Is it possible to donate a share of an apartment?

A share is a part of real estate. In other words, an established part of property rights belonging to a specific owner.

If it is not allocated, by default it is assumed that the housing belongs to the owners in equal shares. When allocating shares, they are distributed as agreed by the parties.

To formalize a gift agreement (hereinafter referred to as DD), the share must be allocated and changes must be registered in Rosreestr. Only in this case will it be possible to give it to another person. The consent of the other owners is not necessary - they are only subject to the right of first refusal when selling real estate.

Note! The allocation of a share does not mean that specific premises in the apartment are distributed among the owners. They will have to agree on who can live in which room.

Complete the survey and a lawyer will share a plan of action for a gift agreement in your case for free.

Is the consent of all owners required?

As stated earlier, the consent of the other owners is not required. It is necessary if the donated property was acquired during marriage, even if the real estate is registered entirely in the name of the donor.

According to Art. 35 of the RF IC, real estate and other valuable items acquired during marriage are the joint property of the husband and wife. For alienation, which is a gift, consent must be formalized. Even if you donate a share to a common child, the spouse whose rights were violated will be able to challenge the transaction through the court within 1 year from the day it became known about the violation of rights - donation without permission.

If the spouses have drawn up a marriage contract, according to which the property acquired during marriage belongs to one of them, and he acts as a donor, the consent of the other is not required.

Spousal Consent Sample

An application for the spouse’s consent to the alienation of a share in the common property is subject to notarization.

When compiling it is indicated:

- FULL NAME. spouse, date of birth, passport details;

- date of purchase of the apartment, information from registration documents, area, floor, address;

- date of marriage registration, certificate details;

- expression of consent to alienation;

- date of compilation and signature.

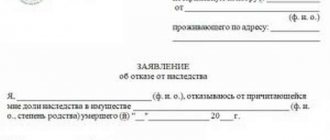

Sample application for the spouse’s consent to donate an apartment (under a deed of gift): alt: Statement of the spouse’s consent to donate an apartment (under a deed of gift)

Consultation on document preparation

How to correctly draw up a deed of donation of non-residential premises?

How to correctly draw up a deed of gift for a land plot?

What is the amount of the state duty when donating a share in an apartment?

Documents for donation registration can only be submitted to 2 authorized authorities :

- MFC (how to draw up a gift agreement through the MFC and where else you can do this, find out here).

- Cadastral Chamber.

At the same time, the details for making a payment are different, and having paid according to the MFC details and submitted the documents to the chamber, the participants in the transaction will receive a refusal, despite the fact that the decision is made by employees of a third organization - Rosreestr.

Attention! In any case, the state duty is two thousand rubles. This is a fixed fee for a newly created right.

But there are nuances when paying, depending on the number of participants. Also, when paying, a bank commission is charged, which can be up to 50 rubles.

Let's look at examples:

The apartment was given to two sons in equal shares. Then each of them must pay one thousand rubles and indicate their full details as the payer. If one son is provided with ¼ under the gift agreement, and the second - ¾, then they still pay the state duty the same amount of one thousand rubles.

If you have been given a share in a huge apartment and its size is, for example, 25/78, and the remaining owners have already been identified, then for the emergence of your right you must pay a state fee of two thousand rubles.

Do I need to have the contract certified by a notary?

If the apartment belongs to different owners, the gift agreement must be certified by a notary. The exception is certain situations when you don’t have to go to a notary’s office:

- real estate has several owners, and all transfer shares to the donee under the DD within one transaction;

- One person owns an apartment and wants to give a share to another.

Case studies:

No. 1. Several owners.

The apartment is owned by the spouses, the shares are allocated. They decide to register a DD for their common child. For this purpose, a tripartite agreement is drawn up, where the parties are the mother, father and minor. One of the donors acts on behalf of the latter - he signs for the child, because he is under 14 years old. The DD is registered in Rosreestr, and ownership passes to the donee.

No. 2. One owner.

A citizen owns an apartment purchased before marriage and decides to donate ½ share to his wife. The donor and donee draw up a DD, then contact the MFC to re-register ownership.

Legal advice: be careful when donating shares in a marriage. In the event of a divorce, the ex-spouse will retain ownership of part of the property and will not be able to evict him. Real estate acquired during marriage through a gift is not subject to division (Article 36 of the RF IC).

Elena Plokhuta

Lawyer, website author (Civil law, 7 years of experience)

Cost of notary services

Notaries charge 500 rubles to certify the consent of the spouse. Certification of DD is much more expensive. According to Art. 333.24 of the Tax Code of the Russian Federation, the state duty is 0.5% of the cadastral value of the donated share, minimum 300, maximum 20,000 rubles.

