Cost of utilities in a one-room apartment

Let's figure out where you have to pay less for utilities: in a one-room apartment or in a private house.

Let's start with the cost of housing and communal services in a one-room apartment with 1 or 2 residents registered in it.

Its area in the example is 35 square meters.

So, how much do utilities cost in a one-room apartment?

View calculations.

As a rule, tariffs for basic types of housing and communal services are set by the city administration. They can easily be found on the Internet for your city.

Let's consider paying for cold water supply. Now this tariff is 21 rubles per cubic meter

.

If you do not have a water meter, then charges will be made according to established consumption standards, they are 5.35 cubic meters of water per 1 registered person

. As a result, we multiply 21 by 10.7 and get 224.7 rubles.

A similar calculation is made for the cost of wastewater disposal. Here the tariff today is 13.6 rubles. At the same time, his consumption rate is always the same as that of cold water

. It turns out 145 rubles a month.

- By analogy, we calculate all other indicators:

- DHW (hot water);

- Heating;

- Maintenance and repair;

- Elevator;

If the area has decreased, the developer pays

According to the law, the developer must transfer to the shareholder an apartment that corresponds to the project documentation - this means that the area should not be less than that specified in the contract.

Article 7 of the law “On participation in shared construction”

If the area of the apartment is smaller, the shareholder has the right to demand a reduction in its value. That is, return part of the money. But at the same time, the law on shared construction allows the parties to determine for themselves what to do if the area of the apartment is smaller or larger. And the developer can indicate in the share participation agreement the conditions under which he pays.

Article 29 of the Law “On Protection of Consumer Rights”

For example, in the contract, the additional payment for reducing the area may be indicated in square meters:

“The cost of an object decreases if the actual area is 1 m2 less than the design area”

With this condition, the developer may not pay extra for reducing the area by 0.9 m2. And there is no more commonplace and reliable way to protect yourself than to carefully read the contract before signing.

Below in the table we provide all calculations of the cost of utilities for the entire apartment

If 1 person is registered

| Index | Tariff, rub. | Man registered | Norm | Apartment norm | Total, rub. |

| HVS | 21 | 1 | 5,35 | 5,35 | 112,35 |

| IN | 13,63 | 1 | 5,35 | 5,35 | 72,9205 |

| DHW | 57 | 1 | 4,2 | 4,2 | 239,4 |

| Heating | 44,3 | 1 | — | 35 m² | 1550,5 |

| Electricity | 3,03 | 1 | 150 | 150 | 454,5 |

| Elevator | 4,15 | 1 | — | 35 m² | 145,25 |

| Maintenance and repair | 20,85 | 1 | — | 35 m² | 729,75 |

| Total | 3304,671 |

If two residents are registered.

| Index | Tariff, rub. | Man registered | Norm | Apartment norm/Area | Total, rub. |

| HVS | 21 | 2 | 5,35 | 10,7 | 224,7 |

| IN | 13,63 | 2 | 5,35 | 10,7 | 145,841 |

| DHW | 57 | 2 | 4,2 | 8,4 | 478,8 |

| Heating | 44,3 | 2 | — | 35 m² | 1550,5 |

| Electricity | 3,03 | 2 | 150 | 300 | 909 |

| Elevator | 4,15 | 2 | — | 35 m² | 145,25 |

| Maintenance and repair | 20,85 | 2 | — | 35 m² | 729,75 |

| Total | 4183,841 |

For heating, the norm is now calculated in many areas based on the heated area. In our case it is 35 square meters.

Electricity meters are available in all apartments. Therefore, we will take as an example a consumption of 150 kW per month.

How much do utilities usually cost per month for a one-room apartment? It depends greatly on the region, but on average it comes out to about 2,021 rubles during the heating season and 2,021 rubles in the summer months.

This calculation does not take into account “Common house electricity” and “Common house heating”. These items in the receipt usually cost from 200 to 800 rubles per month, depending on the number of floors of the building and the “greed” of the management company.

You may be interested in comparing the cost of paying for housing and communal services in an apartment with the cost of paying for utilities in a private house.

If you need detailed advice on disputes with management companies, please refer to the section on consulting services or call our company by phone.

