Alina Tarbaeva, lawyer of the Nizhny Novgorod Bar Association, answers:

The absence of a payment document does not exempt the payer from paying mandatory contributions.

The accrual of penalties is a kind of measure of the payer’s liability for violation of an obligation. What needs to be done? If you do not have a payment document to pay for major repairs, the first thing you need to do is check the debt data on the regional operator’s web page in your personal account or on the State Services website. De jure, an authorized person will be able to collect money and penalties from the debtor only for a three-year period (Article 196 of the Civil Code of the Russian Federation).

Do I need to pay for major repairs?

Who can avoid paying for major repairs?

As for the issue of reducing the penalty (Article 155 of the RF Housing Code, Part 14.1), it can be reduced at the initiative of the court, in the case of a clear disproportion to the consequences of the violation of the obligation. Regarding the collection of debts and penalties in court, a reasonable solution would be to raise the issue of exemption or significant reduction due to the absence of intent to maliciously evade payment.

Can penalties for major repairs be written off if the principal debt is paid in full? | Cheboksary

Federal Law of December 17, 2001 N 173-FZ (as amended on June 4, 2014, as amended on November 19, 2015) “On Labor Pensions in the Russian Federation”

Article 11. Other periods counted in the insurance period1. The insurance period, along with periods of work and (or) other activities that are provided for in Article 10 of this Federal Law, includes:

1) the period of military service, as well as other service equivalent to it, provided for by the Law of the Russian Federation “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, authorities for control of the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penal system, and their families";

(as amended by Federal Laws dated July 25, 2002 N 116-FZ, dated July 24, 2009 N 213-FZ)

2) the period of receiving compulsory social insurance benefits during the period of temporary disability;

(Clause 2 as amended by Federal Law dated July 24, 2009 N 213-FZ)

Consultant Plus: note.

The amounts of labor pensions (the insurance part of the old-age labor pension) established before January 1, 2014 are subject to recalculation from this date in connection with the inclusion in the insurance period of the period of caring for a child until he reaches the age of one and a half years, but not more than four and a half years in total, without requesting an application for recalculation of the size of the labor pension (the insurance part of the old-age labor pension).

Recalculation is made on the basis of documents available to the body providing pensions, and in their absence - on the basis of an application for recalculation of the amount of the labor pension (the insurance part of the old-age labor pension) with the presentation of the relevant documents (Federal Law of December 28, 2013 N 427- Federal Law).

3) the period of care of one of the parents for each child until he reaches the age of one and a half years, but not more than four and a half years in total;

(as amended by Federal Law dated December 28, 2013 N 427-FZ)

(see text in the previous edition)

4) the period of receiving unemployment benefits, the period of participation in paid public works and the period of moving or resettlement in the direction of the state employment service to another area for employment;

(as amended by Federal Law dated November 30, 2011 N 361-FZ)

(see text in the previous edition)

5) the period of detention of persons who were unjustifiably prosecuted, unjustifiably repressed and subsequently rehabilitated, and the period of serving their sentences in places of imprisonment and exile;

6) the period of care provided by an able-bodied person for a group I disabled person, a disabled child or a person who has reached the age of 80 years;

7) the period of residence of spouses of military personnel performing military service under a contract, together with their spouses, in areas where they could not work due to lack of employment opportunities, but not more than five years in total;

(Clause 7 introduced by Federal Law dated July 22, 2008 N 146-FZ)

the period of residence abroad of spouses of employees sent to diplomatic missions and consular offices of the Russian Federation, permanent missions of the Russian Federation to international organizations, trade missions of the Russian Federation in foreign countries, representative offices of federal executive authorities, state bodies under federal executive authorities or as representatives these bodies abroad, as well as to representative offices of state institutions of the Russian Federation (state bodies and state institutions of the USSR) abroad and international organizations, the list of which is approved by the Government of the Russian Federation, but not more than five years in total.

