When is a house and site assessment required?

An appraisal of the house and plot is required to establish the market value of the property. When concluding a purchase and sale transaction, the procedure is carried out on a voluntary basis.

The involvement of an appraiser is provided for by law in the following cases:

- Registration of inheritance. It is necessary to determine the value of the home so that the notary’s office can issue a certificate confirming the right to dispose of the property.

- Bank deposit. A credit institution does not issue money without formalizing an encumbrance. To do this, you need an expert opinion on the value of the property.

- Real estate insurance. To calculate the amount of insurance, it is necessary to obtain data on the value of the property for which the insurance policy is issued.

- Damage assessment. The amount of the amount for repair work is determined.

- Drawing up a gift agreement. The amount of the state duty depends on the value of the property.

- Valuation of a house for trial. In case of divorce or disputes between heirs, determining the value of real estate helps resolve property disputes.

IMPORTANT! The assessment of a residential building is carried out to calculate contributions to the authorized capital of the enterprise. The founders have the right to contribute money or transfer personal property to the company.

When is the procedure necessary?

The need to assess the value of a home may arise in many cases. For example:

- When calculating the taxes and duties you must pay;

- To register it as collateral for a loan or mortgage;

- If you need to introduce real estate into the authorized capital of a legal entity;

- If a property seizure has been imposed on the house;

- If it is necessary to divide property and related disputes;

- If you need to get insurance;

- If the construction of the house is not completed;

- If you need to take into account a house in an investment project.

Let's take a closer look at the most common situations in practice.

Receiving an inheritance

If you inherited a house, you need to pay land tax, state duty and notary fee. To do this, you need to know the value of the house, since duties and taxes are calculated from this value. Knowing the value of the house will also be useful to you in court if a dispute arises over property between heirs.

Sale

We said that it is possible to sell a house without a preliminary appraisal, and this is true. However, in some cases, a home appraisal is necessary before selling it. For example, if the buyer insists on it or you need to provide a report on the sale of the house to a third party. Then it makes sense to jointly select an appraiser to avoid subsequent disagreements.

For the tax office, an independent assessment of the value of your home before selling it is convincing evidence that the taxes you paid were calculated correctly. If the tax authorities have questions for you after the transaction has been completed, you will have to order an examination after the fact to prove that you are right.

For guardianship authorities

If the owner of the house or part of it is a person under 18 years of age or an incompetent citizen, to make any transaction with this real estate you will need permission from the guardianship authorities, whose task is to monitor compliance with the rights of the minor or incompetent person.

You cannot dispose of this housing at your own discretion. Here is a partial list of actions that need to be notified to the board of trustees:

- Selling a house or part of it;

- Renting out a house or part of it;

- Dividing the house into shares;

- Obtaining a loan secured by a house.

If such a transaction is made without the permission of the guardianship authorities, the court may declare the transaction invalid and initiate criminal proceedings against you.

If a minor or incompetent citizen only lives in the house and is not the owner, you can freely carry out the transactions listed above. This legislative amendment came into force in 2005.

Insurance

According to insurance legislation, if it is discovered that the price of property specified in the insurance contract exceeds the market price, the contract is declared invalid and insurance compensation is not paid.

In the opposite situation, if the price specified in the contract is less than the market price, the contract is considered incomplete. The insurance continues to be valid, but if an insured event occurs, you will be partially compensated. It is calculated as a percentage of the present value.

The maximum compensation under insurance can be equal to the cost of a new house, identical to the one that was damaged. But in practice, the maximum compensation is rarely paid, since fraud is possible due to the price of the land plot.

We recommend that you insure your residential building separately from the site. Then the calculation of the damage you have suffered will be unambiguous.

Before you insure your home, you need to get its value assessed by a reputable company. This will help you avoid mistakes in the contract, which could then result in a protracted trial for you.

Contribution to the authorized capital of a legal entity

The transfer of property to the authorized capital is considered its investment, and not its sale. This procedure helps detail the rights of the founders to make decisions regarding the use of the house for commercial purposes.

Before contributing a house to the authorized capital, you need to evaluate it in order to convert the value of this contribution into a cash equivalent. The price of the house determines the amount of property tax and the amount of depreciation.

The price of the house can be determined at a meeting of the founders, but the amount named by them should not exceed the data of an independent assessment.

Divorce of owners

When dividing a house as marital property, one partner must renounce his or her rights to the property by paying compensation to the other. To determine the amount of this payment, you need to know the total cost of the house and land.

