At Sberbank, as at any other bank, clients are offered additional financial protection for loans. The essence of this program is to shift obligations to the insurance company in the event of an insured event. For a number of reasons, citizens often want to return the money they paid for insurance. According to the Civil Code of the Russian Federation, the borrower has this right. Repayment of loan insurance from Sberbank can be made within 14 days from the date of signing the agreement, subject to full repayment of the debt. How to do this will be discussed in this article.

Is it possible to get money back for insurance?

Even after the borrower signs an agreement with Sberbank, it is still possible to return financial protection for a non-purpose loan. It is impossible to accurately calculate the amount due for refund. It depends on the amount of the contribution and the circulation period.

But for a mortgage, it will not be possible to return the insurance, since the policy is issued on collateral in the form of a purchased apartment. If the client has insured his life, then you can count on a refund of the amount paid.

Legislative side

A borrower intending to return loan insurance may refer to the following laws of the Russian Federation:

- Civil Code of the Russian Federation, Article 958. If the contract provides for the return of the entire insurance premium or part paid, the borrower has every right to demand the money back upon cancellation of the contract. By the way, in the Sberbank agreement this provision is listed under clause 4.

- Civil Code of the Russian Federation, Article 1102. If Sberbank withheld the insurance as a commission and did not transfer it to the insurance company, the borrower, through the court, can demand the amount due to him and add moral damages to the claim.

- Russian Law “On the Protection of Consumer Rights,” Article 10. Proclaims the consumer’s right to return insurance payments in full if the bank misled the borrower.

- Law on Consumer Rights, Article 32. The client has the right to demand the return of unused insurance when he repays the loan ahead of time. And according to Article 29 of the same law, the applicant is allowed to cancel the policy after signing an agreement with the bank if shortcomings are identified in the lending program.

- Civil Code of the Russian Federation, Article 359. This article of the Civil Code regulates the following provision: if the money for the requested insurance is not returned for a long time, interest is charged on it. As a result, the company will have to pay the borrower a large amount.

Conclusions from the legislative framework: the bank does not have the right to refuse to pay the borrower the amount of the insurance premium due to him. If faced with opposition from a banking structure or insurance company, you can return the insurance through the court. Such cases are dealt with in accordance with the law of the Russian Federation, and usually the borrowers win.

Insurance company side

Returning loan insurance to Sberbank is unprofitable because it is fraught with losses. Not a single financial organization is prepared to lose profits. Therefore, bank lawyers are trying in every possible way to refuse to return loan insurance to borrowers who apply.

According to statistics, only a small part of clients go to court with a claim to oblige the bank to return the money previously paid for life insurance, although the law of the Russian Federation is on their side. This is due to the legal illiteracy of citizens, which is what the majority of the UK is counting on.

Loan insurance must be guaranteed to be returned to the applicant if this provision is specified in the loan agreement.

Is it worth giving up?

In any case, you should not refuse insurance of collateral, because without this policy, mortgage lending will not be approved. This measure is provided for by law and it is not possible to refuse it during the entire loan period. But all other, optional types of insurance can be covered both at the time of registration and starting from the second year of lending. However, before canceling the policy, you need to consider all possible risks. No one is immune from job loss and health problems. And having lost the ability to pay a loan, a person without insurance condemns his closest relatives (parents, spouse, children) to this. And who would want to doom their loved ones to this? Therefore, this should be a very deliberate act, and not just a pursuit for the return of material resources.

Thus, we can conclude that you can refuse insurance if it does not fall into the compulsory category. This also does not require financial costs or a lot of time. The only thing you need to think about before canceling your policy is the feasibility of this decision.

Insurance companies cooperating with Sberbank

Only accredited insurance companies cooperate with Sberbank (Alfastrakhovanie, Sberbank Insurance, Alliance, etc.). You can take out an insurance policy, even for a large amount, at any organization listed on the bank’s official website.

Clients often use the services of a subsidiary to insure their loans.

Contact details of IC "Sberbank Life Insurance"

Contacts for communication with:

- official portal of IC "Sber Insurance": https://www.sberbank-insurance.ru/;

- Emergency telephone number from any region of Russia: 8 495 500-55-50;

- toll-free number for calls from mobile phones: 900;

- e-mail;

- legal address: 121170, Moscow, st. Poklonnaya, 3 bldg. 1.

The addresses of offices where the insurance service is available are presented on the Sberbank website. You can find the location of the IC as follows:

- On the main page of the Sberbank website, go to the “Branches and ATMs” section.