Back call

Contact our specialists

| Topolev Alexander Dmitrievich Consultant in the field of commercial real estate. |

| Vlasov Evgeniy Alekseevich Rental Relations Manager. |

Rent

Rent is a mandatory deduction provided for owners of apartments in multi-storey buildings. The category of housing (municipal, private, communal room) is not taken into account. The amount of regular deductions includes the cost of utilities, as well as the price of services for maintaining the local area.

According to legal norms, the final rent price is calculated individually for the owners of different apartments. Some payments depend on the area of the premises, while others depend on the number of registered citizens. It is also allowed (in some cases even required) to install numerical equipment.

What is included in the rent is indicated in the receipt received by subscribers monthly. Today in Russia, rent will consist of the following indicators:

- means of communication (landline telephone, radio point and intercom);

- heating;

- organization of continuous and major repairs;

- improvement of the house and surrounding areas.

Payments for housing utilities will be added to this list if commercial management firms are not involved in managing the house.

Average rent for a one-room apartment

November 14, 2021 No comments

Every year prices for utilities and rent increase. Thus, for large cities the amount of payments is slightly higher compared to small settlements. Current payments are calculated in accordance with the area of living space.

The calculation is carried out by employees of authorized bodies on the basis of the Decree of local government structures, taking into account the indicators recorded on personal accounting devices and specific consumption standards approved for a particular region.

To understand the average amount of utility bills for a one-room apartment, you need to study the current regulatory documents, the tariff schedule used, the difference between tariffs in the Moscow region and Moscow, the rules for calculating and implementing payments.

Changing the area of an apartment under a participation agreement in shared construction: what does a shareholder need to know?

Can the DDU provide for a condition on changing the price of the DDU?

Due to the peculiarities of the construction of apartment buildings, the area of the shared construction project is not constant. As a rule, developers rarely transfer to the shareholder an apartment (non-residential premises) with an area equal to the area specified in the share participation agreement or project.

- Law No. 214-FZ allows for a change in the area during shared construction and, in connection with this, the price of the DDU object. That is, the price of the DDU may vary depending on the actual area, if this is provided for in the agreement with the developer.

In accordance with Part 2 of Article 5 of this law, by agreement of the parties, the price of the contract can be changed after its conclusion, if the contract provides for the possibility of changing the price, cases and conditions for its change.

Thus, the possibility of changing the price of residential or non-residential premises purchased under the DDU, both up and down, depends solely on the conditions of the DDU. If the DDU does not provide for a change in the price of the DDU, then it cannot be adjusted when the area changes.

Therefore, the shareholder needs to carefully study his DDU; usually all issues related to price recalculation are written down in the “Contract Price” section. As a rule, in the DDU, a change in the price of an object is associated precisely with a change in the actual area compared to the designed area of the object. At the same time, developers indicate in the DDU the cost per square meter, on the basis of which the final price of the DDU is calculated.

Let's consider 3 main variants of the conditions in the shared participation agreement regarding price changes in connection with a change in the area of the apartment during shared construction (or other object).

- If the actual area of a shared construction project changes, either more or less (regardless of the magnitude of such an increase), the price of the shared construction facility is subject to adjustment - increase or decrease, respectively.

- If the actual area of a shared construction project changes, either more or less, the price is subject to recalculation, but it has been established that for small changes the price is not adjusted. For example, the price changes only if the area of the object has increased by more than 1 square meter or more than 1%.

- If the actual area of the shared participation object changes, the price of the DDU does not change. This option may, on the one hand, be unprofitable for the shareholder (for example, if the area is significantly reduced), or, on the contrary, positive if the area increases. However, it should be noted that by including such a clause in the DDU, developers, as a rule, “count” on reducing the area. At the same time, there are often cases of significant reduction in area in such cases.

In all options for changing the area under any of these conditions, there is a risk for the shareholder. When increasing the area with a condition in the agreement on changing the price, a situation may arise when the area increases significantly and the shareholder will be obliged to contribute a significant amount that he did not expect. At the same time, when the area is reduced, a negative situation may also arise if the area decreases significantly and the premises do not meet the requirements of the shareholder, and even worse if the DDU does not provide for a revision of the price of the object. If there is a significant change in the object of the DDU compared to the project, the shareholder can terminate the DDU, but other nuances appear here: a) for the DDU concluded after 07/03/2016, the basis for termination is an increase in the area by more than 5% (or a lower figure can be established DDU), in other cases, the significance of the changes will be assessed by the court, that is, the assessment of this concept will depend on the conviction of the court b) the time frame for returning the money may be delayed, in addition, the developer may be insolvent at the end of construction. All these risks must be taken into account when concluding a share participation agreement in construction.