If the deed of gift is drawn up by a notary, you will have to pay an additional 5,000-7,000 rubles. The cost of technical services is set by regional notary chambers.

If necessary, you can order documents to be sent for registration by a notary; the service is provided free of charge. Previously, it was paid, but at the beginning of 2021 the tariff was canceled.

Let's look at an example of duty calculation:

A man gives ½ of an apartment to a child, the cadastral value is 2,000,000 rubles.

2,000,000 x 0.5% = 10,000 rubles.

If he had a wife, he would have to pay another 500 rubles to verify her permission.

Important! If the notary fee exceeds 20,000 rubles, the specified amount is paid, because this is the maximum limit. For the calculation, the cadastral or inventory value of the donated share is used, and not the entire housing. The choice of value for calculating the payment rests with the donor.

Are you tired of reading? We’ll tell you over the phone and answer your questions.

How to give a share in an apartment to a close relative without a notary in 2021

So, transferring a share through a notary does not cause any particular difficulties. It’s another matter if the donor needs to transfer part of the apartment without a notary. Read below about how to do this correctly.

Algorithm of actions, instructions

Free registration of the transfer of a share without involving a notary is as follows:

- Firstly , obtain the consent of the second spouse if the apartment is jointly owned. For common shared ownership, such consent is not necessary, provided there is an agreement on the allocation of shares. However, if a child is a close relative, permission is required from his legal representatives, and in some cases, from the PLO (Clause 1, Article 28 of the Civil Code of the Russian Federation).

- Secondly , prepare or order documents for the apartment. There will be no need to approve the already allocated shares, but if there is no technical passport or it is outdated, you will need to invite a BTI employee. Coordination of technical indicators with real proportions is completed by issuing a technical passport for the donated object.

- Thirdly , draw up a donation agreement for a share of the apartment to a close relative or spouse. Let us remind you that contacting a notary is not necessary when donating part of the property of one owner or when allocating a share to a child from a matrimonial apartment (house).

- Fourthly , register the gift agreement with the Rosreestr authority (possible through the MFC). The donor and the donee relative apply to the Unified State Register of Real Estate to make changes to the state register. The final stage will be obtaining a new title document - as of 2021, certificates are no longer issued, they have been replaced by extracts from the Unified State Register of Real Estate.

Documentation

When registering the transfer of a share of an apartment without a notary, applicants will need:

- completed application - the form can be obtained at the reception from the registrar and filled out on the spot;

- passports of the donor and close relative (donee);

- from 3 copies of the gift agreement (minimum);

- documents for the apartment: title documents and approval documents;

- birth, marriage, adoption certificate - as confirmation of family ties between close people;

- permission from the second spouse to alienate the share - if the housing is joint;

- payment in the form of a receipt.

The registrar will accept your documents, help you fill out the application, and issue a receipt for the package. Don’t forget to find out the time when you can pick up the finished document for the donated share - an extract from the Unified State Register of Real Estate.

Taxes and duties

How much does the procedure cost?

As in the previous method, the calculation of state duties and taxes depends on the cadastral price of the property . This is clearly stated in the Letter of the Ministry of Finance No. 03-04-05/21903, dated 2014, and which came into force on January 1, 2021.

Official registration of a transaction with shares will cost 2,000 rubles, which will have to be paid by the beneficiary, i.e. to the lucky recipient. Tax, as mentioned above, close relatives do not pay taxes . The basis for exemption from 13% personal income tax is any document confirming a family relationship (see above).

Deadlines

The desire to quickly issue a deed of gift for a share is quite natural. Therefore, the recipients are wondering how soon they will be able to receive documents for ownership of part of the residential premises (house)?

The general period for registering a transaction in Rosreestr is 3-10 days , and if the documents were submitted through the MFC, another 2-3 days are added for sending the papers.

In a word, the deadlines are not that impressive. It’s easier and smarter to draw up a deed of gift on your own, but it wouldn’t hurt to consult a lawyer for advice. In order not to look for qualified but busy specialists, write to our lawyers - we will give answers to all your questions and select further instructions for you.

Who can I give a share of the apartment to?

Donation is possible in relation to any person - both relatives and friends. The main condition is the presence of an allocated share, which is in the possession of the donor according to documents.

Let us consider the features of drawing up DD for different categories of recipients in detail.

Between spouses

A husband can give a share in an apartment to his wife, and vice versa. When making transactions between two owners, the consent of the second is not required, because the property is alienated in his favor.

The DD is certified by a notary - this is indicated in Part 1 of Art. 42 Federal Law dated July 13, 2015 No. 218-FZ.