- Select “More” in the top menu.

- Select the “Insurance” criterion and click “Apply”.

An approximate list of documents required to receive insurance compensation

The fact of an accident requires documentary confirmation. To receive financial compensation, you must provide the following documents:

- A certificate containing a calculation of the amount of debt under the mortgage agreement as of the date of the insured event (the paper must be certified by the seal and signature of an authorized bank employee);

- Questionnaire;

- Death certificate or other document certifying the occurrence of a fatal outcome (a report of a forensic medical examination of the body, an autopsy report, the results of a chemical examination, etc.);

- A fragment of a medical card or medical history for the last 60 months. The document must contain information about established diagnoses, treatment methods, time of hospitalization, indicating the timing and dates of medical measures. If the patient was sent for a medical and social examination (MSE), then you need to take a certificate indicating the reasons and date of the examination;

- Report on an accident that occurred at the enterprise (form H1);

- Protocols describing the reasons for the occurrence of an insured event (issued by the Ministry of Emergency Situations and the Ministry of Internal Affairs);

- Certificate of determination of the first or second degree of disability (issued based on the results of the ITU);

- Pension certificate (payments are assigned in the event of permanent loss of ability to work);

- Referral to undergo a medical examination (issued by a medical institution);

- An examination report signed by members of the medical commission;

- Results of analyzes and laboratory samples.

These documents are drawn up in Russian. If an adverse event occurred on the territory of another country, then the papers must be drawn up in accordance with current legislation and translated into the state language of the Russian Federation. A Sberbank client who has purchased insurance can use telemedicine services. The borrower can get advice from a doctor using the Internet.

This approach has a number of advantages:

- Significant time savings (no need to go to the hospital);

- Competent specialists;

- Variety of communication channels (corporate portal, mobile software, conversations on a cell phone).

A client who decides to use telemedicine services must do the following:

- Follow the special link and register;

- Log in to your electronic account and enter a one-time password in the appropriate field;

- Click on the “Call a doctor” button.

Remote consultations can be obtained 14 days after the conclusion of the contract. Patients are received online 24 hours a day, without holidays or weekends.

Maximum amount possible for refund

How much money Sberbank will return for loan insurance depends on the time during which the client used the borrowed funds and the date of application.

The amount of compensation will vary depending on the period at which the citizen expresses a desire to terminate the contractual relationship with the bank. The entire insurance premium can only be collected within the first 14 days. Then the insurance company makes calculations based on the unused insurance period.

In practice, it is difficult to obtain a full refund of the insurance amount. The borrower faces a problem even when submitting such a request in writing - they simply refuse to accept it.

Types of mortgage insurance at Sberbank

When taking out long-term mortgage loans, the parties to the agreement strive to fulfill the terms of the agreement in full, but the risks of violating the obligation are present in any case. The bank may not receive the funds issued, and the borrower may lose the apartment or house if the financial condition worsens or applicants for the purchased housing appear.

To minimize the risks of both parties, various insurance products are used to protect against loss:

- real estate purchased with a mortgage;

- life and health of the main borrower and co-borrowers, leading to a decrease in income;

- title (right to own housing).

Mortgage property insurance is mandatory for all borrowers when taking home loans. This requirement is regulated by the Civil Code of the Russian Federation and the Federal Law “On Mortgage”. The purchased object is pledged to the bank until the debt is fully repaid, and the policy will cover part of the loan or its full cost in the event of an insured event.

Life and health are insured voluntarily, but this is a popular type of insurance service. The policy allows you to cover loan payments in the event of loss of life or disability of the main borrower, as well as receive a discount on the interest rate at Sberbank of 1%.

Title insurance is rarely practiced because it protects against loss of title to a property. Typically, this type of insurance is recommended when there is a possibility that third parties will legally claim the property.

Conditions and procedure for returning insurance on an existing loan

Thanks to Directive of the Central Bank of Russia No. 4500-U dated August 21, 2017, the conditions for returning loan insurance from Sberbank have been simplified. This is due to the introduced “cooling off period”, which allows you to cancel your insurance with a refund of the entire amount paid within 14 calendar days.

Expert opinion

Irina Bogdanova

Expert in the field of mortgage lending.

The only situation when the money for insurance may not be returned is if the borrower took out a policy with a third-party company.

If for some reason the applicant did not manage to cancel the insurance within the prescribed period, you can do this in the next 2 weeks.

