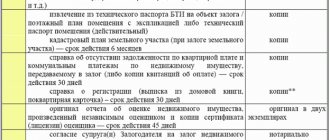

Rosselkhozbank mortgage, what documents are needed for the property.

As already mentioned, after receiving a positive response to the application, it is necessary to decide on the property and obtain its approval from the lender. Let's consider what the provided package of documents consists of in various cases.

- Purchasing an apartment, land plot or individual residential building. Title establishing (sale and purchase agreement, equity participation, etc.) and title registration document (certificate of state registration of rights or extract from the Unified State Register of Real Estate).

- An extract from the Unified State Register is no more than a month old.

- Real estate appraisal report.

- An extract from the house register with an issue date no earlier than a month ago.

- Technical documentation for the object - technical or cadastral passport, etc.

- Consent of the spouse to transfer the object as collateral. Subject to notarization.

- Title documents of the developer, including the land plot.

- Documents for the land plot - title and registration, cadastral passport, extract from the Unified State Registration Register.

This article examined the process of obtaining a mortgage at Rosselkhozbank in a generalized form, as well as in the case of a new program - rural mortgage. Due to the reduced interest rate, it is now in high demand.

Refinancing program

Rosselkhozbank refinances mortgages taken out from other banks on favorable terms. The program includes:

- townhouses and cottages;

- apartments in a new building;

- secondary market apartments.

The banking product has a number of advantages:

- possibility of early repayment of the loan;

- the ability to independently choose a payment scheme (differentiated, annuity);

- possibility of extending the loan term and changing the interest rate.

The consent of the first lender to register a mortgage at Rosselkhozbank is not required. The following can count on a reduction in the bank's annual remuneration:

- employees of budgetary organizations;

- young families;

- salary clients.

The interest rate may be affected by the purpose of the loan and its term. It varies between 10-13%. Bank remuneration allowances:

- 2% - until a certificate from the Unified State Register is submitted to the institution. registry;

- 1% - if you refuse to insure your property.

Rosselkhozbank does not charge any commission for early repayment of a mortgage. The mortgage refinancing calculator will help the client not only calculate the payment amount, but also assess all possible risks.

Bank conditions

Mortgage refinancing at Rosselkhozbank is available to military personnel. The loan is calculated using a calculator. The main difference between this type of program and the others is that the debt of the financial organization is paid by the state. Rosselkhozbank reduced mortgage rates to 8.75%. The loan terms differ slightly from the standard ones - the loan is issued for 27 years. At the time of full repayment of the mortgage, the client must be 75 years old.

Basic requirements for the borrower:

- having citizenship of the Russian Federation and permanent registration;

- total work experience – 5 years (last position – 12 months);

- age – from 21 years.

Required documents:

- papers for a restructured loan;

- military ID;

- copy of the contract (work book);

- birth certificates of children and marriage.

The loan amount is up to 2.7 million. The mortgage can be paid in several ways convenient for the client. To calculate the loan term and payment amount, you can use the refinancing calculator.

Loan purposes and requirements

The goals of a mortgage loan vary depending on the loan program, but in general they can be summarized as follows:

- buying an apartment as a secondary home;

- purchasing a residential building as a secondary home;

- purchasing housing on the primary market (from developers) either ready-made or under construction;

- construction of a residential building;

- completion of construction of a residential building or purchase of an unfinished construction project;

- purchase of land.

As for the requirements that Rosselkhozbank imposes on potential borrowers, among them is mandatory citizenship of the Russian Federation, age from 18 to 65 years. This age is assessed not only at the time the loan is issued, but also for its full repayment. Only close relatives of the borrower can act as co-borrowers. These include, in particular, the spouse, children and parents. In general there can be no more than 3.

Rosselkhozbank mortgage calculator

A mortgage calculator is a convenient tool that allows the client to get an idea of the size of monthly payments and loan terms.

Online calculation results

Thanks to the results obtained during the calculation, the client can plan his own budget. If the monthly payment is more than 40% of the income, then the bank reserves the client the right to attract co-borrowers (close relatives, adult children, spouses).

