Sberbank, like most banks, provides various loans to the population, but unfortunately, not all borrowers fulfill their obligations. In this case, Sberbank, in accordance with the laws of Russia, has the right to sell the collateral property of the debtors.

Let's start with a definition. Collateral is property owned by a bank client, but provided as collateral that secures a loan for a certain amount of money . In fact, such an organization is quite fair for both parties.

What can be classified as collateral? The list is quite extensive. Here are some of his positions:

- apartments and residential buildings;

- land;

- equipment;

- technique;

- materials.

If the borrower does not fulfill the conditions stipulated by the loan agreement, then Sberbank has the right to obtain the mortgaged property at its disposal. As for the sale of confiscated property, it is carried out on the basis of Russian legislation.

The sale of collateral can be carried out in various ways. This may be implemented through a court order or without it. Nowadays, joint sale of collateral real estate with the borrower is also practiced.

Who sells mortgaged apartments?

If the client has not repaid the debt, and the housing is under a mortgage, the owner of the property is the bank itself, as the lending party. All information about this is contained in the Unified State Register of Real Estate. However, the legislation of the Russian Federation does not allow you to simply buy housing with loan arrears.

First, the potential new owner will have to pay off the debt. Then Rosreestr will receive information about the absence of debt and the entry will be deleted. It is sometimes more profitable to remove the encumbrance from a mortgaged apartment than to buy it from a developer. The difference in price can exceed 25 - 30% of the market value of the living space.

Are there other ways?

Indeed, some banks prefer, when drawing up a purchase and sale agreement, to stipulate in it that the funds received from the client will be used to repay the debt. Upon repayment, ownership of the apartment is registered. However, such transactions may carry financial risks for the buyer, and to protect yourself, it is worth contacting an experienced lawyer. He will analyze the terms of the agreement, make sure that bank employees drew up the document honestly, and most importantly, legally competent. Sometimes an accidental mistake or one point can lead to the loss of property, and it will be difficult to prove anything in court.

The down payment does not cover the seller's debt

This situation cannot be called extraordinary, and in the language of bankers the procedure is called “re-borrowing”. To interest the buyer in the transaction, the seller usually gives a good discount. The purchase of a mortgaged apartment secured by Sberbank is carried out in the following order:

- First stage:

- the buyer submits an application for a mortgage from Sberbank, indicating which apartment will be purchased, and receives approval for lending;

- the seller coordinates the sale with the lender. If the apartment is located in a building under construction and there is a mortgage on it, you must obtain permission from the developer;

- the buyer signs a loan agreement with Sberbank. The mortgage has not yet been issued.

- the buyer transfers the down payment and signs a receipt with the seller;

- documents are submitted to the MFC and the purchase and sale agreement is registered; Rosreestr registers the Seller’s encumbrances on the Buyer.

The purchase and sale agreement must include the following condition: At the time of conclusion of the Agreement, the Property is pledged (mortgage) to Sberbank PJSC to ensure the fulfillment of the Seller’s obligations under the loan agreement concluded between the Seller and Sberbank PJSC earlier.

- The seller and buyer receive the finished documents and submit them to the bank.

2. Second stage:

- the bank pays off obligations to the seller and opens a loan or mortgage to the buyer;

- Sberbank issues a mortgage in which the new owner is indicated as the mortgagor;

- the buyer signs a Mortgage agreement with Sberbank;

- Sberbank prepares a letter on the removal of the encumbrance (mortgage by force of law) registered in the first stage and gives it to the buyer;

- the buyer goes to the MFC and, together with a Sberbank employee, submits a letter to terminate the mortgage, and at the same time submits the mortgage agreement and the mortgage for registration.

The state duty for registering a mortgage agreement is 1,000 rubles divided by the number of parties to the agreement, for example, Sberbank and two buyers, which means three participants pay 333.34 rubles each.

- the buyer receives ready-made documents.

Recommended article: Sberbank mortgage programs

According to Sberbank employees, the entire process takes up to 3 weeks, provided that the parties have agreed on the transaction in advance.

Buying an apartment secured by Sberbank is an option to become the owner of comfortable and modern housing. Having carried out a transaction under the direction and control of the bank, you can be confident in the legal purity of the transaction.

Template of purchase and sale agreement Collateral object apartment (via invoice)

Receipt for down payment

Receipt for credit money

Rate the author

(

1 ratings, average: 5.00 out of 5)

Share on social networks

Author:

Maria Yurievna Sokhan

Date of publicationDecember 5, 2018February 25, 2019

The apartment is pledged and the purchase is on a mortgage. Is this possible?

It makes no difference to the bank who the contract is with. In such cases, the deposit is simply transferred to the buyer. Bank employees carry out all procedures themselves. In terms of time, they will take the same amount of time as standard mortgage lending. You submit an application and it is approved. Next, you go collect documents. The mortgage loan manager collects part of the list of required documents himself from Rosreestr. After which all you have to do is sign the purchase and sale agreement, and the home is yours.

Also, upon purchase, you will need to prepare a real estate appraisal report. It can also be ordered from mortgage managers. In some cases, you will be required to collect additional documents. The list will be provided to you by the bank.

What is important when purchasing mortgaged property from Sberbank

Indeed, most often the collateral is represented by an apartment purchased on credit or a mortgage. If there are compelling reasons for the alienation of the collateralized housing, the creditor bank and the debtor come to a mutual agreement on the need for a sale.