The procedure for adjusting the price of DDU when changing the area

Now let’s analyze the situation when a contract has already been concluded with the condition that the price be adjusted when the area of the property changes.

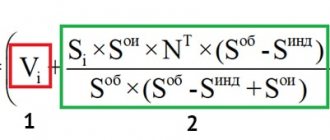

The actual area of the facility has changed compared to the design one. To calculate the amount of additional payment to the developer for “extra meters”, the following data will be required: the design area of the apartment (as a rule, indicated in the “Subject of the agreement” section in the DDU), the actual area (indicated in the property acceptance certificate, as well as in the technical plan of the facility) , the cost of 1 square meter of an object (indicated in the DDU, usually after the clause about the contract price).

- Let's give an example: 51.6 sq.m. — project area; 52.7 sq.m. — actual area, price 1 sq.m. = 37878 rubles. The actual area in this case is larger than the design area, and therefore the shareholder pays the difference to the developer. Additional payment by the developer = (52.7 sq.m. - 51.6 sq.m.) * 37,878 rubles = 1.1 sq.m. * 37878 rubles = 41665.8 rubles.

The amount that the developer must return to the shareholder when reducing the area (if such a price change is provided for in the contract) is calculated in a similar way.

How is the area of the object calculated: taking into account balconies/loggias or not, if taking into account, then with a coefficient or not?

Until 06/03/2016, the law was not clear on this matter; this issue remained solely at the discretion of the parties, that is, the parties were free to determine the price based on various parameters, including the ability not to apply reduction factors established by housing legislation. However, on June 3, 2016, amendments were made to Law No. 214-FZ, according to which the area in the DDU should be determined taking into account reduction factors for balconies, loggias and terraces.

What are the deadlines for additional payment or refund of the price of the DDU when changing the area?

The terms and procedure for additional payment of the contract price when increasing the area of an apartment under a shared participation agreement or returning the amount paid when reducing the area of an apartment under an equity participation agreement are prescribed in the agreement, but, as a rule, this occurs even before the parties sign the acceptance certificate of the object.

It should be noted that the developer has the right to demand a penalty for late payment (Part 6, Article 5 of Law No. 214-FZ), in connection with which the additional payment must be made within the deadlines established by the contract. If the deadline for returning the price of the DDU is violated, the developer is also responsible for the delay.

What to do if the actual area does not correspond to the developer’s technical plan?

Often equity holders have a question: what to do if, based on the documents, the area of the property has increased, but in fact there has been no increase in the area or, on the contrary, it has decreased. There is only one option here: to challenge the technical plan of the premises in court. To do this, you need to call a cadastral engineer to take new measurements and go to court. In court, an independent specialist may be brought in to carry out measurements.

Moreover, as long as the technical plan is not challenged in court, it is legally valid and the shareholder has no grounds for non-acceptance of the object and underpayment for the “extra meters”.

The procedure for a shareholder when challenging the measurements of a building construction facility provided by the developer

If you have any doubts about the actual square footage of the room, we recommend following the following step-by-step instructions to protect your interests:

Step 1. Analysis of the conditions of the DDU on changing the area of the object

As discussed earlier, the shareholder has the right to return part of the price of the DDU when reducing the area only if this is provided for in the DDU. At the same time, in judicial practice one can find positive court decisions to reduce the price of the DDU due to a reduction in area, even in the absence of such conditions in the contract (some courts recognize the reduction in area as a lack of quality of the object). However, such decisions are rather an exception to the general rule.

Step 2. Order a technical plan of the premises ≈ 10 days

The person authorized to measure the property is the cadastral engineer. If the shareholder has doubts about the compliance of the measurements carried out by the cadastral engineer hired by the developer with the actual area of the premises, then the shareholder has the right to involve an independent cadastral engineer. In practice, one can find positive court decisions based on the opinion of a construction expert who is not a cadastral engineer, but this is also rather an exception to the general rule.

Step 3. Send a claim to the developer ≈ 15-20 days

If, based on the results of measurements carried out by a cadastral engineer, your doubts are confirmed, send a claim with your requirements and a copy of the technical plan to the developer in a valuable letter with a list of the attachments. In the complaint, indicate the deadline for a response (if your contract does not provide for a period for returning the price of the DDU if the area is reduced, then we recommend specifying a period for the return - 10 days from the date of receipt of the complaint).