We advise former spouses to agree on the choice of an appraisal company. Even if you do not want to see each other, we advise you to compromise on this issue, otherwise your former significant other will spoil your nerves for some time.

Karl and Clara filed for divorce. Over the years of marriage they built a country house. Clara ordered his evaluation without consulting Karl. Now Karl has two options: beg Clara to re-evaluate the house or submit a controversial report for examination.

A similar scheme is used when liquidating a legal entity that owns a house, or when one of the owners sells their share.

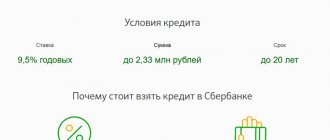

Obtaining a secured loan

The loan amount that you will be given against the security of your home is equal to 80% of its value. Banks do not accept examination data from all appraisers, but only from those companies that they trust. You can find a list of accredited companies on the website of the selected bank. This is not an imposition of the services of any particular company on you, but the freedom to choose a company from those offered by the bank.

Who has the right to evaluate a house and land plot?

Independent specialists - persons licensed to conduct expert activities - have the right to evaluate a house. Appraisers are members of the SRO and have a civil liability insurance policy in the amount of at least 300 thousand rubles.

Property owners choose an expert on their own, taking into account prices for services, reputation and other parameters. However, lending institutions refer borrowers to certain appraisers when issuing a mortgage loan.

ADVICE! SROs that cooperate with credit institutions draw up a report in accordance with the requirements of the bank. This eliminates the risk of sending the document for revision or re-registration.

Where will the assessment report from the Center for National Economy “Pravo” be accepted?

The competence of our appraisers is confirmed by certificates, therefore the assessment report is a document required for consideration by the Moscow authorities:

COURT

In case of division or seizure of property, divorce, disputes with tax authorities (for legal entities), to protect any other interests of the customer.

NOTARY'S OFFICE (NOTARY)

When registering an inheritance, deed of gift, or sale of property.

CHILD PROTECTION

In real estate transactions, for example, apartment exchange.

The procedure for assessing a house with land

The procedure for assessing a country house consists of a number of stages. The home owner negotiates the terms of cooperation with the appraiser and sets deadlines for the examination. A corresponding agreement is drawn up.

After signing the contract, the owner of the property gives the expert the documentation for the house and agrees on the date of the specialist’s visit. During the inspection process, the appraiser takes photographs of the housing and inspects the building for illegal redevelopment.

An independent assessment of the house and site is carried out based on one of the methods:

- Analog. The essence of the examination is to compare prices for such transactions throughout the year. Based on the results of the analysis, the appraiser identifies the value of the current object. This technique is used in large populated areas.

- Expensive. A special feature of the methodology is the assessment of expenses incurred by the homeowner during repair and construction work. Cost expertise is used to establish the cost of country cottages.

- Profitable. Used to evaluate city apartments and commercial real estate. Market value is determined by assessing the return on investment in real estate.

When examining a private house and plot, the appraiser pays attention to the following parameters:

- Location of the property (infrastructure development, type of settlement, etc.).

- Condition of the building (year of construction, number of floors, area, type of building materials, condition of communications).

- The presence of encumbrances on the site and dacha.

ATTENTION! If the property being sold was purchased using borrowed funds and the loan is not repaid, the owner needs to remove the encumbrance from the house and order an updated extract from the Unified State Register.

The validity period of the report for housing purchased with a mortgage is six months. If not only a house, but also a plot of land was purchased on credit, an additional assessment of the land is required.

Step-by-step instructions for assessing a private house

- Selecting an appraisal company

First you need to choose a company to evaluate a private home. Keep in mind that depending on the purpose of the appraisal, you may need a certified appraiser. This is especially important if the appraisal is needed for a bank or insurance company. If the appraiser does not have certification, the company will not accept its results.

- Inviting specialists to the site

Before the appraisers come to the house, it is necessary to tidy it up. It is necessary to clear all corners, as well as the basement and attic, if any. All this should be available for inspection. In addition, you must definitely check the pipes, taps, handles and other little things. All this should work fine.

IMPORTANT! The amount of cleaning and preparation you do will determine your final estimate.

- Determining the prestige of the city area in which the house is located

The location of your home determines its value. In any city there are prestigious areas, and there are bedrooms or even disadvantaged ones. The final cost is influenced by the distance of the house from infrastructure and transport interchanges, noise level, environmental situation, and so on.