There are risks in purchasing an apartment secured by Sberbank, and the buyer is advised to pay attention to the following:

- The purchase of an apartment pledged by Sberbank is possible with the written consent of the lender. The document is necessary to remove the encumbrance and register a new transaction;

- banks “shift” the statements of registered residents to the contracting parties, trying not to participate in the process;

- remember that forced discharge of minor children through the court is possible only with the permission of the guardianship and trusteeship authorities, so discuss this in advance;

- the registration procedure is longer, since it requires the removal of encumbrances, and when buying on credit, checking the creditworthiness of the new borrower and obtaining Sberbank’s consent to lend to him.

The parties need to discuss the above points before transferring the deposit or making a down payment by the buyer.

Recommended article: Sberbank mortgage for a dacha

What risks are also possible and how to write them down in the contract and what to check, read in another article: Sale and purchase agreement with a mortgage - important points for the seller and buyer

Are there any restrictions when purchasing?

Suppose you decide to buy a mortgaged home from Sberbank and find an interesting offer. However, you should know an important detail - the repurchase of collateralized real estate can only be carried out in the same locality where you are applying for a mortgage. The legislation does not yet allow transactions at the interregional level if we are talking about the presence of encumbrances.

Complete turnkey apartment renovation

- Everything is included The cost of repairs includes everything: work, materials, documents.

- Without your participation After agreeing on the project, we only bother the owners when the repairs are completed.

- The price is known in advance. The cost of repairs is fixed in the contract.

- Fixed repair period Turnkey apartment renovation in 3.5 months. The term is fixed in the contract.

Read more about Done

Procedure for purchasing an apartment

Despite the wide range of services and mortgage loan programs that are offered on the bank’s official website, there is no tariff within which one could buy an apartment as collateral from Sberbank.

If we talk about the instructions for obtaining a mortgage loan, for example, to purchase an apartment in a new building or to purchase a private house under construction, the process is quite simple:

- visit the nearest Sberbank branch;

- contact an employee of the department for working with individuals;

- Having studied the list of mortgage lending programs, you will need to choose the most suitable one

- and a favorable tariff for yourself;

- Select a developer company from the list of accredited partners;

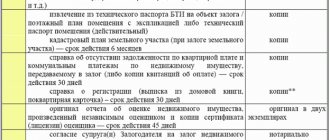

- provide a list of necessary documents confirming both the client’s identity and the level of his financial situation;

- conclude a loan agreement with a bank;

- make a down payment on a recently taken out real estate loan.

Upon successful receipt of borrowed funds, the borrower should make monthly payments to repay the mortgage according to the terms specified in the contract, otherwise, as stated on the Sberbank website, penalties and one-time fines will be charged.

Sometimes a loan delay leads to more serious consequences - litigation and deterioration of credit history.

Debts, arrears and buying a home

The buyer's main fear is responsibility for other people's debts. What happens if the previous owner was behind on mortgage payments, had fines and other problems? The law is on your side in this case. The obligations of the previous owners do not transfer to the new ones. Essentially, these are the bank's problems.

Also, the sale of a mortgaged apartment is not always associated with some kind of conflicts. Sometimes people simply move and sell housing that they have not yet managed to fully pay for. This is normal practice in our country.

About real risks

Remember that all transactions are carried out only through the bank that issued the mortgage loan. If some intermediaries communicate with you and demand a deposit of several hundred thousand, this should raise suspicions.

Important!

Be sure to review the documents that form the basis for selling your home with a lawyer. He definitely won't miss the details. For example, it is worth checking that the papers indicate a clause on the eviction of tenants. Otherwise, they will have to be evicted through the courts, which will delay the process of obtaining an apartment.

Another simple but important tip concerns price. There is no point in buying distressed housing as collateral if the difference between the proposed price and the market average is about 300 thousand rubles. The benefit begins only in cases where the supply is below the market.

It also happens that the bank refuses a new buyer. This usually happens in cases where the latter has problems with his credit history. Sometimes bank employees set additional conditions. For example, they require the mortgagor to pay 50% of the cost of the mortgage.

If you have the required amount, you can come to an agreement, sign the agreement with a notary, and pay the required part. After this, the transfer of ownership rights is carried out according to the standard scheme - with the signing of a purchase and sale agreement. In this case, there are usually no pitfalls.

Do you need repairs?

We have already renovated more than 500 apartments, we will be happy to help you too

Find out the cost of repairs

The buyer's down payment covers the seller's loan debt.

This is ideal when the remaining loan or mortgage debt is small. But the seller decided to alienate it because the opportunity arose to buy more spacious housing or move to another city or country.

The purchase of an apartment secured by Sberbank and the actions of the parties are carried out according to the following algorithm:

- the buyer submits a package of documents to the lender for approval of a mortgage or mortgage loan and receives approval;

- the seller receives Sberbank’s consent to early repayment of the mortgage and alienation of the apartment;

- the parties enter into a preliminary alienation agreement and the buyer makes an initial payment as a deposit, for which he rents a locker at Sberbank;

- on the appointed day, the initial payment is credited to the seller’s credit account and his obligations to the bank are closed, about which the bank draws up a document;

- Sberbank credits the buyer for the remaining amount, reissues the mortgage to a new mortgagor, or draws up a document for the submitted other mortgage. At the same time, opens a current account for the seller, where the remaining money for the transaction will be credited;

- the parties go to the Registration Chamber to register the alienation agreement, mortgage and re-registration of the encumbrance.

Recommended article: How to calculate a mortgage online at Sberbank - instructions

In mortgage lending, a mortgage can be issued both for the apartment being financed and for any other liquid real estate. When taking out a mortgage for housing under construction, the mortgage is drawn up for the apartment being purchased.

!['Sberbank's requirements for an apartment with a mortgage in [year]: reasons for the "tough](https://2440453.ru/wp-content/uploads/trebovaniya-sberbanka-k-kvartire-po-ipoteke-v-year-godu-prichiny-330x140.jpg)