Step 4. Contact Rosreestr with an application to change the information in the Unified State Register of Real Estate

The question of the need to make a change in area in the Unified State Register of Real Estate before going to court is controversial. At the same time, we recommend that you first contact Rosreestr and make changes, since in judicial practice there is no unanimity of opinions of judges on this matter.

Step 5. File a lawsuit and actively defend your position in court for ≈ 5 months

If the developer refuses to satisfy your demands pre-trial, file a claim in court. The period depends on the workload of a particular court, the behavior of the defendant in court and the number of courts. When a forensic examination is ordered, the period for consideration of the case increases by an average of 3 months.

Step 6. Execute the court decision ≈ 10 days

If you manage to get a court decision in your favor, you need to obtain a writ of execution to collect money and find the developer’s money. The deadline for execution of a court decision depends on the availability of funds, other property of the developer and the activity of the shareholder.

If the area of the property has decreased according to the developer’s measurements and you have no doubts about the accuracy of the measurements, and the contract provides for the return of the price of the DDU if the area is reduced, you also need to file a claim with the developer. If the requirements of the claim are not fulfilled, you have the right to recover from the developer in court the amount of return and a penalty for violating the return period. Individual shareholders also have the right to recover a “consumer” fine and compensation for moral damage.

Is it possible to collect or set off a penalty for late transfer of an apartment if “additional meters” have not been paid?

Before filing a demand with the developer to pay a penalty, it is better for the shareholder to pay extra “extra meters”, otherwise this may serve as a basis for refusing to satisfy the shareholder’s demands.

The fact is that this additional payment is included in the concept of “contract price,” and accordingly, if the shareholder does not pay it, this means that the shareholder has not fulfilled its obligations to pay the price of the DDU in full, which, according to some courts, releases the developer from responsibility.

However, we were able to collect a penalty in court in the absence of an additional payment and set off the amount of the collected penalty against the additional payment for footage, but there are other decisions in judicial practice in which the plaintiff was refused to collect a penalty on this basis. Due to the lack of unified practice in this regard, we advise you to pay additionally the price of the contract before going to court with a claim to collect a penalty.

If the shareholder has an unfulfilled court decision to collect a penalty from the developer (the shareholder has the right to collect the penalty without waiting for the transfer deed to be signed, and in many situations we advise collecting the penalty in stages, and not “accumulate” the penalty), then the shareholder can offset counterclaims. The developer's consent is not required for offset; a statement from the shareholder for offset is sufficient.

Legislative regulation

In the Russian Federation, the obligation of real estate owners to pay for housing and communal services is regulated at the legislative level.

Rent is a certain amount of money that is transferred to Russian citizens by structures implementing their activities in the field of public utilities for services provided, among which it is necessary to highlight the following:

- implementation of repair work;

- maintaining a residential building in a condition suitable for living;

- provision of other public services.

The person responsible for systematic monthly payments is the direct owner of the living space or the tenant who occupies the apartment on the basis of a lease agreement. At the same time, the absence or presence of income does not matter. The described requirement is fully regulated by the Russian Housing Code.

The obligation to make payments is formed at the time of signing the employment contract, incl. social or after registration of property rights

.

The provisions of Art

. No. 154 of the Housing Code of the Russian Federation determine the rent structure.

Standards Art. No. 154: payment structure for housing and communal services, living space

These payments are made for:

- maintaining common property in good condition - for example, transferring payments for current repairs;

- apartment maintenance;

- use of property;

- renting an apartment from the housing stock (municipal).

It is important to indicate that, in a separate manner, the property owner undertakes to pay contributions for the implementation of planned work related to major repairs. In addition, residents receive separate bills to pay for housing and communal services.

Current tariffs

It was previously noted that tariffs for housing and communal services are steadily increasing every year, and 2021 was no exception. In particular, in comparison with 2018, in 2021 the increase in tariffs is about 7%

. The average cost of such growth per individual payer is 200 rubles.

The Russian Government differentiates residential buildings depending on their type. This indicator determines the final amount of utility payments

. Consequently, in multi-storey buildings this tariff is equivalent to 27 rubles. for 1 sq.m., if the house does not have an elevator, the payment is 21 rubles.