Within 14 days

The premium is returned to the client’s bank account within 14 calendar or 10 working days from the date of signing the contract. During this period, the borrower has the right to receive the paid funds in full, provided that the insured event does not occur.

The contract is canceled and the premium is returned based on the original application for refusal of insurance received by the insurer.

It must indicate:

- FULL NAME. (no abbreviations);

- contract/policy number;

- the amount paid under the insurance contract;

- payment number;

- name of the insurance intermediary;

- bank details of the policyholder for transferring money.

How does the borrower proceed to return the insurance premium:

- Collects the necessary package of documents (loan agreement, Russian passport, receipt).

- Submits an application in duplicate by personally visiting the IC office or bank branch.

- Awaiting a decision and transfer of funds to the account indicated in the application.

Expert opinion

Irina Bogdanova

Expert in the field of mortgage lending.

It is easier to get your money back if you have an individual insurance contract, when the bank is not an intermediary.

After 14 days

Return of the insurance premium is possible after 14 days, but subject to early repayment of the loan. The payment is calculated individually depending on the remaining unused days of the loan period.

Refund of insurance after repayment of loan obligations

To return the insurance after repaying the loan at Sberbank, you must submit the following documents:

- Russian passport;

- loan agreement;

- insurance certificate;

- bank statement confirming the loan coverage;

- payment slips for the transfer of insurance premium (if payment was made elsewhere).

To receive an insurance payment from Sberbank after repaying the loan, you need to fill out a special form (directly at the branch or office of the insurance company). It is important to pick up a second copy signed by the insurer.

The nuances of refusing insurance: after a year or more

The insurance contract must be valid for the entire loan period, therefore, in the second year and until the loan is fully repaid, the debtor must remember the need to prolong the document. If such action does not follow, the bank has the right to revise the rate, but the conditions and rights to carry out such actions are determined by the terms of the mortgage agreement.

You can draw up an agreement with an insurance company that is accredited by this credit institution. The general list of organizations today includes several dozen companies. All of them have been tested, so clients have no reason to doubt the reputation, reliability and solvency of the organizations.

Extension of an insurance contract when lending at Sberbank can be carried out using the following options:

- Contacting the office of the company where the contract was previously drawn up;

- Registration online using the official portal of the insurer;

- Involving the services of a bank as an intermediary during a personal visit;

- Sending documents through special bank services.

If we are talking about voluntary title insurance, then such contracts are usually concluded for a certain time. In the third year, the terms of such agreements still apply, and for a longer period they are extended in rare cases.

After concluding a mortgage agreement, refusal of voluntary insurance is possible during the “cooling period”, the duration of which is currently limited to 14 days. In a significant proportion of cases, borrowers agree to cooperate with insurance organizations, since in such a situation they can count on a lower interest rate. Careful study of the papers being signed and knowledge of the borrower’s rights will help you avoid unpleasant consequences and disappointments.

Refund of insurance upon early repayment of loan

In case of early termination of the loan agreement, a separate application for the return of paid insurance must be written.

In the case of a mortgage, payments are calculated based on the price of a life and health insurance policy. It does not matter for what amount the loan was issued. The insurance company returns the unused part of the financial guarantee. But it will not be possible to return insurance on collateral real estate (it is stated in the contract and justified by the law of the Russian Federation). You can take out consumer loan insurance at any payment term.

Expert opinion

Irina Bogdanova

Expert in the field of mortgage lending.

The client writes an application at a bank branch or directly to the insurance company. If the employee does not want to accept the application, the borrower contacts management.

Application Procedure

The applicant fills out an application for refund of insurance according to the approved form. Then he submits it along with a package of documents personally to Sberbank or SK.

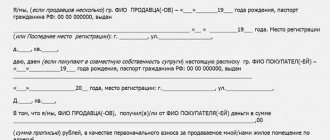

Rules for filling out an application

When filling out the application, the first thing you will need to pay attention to is the “header”. Here it is important to correctly indicate information about the addressee and your own (full name, registration address, information on the insurance policy). The borrower also indicates the amount of payment for the insurance premium, bank details of the card (account) for transferring money and a list of attached documents.

Sample application for return of financial protection:

Where to apply

The completed application is submitted to the address of the insurance company where the insurance was taken out, or directly to the bank branch (if Sberbank acts as an intermediary). The employee accepts and registers the application in the incoming documentation journal.