- Calculating the cost of land

This amount is influenced by many different factors, such as:

- size of the plot (if it is more than three acres, then this adds 2-3% to the cost, if less, then it reduces 2-3%);

- whether it is regular or irregular in shape;

- its width is more or less than 12 meters;

- how close are transport interchanges;

- is the road covered with asphalt or not;

- natural conditions, whether high and industrial facilities are nearby;

- flat terrain or with a slope;

- is there a central sewerage system or not?

- separate entrance (sharing an entrance with someone reduces the cost by up to 30%).

- Determining the cost of the main building

To determine the cost, you need to know the net area of the house. To do this, you need to multiply the area of the foundation by the number of floors. This does not include verandas, basements, extensions, or garages.

After this, the cost of one square meter is estimated, taking into account discounts or surcharges depending on the following factors:

- brick walls near the house or shell rock;

- age of the house (if less than 7 years, then 5-10% is added, if the house is 8-20 years old, then 5-15% is reduced);

- area of the house;

- a modern house project or an old one;

- the house is turnkey ready or construction is not completed;

- new or old pipes in the house;

- whether the house needs repairs or not;

- separate or adjacent rooms;

- whether there are amenities in the house or not;

- high or low ceilings.

- Determining the cost of additional buildings on the site

You need to find out the approximate cost of these buildings separately. We found out above how they affect the total cost. To calculate the cost of additional buildings, you simply need to calculate the cost of their construction.

REFERENCE! Unfinished construction reduces up to 60% of the cost.

- Receive a report on the final cost of the house

Now it's time to determine the final cost. To do this, you need to add up the price for the house, land and additional buildings. Legal advice will be a good help in appraising a house.

What documents need to be provided

To determine the value of a home, the following documentation is required:

- A duplicate of the identity card and TIN of the owner of the property.

- Cadastral passport and topographic plan of the site.

- A document confirming ownership of the house.

When purchasing housing in a building under construction, an agreement with the developer is required.

Types of services

You can calculate the cost of a house or plot of land in the following ways:

- On one's own.

- Using the services of a private company.

- By contacting a state specialized organization.

- Using an online calculator.

Real estate can be appraised free of charge and for a certain amount of money. In the latter case, the work will be done more efficiently and the result will be as accurate as possible.

Experts use the following assessment methods in their work:

- Expensive . The costs of constructing a residential property are taken into account.

- Profitable . Suitable for assessing commercial real estate and apartments.

- Analog . The prices of transactions concluded over the past year are compared. Suitable for evaluating houses located within the city.

- Complex . This is a rather difficult method to implement. Therefore its cost is higher.

Depending on the object, an assessment can be made:

- Private house, cottage, multi-storey building.

- Land plot.

- Dwellings and land.

Evaluation report

The real estate inspection report is prepared in writing. The pages are numbered, the report is stapled, certified with a stamp and signature of the SRO representative. The report averages thirty pages.

The document contains the following information:

- information about the expert and the customer;

- information about methods for assessing housing;

- information about the house being inspected;

- real estate market analysis;

- identification of the market value of the object.

The report for the bank when applying for a mortgage loan contains:

- documentation for housing;

- photographs taken during the examination process;

- market price of real estate;

- liquidation value (the amount for which the bank will be able to sell the house if the borrower fails to fulfill its obligations).

If the bank client independently chose an appraisal company, additionally the following should be attached to the report:

- Diploma in Evaluation;

- document confirming membership in the SRO;

- civil liability insurance policy.

ADVICE! The assessment customer needs to carefully study the expert’s completed report while in the company’s office. This will help you quickly resolve possible issues and understand the nuances.

Assessment readiness

The completed Assessment Report for an individual residential building can be obtained from our office at the address: Moscow, Rozhdestvensky Boulevard, 9, office 21.

Our company has organized free delivery of the prepared reporting documentation directly to the Customer or to the actual user of the Assessment Report for an individual residential building (for example, to a branch of a lending bank) throughout Moscow, delivery cost 300 rubles.

It is possible to provide reporting documentation in electronic form.

What can the assessed value affect?

The SRO expert’s report affects the following lending conditions:

- size of the amount;

- loan term;

- interest rate.

If the real value of the property, as determined by the appraiser, is lower than the market value, the bank does not issue the required amount. In such a situation, the borrower needs to:

- request a re-examination;

- conduct an assessment in another company;

- apply for a consumer loan for the missing amount.

It takes three to five days to complete an appraisal and report on real estate purchased with borrowed funds.