(Clause 8 introduced by Federal Law dated July 22, 2008 N 146-FZ)

2. The periods provided for in paragraph 1 of this article are counted towards the insurance period if they were preceded and (or) followed by periods of work and (or) other activities (regardless of their duration) specified in Article 10 of this Federal Law .

Legal General Director Alexandra Brodelshchikova answers:

Failure to receive receipts for contributions for capital repairs is not a valid reason for non-payment. The obligation to pay these fees lies with you, in any case. To avoid accrual of a significant penalty, it is recommended to pay off the debt.

The courts currently proceed from the fact that payers must independently take the initiative in this matter and request the necessary information. But this does not mean that payers do not have the right to complain about the illegal inaction of the Capital Repair Fund.

Should I pay off debts for major repairs from previous owners of the apartment?

I haven’t received receipts for utility bills – should I pay?

The procedure for considering cases of debt collection for major repairs

Cash provision for contributions for major repairs is a sore subject for most owners of apartment buildings.

Typically, debt is formed for a number of reasons:

- lack of money to pay the fee;

- fundamental ignorance;

- filing a claim against the regional operator for a refund;

- other.

Debt collection procedure

The Capital Repair Fund has the right to sue for non-payment, but to do this, the organization must comply with the established regulations for debt collection.

Pre-trial claim

A pre-trial claim is a mandatory element of resolving a dispute. Often the debtor receives payment within 2-3 months. written notices demanding payment of arrears. If the regional operator refuses to top up the balance, the regional operator will initiate legal proceedings. The letter of claim serves as evidence of an attempt to resolve the issue amicably and indicates that the defaulter has been notified of the existence of a debt.

When is a court order issued to collect a debt?

Preparation of a court order is carried out within five working days from the date of receipt of the claim and documentation. However, the date of assignment of legal status may differ from the day the paper was drawn up. However, the time is always written in the text, because otherwise the bailiffs will have difficulty executing the decision.

The procedure for executing an order (court decision) for debt collection

The execution of a judge’s decision is subject to Federal Law No. 229. According to the current provisions of the regulatory document, the order takes on legal status within 10 days after its adoption. However, bailiffs are often faced with a situation where the text does not contain an effective date. Therefore, FSSP employees need more time to resolve the legal conflict.

Having processed the decision and received an explanation of the case, the enforcement order has the following stages:

- A decision is made on the registered application.

- Objections from the defendant are expected.

- The document is submitted to the FSSP at the debtor’s residential address.

- Enforcement actions are initiated.

- The bailiff comes to the individual at the place of registration or summons him to the department of the institution.

- An inventory and assessment of the citizen’s financial situation is carried out - sources of income are identified.

- Forced debt collection.

If you voluntarily pay off the arrears for major repairs at the initial stage, you can avoid blocking accounts and putting the property up for auction.

Procedure for paying debts and penalties

Reasons to pay for utilities.

For 2021, the housing cooperative legally uses leverage over the debtor for major repairs - the imputation of penalties. This method of combating arrears was previously the prerogative of supervisory agencies. The procedure for collecting fees for special account or to the Fund - priority payment. Refusal or ignorance of this type of payment will result in fines, which can also be collected through the judiciary.

Note: When, as part of a purchase and sale agreement, a person purchases an object with debt for major repairs, the new owner is obliged to pay off the arrears. Experts recommend checking the register of debtors to the regional operator before concluding a transaction.

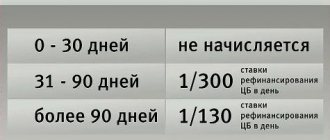

Penalties are calculated according to a simple algorithm. If the monthly installment is not paid the next day, the debt increases according to the current interest at the refinancing rate - 1/300. The penalty is accrued until full repayment.

On the one hand, the amount of the penalty is small, on the other hand, when it is applied to the total mortgage every day, then after 2-3 months, the amount becomes significant. In addition, the management organization has the right to initiate legal proceedings to collect contributions. The defendant will be required to pay costs.

Private practicing lawyer Victoria Suvorova (Pyatigorsk) answers:

Unfortunately, residents of many regions are faced with a similar problem, but judicial practice is not in favor of the owners.