Rules for issuing an insurance policy

An agreement can be concluded by an adult capable citizen who has reached the age of 18 years. An unfavorable case is acquired disability (group 1 or 2) or death. An insurance policy helps compensate for financial expenses that inevitably arise as a result of fractures, burns, frostbite, electrical injuries and other adverse events.

Train and plane accidents are considered special cases. If the person specified in the policy dies as a result of a transport accident, then the beneficiaries will receive an additional payment in the amount of one million rubles. The policy period is 12 months. After this, it can be extended for another year (Sberbank has a “Protected Borrower” program, which allows you to buy a long-term policy).

The agreement is concluded using an enhanced digital signature and sent by email. The entire world is considered to be the coverage area of the insurance policy (financial protection is valid around the clock). The final amount of compensation payment is determined according to a special table and depends on the severity of bodily injuries (maximum financial compensation is received by persons who have lost limbs or lost vision).

The policy contains the following information:

- Details of the parties to the transaction;

- Amount of compensation amount;

- List of insured events;

- Amount of tariffs and premiums;

- Contract time.

The amount of compensation depends on the balance of the mortgage debt. The cost of the policy is determined based on a comprehensive analysis of various factors (gender, age, health, etc.). The premium can be paid in cash or by credit card.

Buying a policy has certain advantages. If the borrower dies for one reason or another, the mortgage debt will be repaid by the company. The lack of financial protection will result in the debt burden falling on the shoulders of co-borrowers. Not taking out life insurance will result in higher interest rates on your home loan.

What to do if Sberbank refuses to return insurance

If the policyholder refuses to return the paid loan insurance, the applicant should adhere to the following algorithm:

- Contact the Central Bank of the Russian Federation with a complaint about the unreasonable rejection of the application for the return of the insurance premium. Be sure to provide copies of all documents.

- Write a letter of claim to Rospotrebnadzor. Provide relevant certificates and papers to confirm your actions. The application is considered by this authority for no more than 30 days. The borrower receives a written response by mail that lists his rights. If, after an inspection, it is determined that the bank’s actions were illegal, the borrower will be paid compensation in full, including for moral damages.

- Having received a refusal from all government agencies, file a claim in court, citing the Law “On Protection of Consumer Rights”.

Sample claim to court:

Thus, the borrower has the right to receive back the entire loan insurance premium in the first 2 weeks after signing the agreement. This applies only to consumer loans. You should not expect a refund of the unused portion of the mortgage insurance premium, even if you repay the debt early.

The nuances of returning insurance

The mortgage borrower needs to take into account some nuances. They depend on the grounds for termination of the contract.

During the “cooling off period”

Refunds within the first 2 weeks will be:

- in full - if the cancellation of the contract occurred before the start date of the insurance;

- in proportion – if after the start date.

Also, a mandatory condition for a return is that during these 14 days there are no events that have signs of an insured event. If there were any, it will not be possible to return the premium on this basis.

For early and scheduled repayment

If the mortgage with Sberbank is repaid according to the schedule, then it is possible to return the premium (in cases specified in the agreement and the law) only if the insurance contract has a longer validity period than the loan contract. If the terms are the same, then the insurance simply ceases to be valid. The insurer's obligations are considered fulfilled, which means the premium is not refundable.

Early repayment in itself, as a rule, is not a basis for a return. Likewise, in case of premature closure of a mortgage, one cannot claim a refund under Part 1 of Statute. 958 Civil Code. For example, the borrower may still die or become disabled, and the property may still be flooded or burned. This means that the insurance risk does not disappear in this case.

But there are exceptions - for example, in the same Sberbank insurance, a refund for early cancellation is carried out if the counterparties initially agreed on this.

Attention! In any case, you need to look at the Insurance Rules or the agreement of the counterparties in order to obtain the most reliable information on the matter presented.

When refinancing

If the bank issuing the refinancing loan has approved the current insurer, it is possible to simply extend the insurance (after all, neither the insured nor the collateral has changed), replacing the beneficiary (under a property insurance policy - stat. 956 of the Civil Code).

Otherwise, you will have to terminate the insurance and enter into an agreement with another, accredited insurer. There is no exact information about the return of the mortgage premium in these cases. It is likely that the general provision specified in para. 2 hours 3 stat. 958 Civil Code - that is, the premium is not refundable.

After the death of the borrower

After the death of the borrower, an heir takes his place (Art. 1, Stat. 960 of the Civil Code of the Russian Federation) - if he accepted the inheritance. Accordingly, the return of the Sberbank mortgage premium will be carried out by it according to the same rules (by law or agreement of the parties) as if the borrower were alive.