For a minor child

A child can act as a donee without the consent of the guardianship authorities - it is required only for the alienation of property.

An exception is a gift to a minor under guardianship: here you will have to act through guardianship, because any property transactions are controlled by this body.

Up to 14 years of age, parents sign for the child; his presence to sign the DD is optional. The donee aged 14 to 18 years old participates in the transaction independently, but with the permission of his parents or legal representatives.

Adult son or daughter

There are no restrictions here: adult citizens sign themselves. The exception is when an adult child is deprived of legal capacity. In this case, the guardian signs for him and gives consent to the transaction.

If the apartment is in common ownership with a spouse, you need to obtain his consent and have it certified by a notary.

Mother or father

The property of parents and children is demarcated; if desired, the child can donate part of the living space to the mother or father.

Notarization is required if the property has several owners. The consent of the spouse will also be required if he is one of the owners of the gift.

Sister or brother

Several situations are possible here:

- The apartment is shared ownership with the parents. Their consent is not required, but the DD is certified by a notary.

- The property is owned by married couples. The donor must obtain the permission of the spouse.

Important! It should be borne in mind that after the alienation of the share, the brother or sister will be able to live in the living space with the donor’s spouse, or sell the part, having first offered a buyout to the second owner. Challenging a donation is problematic.

Grandson or granddaughter

Grandparents have the right to give shares in the apartment to their grandchildren.

The same rules apply here as for parents:

- in case of common property rights with the spouse, consent is previously drawn up;

- if the donor is not married to the second owner, permission is not needed - it is enough to have the DD certified by a notary.

To grandma or grandpa

Grandchildren have the right to alienate shares in apartments that belong to them as property. If the second owner is not a spouse, consent is not required.

It is important to take into account that in the event of the death of grandparents, the gifted property will become the property of the second spouse by inheritance by law. If there is a will, the citizen indicated in it becomes the owner - the right to choose an heir is given to the testator.

To the second owner

If one owner decides to donate a share to the second, regardless of the type of relationship (spouses, relatives, strangers), the notarized consent of the donee is not required.

It is expressed in the DD itself and confirms that the donee accepts the terms of the transaction and the subject of the donation.

On behalf of a minor

In Art. 575 of the Civil Code of the Russian Federation directly states: donation on behalf of a minor child is prohibited. In the Russian Federation, a person under 14 years of age is considered a minor.

But a child between 14 and 18 years old will not be able to donate a share in the apartment. Such transactions will be declared invalid, since the parent cannot give consent to a significant deterioration in the property status of the minor.

How to properly gift a share in an apartment to a close relative: mother, daughter, son

Before you begin drawing up a gift for the alienation of a share, you need to familiarize yourself with the requirements for the procedure.

Conditions for donating a share

Features of donating part of an apartment:

- Free transaction - no transfer of money or other property of the recipient (Clause 1, Article 572 of the Civil Code of the Russian Federation);

- A specific item is a part of the apartment as a percentage (⅓, ⅔, ⅛, ⅞, etc.);

- Voluntary status - the parties must express a personal desire to participate in the transaction;

- Transfer of the right to a share of the apartment during the life of the donor;

- Certification by a notary or approval by FKP Rosreestr.

Close relatives must confirm their relationship with the donor-owner. This is necessary to be exempt from paying 13% personal income tax - tax on personal income in the form of a donated share of an apartment.

Varieties, methods

An affordable and simple way to transfer a share of an apartment to close relatives is to prepare a gift agreement, contact a notary for certification, and then register with Rosreestr.

It is possible to donate a share of an apartment without a notary:

- The housing belongs to one owner (donor).

- The spouses have a jointly owned apartment and want to alienate part of the housing to their minor son or daughter.

Counterexamples when the participation of a notary is indispensable:

- One spouse transfers his or her share to the other spouse as part of the prenuptial agreement.

- The property is in common shared ownership.

- Participation in the case of close relatives under 14 years of age (see “How to donate a share in an apartment to a minor child”).

- Other cases.

There is also the possibility of litigation. For example, if the heirs find out that a share of the apartment was donated to one of the relatives, but the transaction was made as a result of deception, fraud, abuse of trust, threats, or blackmail.

Procedure

So, in order to give a share of the apartment to the mother, daughter, son and other close relatives, you will need:

- Determine size

If the housing is in shared ownership, the size is already fixed. Just look at the title document (certificate or extract from the Unified State Register of Real Estate). The common joint property of the spouses does not have specific shares. You will need to allocate it as a percentage. For example, elderly spouses remain ⅔ of the apartment, and their grandson receives ⅓ of the share. At the first stage, you need to obtain the consent of the recipient.