All payments for housing and communal services must be paid on the basis of decisions of municipal or regional government structures.

Average rent for one-room housing

For residents of the capital, the following tariffs apply for each individual residential unit:

- — 1-room premises – over 3 thousand rubles;

- — 2-room apartments – from 3.5 thousand rubles;

- — 3-room apartments — from 4.5 thousand rubles.

Provided that individual metering devices are installed in the apartment, this means that the number of residents registered at a specific address is not taken into account. In the described situation, the size of the final payment depends on the current area and meter readings.

Read about the dangers of rent arrears in the article: rent arrears.

Payments in a communal apartment

The calculation of the mandatory payment will be carried out under special conditions if we are talking about a communal apartment. So, determining the final cost will include:

- each separate room must have a personal light meter (if it is a two-room space belonging to only one owner, then the installation of one device is allowed);

- water consumption is divided in equal parts between residents, depending on the number of citizens living in the block;

- the remaining resources are distributed among the owners in proportion to the number of services used.

Therefore, despite the same living conditions, the amount of final deductions may differ between different owners.

Regulations for making calculations and payments

The final payment amount is obtained solely upon completion of a detailed calculation.

The utility fee includes the following payments:

- drainage;

- gasification, heat supply;

- supply of water, light;

- rent.

The calculation process involves multiplying the tariff by the actual volumes of natural resources consumed. Payments are made monthly. It is important to emphasize that if there are no accounting devices in the apartment, the calculation is carried out according to established standards

. For this reason, apartment owners are required to make a fixed payment every month, which depends on the number of registered residents in the apartment.

Upon completion of the calculations, it is necessary to carry out a cash transaction to the account of the management organization. In this case, it is possible to use non-cash or cash payment options

.

It is recommended to pay housing and communal services by the 10th day of the month

. Payments for 1-room apartments are transferred in the amount indicated in special payment documents.

If there is no payment invoice, interested persons have the right to find out the amount of payment by visiting the official web resource of the housing organization or the single website of the locality (if there is one). When making a payment, you should definitely take into account the tariff that applies in a specific region of the country.

All Russian citizens have legitimate grounds for independently implementing calculations for housing and communal services.

Thus, utility bills for a 1-room residential premises can be paid in this way:

- through a specialized self-service terminal;

- through the operating cash desk of a financial structure;

- via Internet banking.

The following categories of citizens must make payments:

- members of partnerships, housing cooperatives;

- lodgers;

- tenants of premises on the basis of a social tenancy agreement;

- property owners.

It is acceptable to restructure the amount of payment in the event of the formation of significant debt obligations. This service can only be used after obtaining consent from the authorized housing company.

Read about who is entitled to a rent subsidy here.

Video: Housing and communal services tips: how to transfer meter readings if you change the management company

Payment order

After calculating how much the utility bills are, you should make the payment. It is allowed to use cash and non-cash payment methods. Money is transferred by the 10th day of the month following the billing period.

Rent for a one-room apartment is paid in the amount specified in the payment document. If it is not available, the payment amount can be found out via the Internet on the website of the management company or the unified city portal. In accordance with the consumed amount of resources, payments are made for electricity, water, gas, and heat during the heating season. You should focus on the tariff established in the region and the amount of resources consumed.

If you haven’t received a payment document, you should look for it on the management company’s website or the State Services portal here. Russians have the right to calculate the cost of communal services for a multi-room or one-room apartment on their own. You can pay for services:

- through the Internet;

- at a bank teller;

- through self-service terminals.

Must pay:

- premises owners;

- tenants;

- tenants of premises;

- members of cooperatives and residents' associations.

Before residents move into an apartment building, the need to pay is assigned to the municipal authorities. To make payment, owners or tenants must enter into an agreement on the payment of utilities. The signed agreement specifies the terms of accrual, payment, and settlements. The contract also specifies the procedure for the provision of services and their termination.

How much do they pay for utilities?

Payments for residential accommodation and utilities are trending upward. These country statistics apply to all regions. When calculating, the price for using living space is calculated based on the number of square meters

.

Utilities) are estimated by summing up the cost of cold and hot water, heat, gas, and other amenities

.

In large cities, rent rates are much higher than payments for a similar area in small towns

. The average monthly cost of living in a three-room apartment for 2021 reached 6.5 thousand rubles. In the winter season it is at its maximum.

