What is a mandatory share for a pensioner?

A compulsory share is a part of the property of a deceased person to which persons established by law have the right to claim. An employee of the notary agency is responsible for calculating the size of the share, based on the number of all heirs.

A pensioner has the right to claim a compulsory share if there is a will. Even if the disabled dependents of the deceased person or his parents are not indicated in the text of the document, the notary agency employee still includes them in the list of heirs. If property rights are violated, the pensioner has the right to initiate legal proceedings and challenge the will.

The contents of the document drawn up are kept secret until it is read out by a notary after the death of the testator. If the spouse or parent realizes that he was not indicated in the document, then they will need to confirm their disability and receive a mandatory share.

We recommend reading

Selling a car by inheritance without registering it in your name

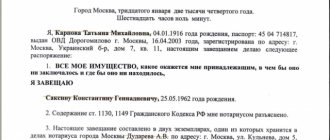

The procedure and procedure for providing a mandatory share to a pensioner are regulated by Art. 1149 of the Civil Code of the Russian Federation.

Judicial determination of the validity of a will

Any of the heirs indicated in the will or who believe that a challenge to the act is required will have to file a claim. The court will only consider the case if the claim has been properly prepared. The statement must indicate the essence of the requirements, as well as the grounds for considering the plaintiff’s position to be justified.

Gennady Zh. made a will in favor of his wife. But on the same day, a quarrel occurred between the spouses, and Gennady wrote another will, bequeathing an apartment in Moscow to his daughter. A few days later the man died. There was a dispute between the heiresses, and they turned to a lawyer for help with the question of how to resolve the conflict and determine the heiress. The lawyer pointed out that if there are no references to another in the will, then one will have to look for evidence. The women remembered that their father’s car had a video recorder. The lawyer advised to attach the registrar's record as evidence to the lawsuit.

During the trial, all necessary examinations will be carried out to determine the time of drawing up the wills. The court will carefully study the evidence presented and make a decision. But if it is impossible to reliably establish the time when the will was made, the court will cancel both of them. This entails inheritance by law in order of priority.

Grounds for receiving a mandatory share

The grounds include the following.

- Lack of ability to work. Old age or disability pensioners have the right to a compulsory share.

- Disabled dependents. In addition to lack of ability to work, they must be supported by the deceased person for at least 1 year. Sometimes they are asked to live with the deceased person for at least 1 year before his death.

If a person is disabled, then the representative of his property interests is an employee of the guardianship authorities or a guardian.

The recipient of the inheritance has the right to refuse the obligatory share. The waiver will be absolute—the person will not be able to transfer the property to another person.

If the pensioner does not take any actions aimed at entering into inheritance rights, then by law he thereby waives the share due to him. It will be divided among the remaining heirs.

Also, a pensioner may be denied the mandatory part. For example, a person was recognized as an unworthy heir and excluded from the general list of inheritance recipients. The basis is a court verdict in a criminal case that was initiated due to the commission of a crime against a deceased person, or other unlawful actions of a pensioner.

What to do if the testator left two wills

A will is a convenient legal document that allows you to resolve all inheritance disputes. But the matter becomes more complicated when there are several orders of the deceased person at the same time. In such a situation, it is important to take into account additional circumstances of the inheritance case and correctly determine the status of the second will. There are several common situations in which a notary has to distribute property between heirs - there are two wills that either exist independently of each other, or one of them completely or partially revokes the other.

This is interesting: Will new law 2021

Confirmation of disability

In order to exercise the right to a compulsory share, it is necessary to confirm the lack of ability to work. For this you can use:

- pension certificate, which is issued by the Pension Fund of the Russian Federation;

- certificate of early retirement due to disability or other legal grounds.

Reaching retirement age in accordance with the legislation of the Russian Federation is also confirmation of the lack of ability to work.

Establishing the fact of retirement is important when inheriting under a will and establishing a mandatory share. If the deceased person did not make a will during his lifetime, then the spouse or retired parent will be included in the priority group of heirs according to the law solely based on the presence of family ties with the deceased.

If the inheritance was privatized during the marriage

The court heard a case: after the death of his father, the son inherited a land plot and a garage in his will. However, the former wife of the will-maker also filed an application for division of property, appealing that the plot was received from the administration, and privatization took place during the period of legal marriage with the father of the heir.

The ex-wife demanded that the court allocate her a share in the jointly acquired property, therefore, remove it from the total inheritance mass. At first, the courts did not satisfy the claim, citing the fact that the privatized plot was the personal property of the deceased person, and accordingly, it could not be divided.

But the Supreme Court made a different decision. The position is that privatization is not a gratuitous transaction that gives rise to the emergence of personal property of the spouse.

Privatization is understood as an act of a public authority, as a result of which property is transferred into personal ownership. Therefore, it is necessary to apply the general rules regarding the emergence of joint property acquired during marriage.

Therefore, it was decided to recognize half of the land plot as the property of the testator and his ex-wife, and the son had to come to terms with this court decision.

Unwanted heirs from whom even a will cannot protect

Registration of a mandatory share by a pensioner

An employee of a notary agency examines documents when opening an inheritance case. When determining the presence of compulsory heirs, he must inform them that the testator has died and that they are entitled to a certain share.