The law is such that you were required to pay contributions: to do this, you could call the hotline, contact the Capital Repair Fund of your region by phone, etc.

If a court order has been issued against you to collect debts for past periods, you can cancel it if you do not agree with it. In this case, you will most likely be sued, and the amount of state duty paid will double.

In court, you can refer to the missed statute of limitations; it is three years. That is, if they file for collection of debts from you, then you can successfully challenge the amount that is beyond the three-year statute of limitations.

What may be the consequences of non-payment for major repairs - court

- A person who is accustomed to eliminating problems related to the technical condition of the premises at his own expense;

- People who do not trust the management company;

- Residents who simply do not want to pay bills, without motivating their decisions.

In this case, a penalty is charged, which is comparable to the amount of the debt. In case of non-payment of the required amount after another day, the amount of debt doubles . When the payment process is delayed, the penalty continues to grow every day until the debt is fully repaid.

We recommend reading: Can Bailiffs Seize My Wife’s Account If the Debt Was Before Marriage

Yulia Dymova, director of the Est-a-Tet secondary real estate sales office, answers:

Major repairs are included in utility bills. There is a general period of claim for the collection of this debt, which is three years. In this regard, you need to understand what amount is still subject to recovery and at what point the corresponding demand was made.

It is also worth understanding that if a house is included in the capital repair program and deductions are required for this object, then they fall directly on the owner of the property. This responsibility falls on the new owner in the event of a transfer of ownership.

Should I pay for major repairs if the new building is still under warranty?

Is it possible to simplify the overhaul system in Russia?

Penalties for major repairs, and what else threatens non-payment of contributions for major repairs - liability

However, not every buyer agrees to purchase such housing, because when registering his ownership rights with the authorized body, he will have to present a document certifying that he has no debts on the apartment.

This rule is provided for in Article 155 of the Housing Code and is presented as a method of influencing persistent defaulters. Penalties have the nature of a sanction, rather than the nature that is enshrined in civil law.

We recommend reading: Common Household Needs Included in Housing Payments Debt of Neighbors

When are penalties calculated?

Many citizens refuse to pay fees for major repairs. And, as mentioned above, this entails the accumulation of penalties. But when are they credited to the payer’s personal account?

After all, situations quite often occur when the warning system or other systems of a banking organization fail, a citizen regularly paid for utilities, but information about the payment was not received by the management company.

A penalty is charged when a resident of an apartment building does not pay for the month before the 10th day of the next month. The 11th of the next month is the cutoff date. Afterwards, the management company has the right to charge a penalty for non-payment of utilities.

Every month the amount of debt and penalties doubles. Thus, very small amounts can grow into larger ones.

The management company is not obliged to notify the payer about the accrual of penalties. There are often situations where a resident regularly paid utility bills, but the information did not reach the management company due to a malfunction of the warning systems.

Penalties were accrued that the citizen was not even aware of. That is why it is important to constantly monitor the status of your personal account and the absence of penalties.

You can learn more about calculating penalties in the following video:

the period of residence abroad of spouses of employees sent to diplomatic missions and consular offices of the Russian Federation, permanent missions of the Russian Federation to international organizations, trade missions of the Russian Federation in foreign countries, representative offices of federal executive authorities, state bodies under federal executive authorities or as representatives these bodies abroad, as well as to representative offices of state institutions of the Russian Federation (state bodies and state institutions of the USSR) abroad and international organizations, the list of which is approved by the Government of the Russian Federation, but not more than five years in total.

the period of residence abroad of spouses of employees sent to diplomatic missions and consular offices of the Russian Federation, permanent missions of the Russian Federation to international organizations, trade missions of the Russian Federation in foreign countries, representative offices of federal executive authorities, state bodies under federal executive authorities or as representatives these bodies abroad, as well as to representative offices of state institutions of the Russian Federation (state bodies and state institutions of the USSR) abroad and international organizations, the list of which is approved by the Government of the Russian Federation, but not more than five years in total.