Legal regulation

The Housing Code of the Russian Federation obliges everyone who has a permanent residence permit in a house or apartment under certain conditions (ownership, rent, rent, etc.) to pay for consumed utilities, as well as the maintenance of the house.

Tariffs and standards for the calculation and payment of housing and communal services are determined in accordance with the decree of the Government of the Russian Federation dated May 6, 2011. No. 354.

However, for each individual service (water supply, gas supply, electricity, etc.) the unit cost is set individually.

Residents' payment obligations

The rent, including utility bills, is finally established under an agreement with the HOA (Home Owners Association) or management company. For the calculation, the legislator's tariffs are applied, related to square meters of a specific area.

. Residents of houses in disrepair do not pay rent.

The law explains the term “rent” as follows: it is a sum of money transferred by citizens to housing and communal services enterprises (Housing and communal services) in the form of payments. Price includes:

- exploitation of living space;

- repair;

- payment of utilities.

Every tenant is required to pay for their accommodation, regardless of their source of income. This norm is specified in Art. 157 Housing Code of the Russian Federation (Housing Code of the Russian Federation)

. It also sets out the regulations on how payments are made and services are provided.

- In Art. 154 of the RF Housing Code describes the structure of payments.

- Art. 155 LCD - rules and terms by which payment is made.

- Art. 157 - methods of calculation using instruments, norms per person, how much you need to pay according to the fixed amount.

Some citizens, due to financial difficulties, cannot pay the amount every month before the 10th. Failure to do so on time will result in penalties. If there is a malicious attitude towards responsibilities and large debts, a person may lose the right to provide utility services.

Usually you are asked to pay the amount against a receipt that is delivered to your mailbox. The document contains complete information: tariff charges, prices, consumption standards, services provided. The law allows for partial payment of the amount indicated on the receipt form.

Rates

Tariffs for services and housing are set by local governments and state authorities. Standards from legislation are taken as a basis

.

Regions can introduce their own tariffs for making payments by citizens

. In some areas, social status is taken into account. There are benefits to help the poor and other categories in need:

- disabled people;

- minor orphans;

- pensioners;

- unemployed;

- persons with incomes less than 50% of the subsistence level.

Regulatory and legal acts are regulated by the Ministry of Construction and Housing and Communal Services. The same department sets tariffs based on average values.

Average rent

Looking around the country, you can see that rents vary greatly. If in one particular region citizens pay 2 thousand for a one-room apartment

.

rubles, in another city residents pay 3,000 monthly

.

About 17% of the family budget consists of rent and utilities

. The average amount is derived from the calculation that in the winter season the charges are higher, which is associated with heating. And also in the building of 5 floors there are no additional amenities: an elevator, a garbage chute, which are paid for by residents of nine-story buildings.

For example, it will be useful to find out what the rent is for a two-room apartment. Tariffs are approved by city governments. They have been increased in 2021

.

The average monthly cost of living is 3.7 thousand

.

rubles per month for an apartment of about 50 sq

.

meters, two-room, if no more than two people are registered in it. How much citizens pay for electricity and some other needs is not included in the amount

. And for a one-room apartment (30 m2) it costs approximately 2 - 2.4 thousand rubles.

Tariff rules

The law establishes average tariffs for the country (for all types of buildings). So for a three-room living space they pay up to 5 thousand

.

rubles Amendments are made by regional authorities taking into account local conditions. For example, the city administration decided to charge 7.5 rubles per 1 meter of living space as the base rate

. The material of the building walls is taken into account: brick. panel or wood.

According to the usual rule, the footage is summed up, taking into account the number of residents. Utilities are charged according to the readings of water, gas, electricity meters (metering devices)

.

As a result of the calculation, citizens have a different amount that is not related to the average value

.

Receipts are also often issued separately for each service. Garbage removal from the area near the house is calculated based on square footage, when a “kopeck piece” pays less than a “three ruble” in the same building

. The tariff for each meter is approved in an agreement with the Housing Office (Housing Maintenance Office).

An annual review of rents, consumption standards and tariffs with amendments to tariff plans is generally accepted. The housing office, by law, sends all residents a month before delivery of the receipt a written notification of changes.