Entry into inheritance rights consists of the following steps:

We recommend reading

Cancellation of a will

- contacting a notary agency;

- provision of documents to the notary;

- contacting an appraisal company to determine the value of the property;

- payment of state fees and services of a notary agency specialist;

- obtaining a completed certificate on the basis of which the pensioner will enter into inheritance rights.

You need to contact a notary agency:

- at the last place of residence of the deceased person;

- at the address of the deceased's property.

You can also contact your regional notary chamber. Representatives of the agency will provide the applicant with the specific address of the agency that contains the will of the deceased.

The certificate will be presented to the pensioner six months after his application. The person will then need to register the property rights.

Preparation of documents

Required documents include the following:

- passport;

- certificates confirming the presence of family ties with the deceased (for example, marriage registration certificate, birth certificate);

- documents confirming the existence of a special status, being a dependent of the deceased.

The procedure for entering into inheritance rights for pensioners is the same as for other inheritance recipients.

Costs for registering a share

Registration of an inheritance requires payment of a state fee. The amount is influenced by 2 factors - the value of the property and the degree of relationship.

If a pensioner has a disability of group 1 or 2, then he does not need to pay the state fee.

The state fee is as follows:

- 0.3% if the pensioner is the parent or spouse of a deceased person (maximum amount - 100 thousand rubles);

- 0.6% if the pensioner is a disabled dependent of the deceased, but he does not have a disability (maximum amount - 1 million rubles).

Also, to enter into inheritance rights, you will need to pay for notary services. The cost depends on the specific agency and the region of residence of the applicant. On the site

Federal Notary Chamber

There is information about maximum regional rates.

The third item of expense is paying off the debts of the deceased person. Entering into inheritance rights involves not only receiving property, but also paying the debts of the deceased - for example:

- debts on loans (mortgages, consumer and car loans) and loans issued from banks and microfinance organizations;

- debts to third parties.

The debts of the deceased are distributed among the heirs either equally, or in accordance with the will of the debtor, reflected in the text of the will. And the debt is divided in proportion to the share of property that each person inherited. The amount of financial obligations depends on the value of the property that a particular heir received.

If a pensioner wants to refuse to fulfill the debt obligations of a deceased person, then he no longer has the right to claim the obligatory share.

At the same time, the legislation establishes a list of debt obligations that are associated with the personality of the deceased person and are not subject to repayment by the heirs:

- debts on alimony payments;

- debts for compensation for damage caused to the victim’s health;

- debts to banks that were repaid through the insurance program;

- debts for which the limitation period has come to an end.

Practice shows that pensioners often pay off the debts of the deceased using the property received from him.

If a will is made for one of the children, can the other children challenge it?

Answer from a lawyer. Yes, you can challenge, but you will challenge not the will itself, but the moral and ethical side - the deal that the parent left everything to one child.

This is interesting: Procedure for revoking a will in 2021

If the will has some elements of contestability, or the nullity of the transaction, then you can challenge it as a transaction. In this situation, it may be a mistake by the testator, writing a will under threats, etc.

Who can help

Any ambiguous situations can only be resolved in court. If a dying person has two wills and they contradict each other, and it is impossible to reliably determine the time of their execution, he will have to go to court.

In all other cases, only the act that was written later and does not contain errors that would allow it to be challenged will be valid. For example, if a person first wrote an open will in a notary’s office, and then wrote a new one in violation of the requirements (for example, printed out a closed will), then only the one that does not contradict the requirements of the law will be recognized.

In difficult situations, an inheritance lawyer may be involved in the case. A lawyer, of course, cannot determine the fairness of wills and their legal force, but can help defend the interests of the heir in court. This can be done by challenging an unfavorable will.

Due to frequent updates to legislation and the legal uniqueness of each situation, we recommend obtaining a free telephone consultation with a lawyer. You can ask your question by calling the hotline number 8 (800) 555-40-36 or write it in the form below.

How to challenge a will

Based on judicial practice, in our state we can identify the following several grounds, in the presence of which a will can be challenged:

- The incapacity of the maker of the will at the time of leaving it, or the lack of ability to understand the meaning of his actions or to manage them in full;

- Violations in the form and procedure for writing a will. As an example, when a will is signed not by the testator himself, but by another person due to the physical incapacity of the first, or in the absence of appropriate execution of the will;

- If the property transferred by the testator was acquired at the expense of the common funds of the testator and another person in the presence of a marriage relationship;

- If another transaction was covered by a will, as a rule, this is an annuity agreement with lifelong maintenance;

- The will was drawn up in favor of the heir, who, by law, is not worthy to be called such.

Regardless of whether there is a will or not, those heirs who have the status of disabled persons and belong to the first priority have the right to inherit property.

The surviving spouse, regardless of the will, has the right to part of the property acquired during the marriage, which is their joint property.

In other words, if a husband, by will, transfers his residential house in favor of his children, and does not indicate his wife, then she can claim ½ part of the house that was acquired by the testator during the period of their common marriage.