Monthly payment amount

The monthly payment amount consists of the following amounts:

- interest rate;

- total property value;

- loan terms;

- the amount of the down payment.

According to reviews, it is more convenient to pay off a mortgage with annuity payments (fixed monthly payment amount).

Total amount paid to the bank

To understand how much you will ultimately need to pay the bank for an apartment or residential building, you need to study the operating principle of the Rosselkhozbank mortgage calculator using an example. Provided that the total cost of housing is 1.5 million, the loan is issued for 15 years at 10% per annum, the amount of payments to the bank will be 2105 thousand rubles.

Amount of overpayment

The amount of overpayment on a mortgage is most often 70-80%. Based on the example described above, the client will overpay the bank for 15 years 905,000 rubles. (75.42% of the property value).

Data required for calculation

To use the Rosselkhozbank online calculator, the borrower must fill out the appropriate fields on the official website. Data for calculation:

- cost of the apartment;

- the amount of the down payment;

- mortgage term;

- desired interest rate (depending on the chosen program);

- payment type.

Once the borrower has approximately calculated the loan, you can begin filling out the application. It must be remembered that by indicating a contact phone number and a valid email, the borrower automatically consents to the collection and processing of personal data. In addition to the data described above, personal information is entered into a special form.

How to get a mortgage from Rosselkhozbank?

To get started, you'll need to pre-calculate your monthly payment to understand your chances of approval. The bank will approve the application only if your payment does not exceed 40% of the borrower’s official earnings.

The most convenient way to do all this is on the rshb.ru portal. You can also make calculations and fill out an online application on the official website.

4 banks that are happy to issue mortgage loans

To receive a loan, you need to provide a package of documents, which includes the following:

- Application – questionnaire

- A passport of a Russian citizen or a document that replaces it, for example, a sailor’s passport, an identity card for persons undergoing military service.

- For men under 27 years of age, military or registration certificate.

- Certificates that indicate material security and stable income.

- Documents on marital status (marriage registration certificate) and family composition (birth certificates of children), if available.

- Papers on credited real estate. They depend on what object is being purchased.

If you take out a loan to purchase an apartment, house or land, you will additionally need:

What does a bank form certificate mean and what is it needed for?

Rosselkhozbank's income certificate is a document intended to confirm the borrower's income, signed and certified by the employer. It confirms that the potential borrower has a permanent official income.

The bank offers to fill out a certificate on the RSHB form in order to simplify the requirements for the borrower as much as possible. The help contains the following information:

- Full name of the enterprise, its legal and actual address, TIN, bank details.

- Personal data of the employee (full name).

- The position in which the employee is listed, his length of service.

- Information about average monthly earnings and deductions for the last six months or year.

- Information about the head of the organization and the chief accountant.

- The manager's seal and signature.

The certificate is signed by the manager and chief accountant. If there is no full-time accounting department and the position of chief accountant, a note about this is made in the certificate, certified by the signature of the manager.

For pensioner borrowers, a similar document is issued by the Pension Fund branch at the place of receipt of social benefits.

The certificate can be issued on the official letterhead of the employing company with a stamp in the upper left corner.

The certificate cannot be issued to persons subject to dismissal for any reason and to employees whose salary deductions amount to more than 50%.

We do not recommend completing the documents yourself. Save time - contact our lawyers by phone:

8 (800) 302-76-94

Features of the mortgage program based on two documents

This type of loan has an annual interest rate of 9.55%. Money is issued to clients for a maximum of 25 years, debt repayment is carried out using an annuity or differentiated method, and early repayment of the loan is provided. In addition to the minimum package of documents, the advantages of this mortgage program include:

- no commissions;

- give out from 100,000 rubles. up to 8,000,000 rubles;

- a mortgage under two documents is issued with a down payment of 40%;

- the application is considered within 10 days;

- money is issued one-time, both in non-cash and cash form.