Availability of meters

The average rent in Russia is calculated taking into account the amounts contributed by citizens monthly to the state budget. As practice shows, it is much more profitable to pay for services according to meter readings rather than within the standards.

Citizens can also purchase special appliances for gas and heating. Housing and communal services specialists regularly organize maintenance of devices within the framework of the contract and confirm their serviceability.

Home owners and apartment tenants have the right to independently submit an application to the housing complex company to call a specialized specialist to troubleshoot problems, but such a call may be paid additionally, which must be provided for in the agreement.

The calculation of the monthly payment, in this case, will depend entirely on the consumption of utility resources. So, a person needs to record the number of units used (in early July for June), transfer them to the housing and communal services and wait for a receipt. The payment document indicates the difference in readings for the current month and the previous one, as well as the final payment amount, based on the established tariffs.

What is included in payments

Article 425 of the Civil Code of the Russian Federation provides for rights and obligations in the provision and receipt of public services. Typically, the fee includes:

- specific characteristics of the living space;

- consumption of water (hot and cold), gas, electricity, heating;

- garbage removal;

- cleaning the area near the house;

- lighting of the adjacent space.

For example, thermal energy costs according to the tariff in the capital for 2021 from 2021 (until June) to 2021 rubles per Gcal (from July). Regions are making adjustments to the rate

.

Electricity can be priced at 3.5 rubles per 1 kWh. The time of day is taken into account: during the day it is 3.55 rubles, and at night - 2.14 rubles per kWh

. For rural areas, a coefficient has been introduced for these figures.

The rent is affected by the class of construction. Square meters in a townhouse cost 50 rubles per month for each

.

If you buy a similar living space measuring 120 sq

. meters in the “comfort” class, you will have to pay up to 15,000 rubles monthly.

When paying for “utilities” in accordance with the readings of the meters, which must be kept by citizens in order to avoid being charged at the maximum tariff, the readings are taken by a representative of the housing office. Heating is calculated for each meter (for 1, 2, 3-room living space). Water and electricity - according to the number of living persons multiplied by the tariff

. The gas rate (without a meter) is multiplied by the number of residents. It does not matter which apartment is supplied with the resource: two-room, three-room or 1-5-room.

Average rent rates for a 3-room apartment

In large cities, in the vast majority of cases, in addition to basic utilities, additional ones are also taken into account, and therefore, when deciding to move to any other city, it is best to first understand how much you will have to pay for a three-room apartment .

In Moscow, if a person lives in a three-room apartment, the approximate area of which is 60 m2, he will need to pay utilities in the amount of 2,000 to 3,000 rubles.

If the building in which a citizen lives is recognized as unsafe in accordance with current legislation or its wear and tear is more than 60%, no rent will be charged in principle.

Special attention should be paid to the fact that, compared to the capital in St. Petersburg, paying for the maintenance of a three-room apartment is much more expensive, and therefore citizens on average pay amounts of approximately 7,000 rubles, while only payment for electricity in the vast majority of cases amounts to about 1,500 rubles.

Standard tariffs look like this:

| Heating | 1,400 rubles for each Gcal. |

| Hot water | 26.5 rubles for each cubic meter. |

| Electricity | 3.5 rubles per kW (standard tariff), 3.55 rubles (day) or 2.14 rubles (night). |

| Electricity in houses equipped with an electric stove | 2.5 rubles per kW (standard tariff), 2.5 rubles (day) or 1.5 rubles (night). |

| Cold water | 21 rubles for each cubic meter. |

| Gas supply | 5.4 rubles for each cubic meter. |

| Water disposal (sewage) | 21 rubles for each cubic meter. |

Subsidies

Both “utilities” and rent, with the observed constant increase in tariffs, are becoming unaffordable for some segments of the population. There is a social

.

program to support the poor

.

When subsidies are provided, expenses are reimbursed. The rules are regulated by Government Decree No. 761 of 2021

. The purpose of these measures is to resolve housing problems.

If a person’s income is less than the subsistence level, a coefficient is applied that reduces the maximum amount of housing payment. This figure is set differently for regions, taking into account factors:

- remoteness;

- local conditions;

- consumer basket.

The state assists citizens for whom rent becomes unaffordable relative to expenses. To apply for a subsidy, a citizen must visit the social protection office in his locality

. If an individual (or citizens)’ housing and services associated with it amount to more than 22% of their income, such assistance is assigned.