- Find a notary office

Contact your friends, directories, websites and advertisements. Find a suitable notary at the place where the property is registered. Find out the appointment schedule, sign up for a consultation and visit the office at the appointed time.

- Draw up a gift agreement

A notary office clerk performs a wide range of work, starting with consultations and ending with the issuance of finished documents. The notary will provide the form and sample of the gift agreement; all you have to do is hand over the documents, discuss the terms of the transaction and put down personal signatures. The presence of the donor and recipient is required!

- Registration of a transaction

The notary's clients do not even have to register the agreement with the Rosreestr authority. Usually, all actions are performed by the notary himself, and free of charge - an innovation from February 1, 2021. Participants in the transaction will only have to receive a receipt, pay the state fee and wait until the notary informs about the completion of the procedure.

- Obtaining an extract from the Unified State Register of Real Estate

Remote registration of a gift does not require the presence of the parties. Immediately after making changes to the Unified State Register, you will receive a message informing you that you need to go to the nearest branch of Rosreestr for a new document (or you can pick them up from a notary). From now on, the transfer of the share to a relative is considered successfully completed.

Example: Immediately after the wedding, the Shubins moved in with their husband’s mother. The housing belonged to three owners in equal proportions - ⅓ shares each. Soon the Shubins had a son, and the couple decided to give him a share of the apartment. The couple intended to give the child a full share, so a decision was made: the husband gives the child his share, and the wife gives the husband half of her interest in the property. The final redistribution at the notary: the husband’s mother kept ⅓ of the share, the child got the same amount, and the spouses registered 1/6 of the share as their property.

Registration of deed of gift

A well-drafted gift agreement includes:

- place and date of agreement;

- Full name, passport details and other contact details of the parties;

- what is the subject of the transaction - share in a privatized apartment, address of housing, area, floor, building, structure, cadastral information;

- the basis for allocating the donor’s share (for example, a court decision or an apartment privatization agreement);

- information about other residents of the apartment;

- conditions that do not contradict the law - for example, you can indicate that the donor retains the right to live in the apartment indefinitely, will transfer the share to the child after graduation from school/university, etc.);

- rights and obligations of the parties;

- how many copies of the agreement are available;

- signatures.

The main gift agreement is preceded by a preliminary agreement. You can find information about this in the article “Preliminary agreement for donating a share of an apartment to a minor.”

Sample deed of gift for a share in an apartment between relatives 2021

Check out the example:

Check out the visual example:

Required documents

When going to an appointment with a notary, keep in mind that you need to take with you a minimum package of documents:

- passports of both participants (donor and recipient of the gift);

- documents on close relationships - birth certificates for relatives, marriage certificates - for spouses;

- purchase and sale agreement, certificate of inheritance, privatization agreement and other documents for a residential property;

- an extract from the Unified State Register or an old certificate from Rosreestr;

- consent of the second spouse (if necessary).

The notary requests individual papers from the electronic database or asks for missing documentation.

State duty, taxes

More recently, the agreement on the donation of shares was not subject to mandatory certification by a notary, but since 2021, the procedure cannot be completed without the participation of a notary office clerk . How much does expert help cost?

The tariff for approval of a deed of gift depends on the cadastral or market value of the share of the apartment/house. You can find out the exact figure in the cadastral passport, an extract from the Unified State Register or a specialist’s appraisal report. The state fee for certification of a donation agreement by a notary is 0.5% of the provided value , but within the range of 300 rubles and 20,000 rubles.

The mandatory contribution for transferring a share through a gift is income tax - 13% personal income tax. Since we are considering close relatives, we will immediately say that they are exempt from such a contribution - by virtue of clause 18.1 of Art. 217 Tax Code of the Russian Federation. In addition to parents, grandparents, grandchildren, brothers and sisters, this also includes spouses as family members of the donor of the share. If a relative is not included in the “close” category, he will have to pay a 13% tax.

Example: Shchapov issued two deeds of gift for his mother and daughter from his first marriage. Our donor remarried, started a family, and paid off his mortgage—now he had his own apartment. He wanted to get rid of his share in the old apartment by transferring it to his mother and daughter. Both relatives had to confirm the relationship with the help of birth certificates: the mother - that Shchapov (the donor) is her own son, and the daughter - that the generous owner is none other than her biological father. Thus, both recipients of the gift indicated a close relationship with the donor and saved on paying 13% personal income tax.

Who can't be given a share in an apartment?

Art. 575 of the Civil Code of the Russian Federation indicates that donation is prohibited not only on behalf of children under 14 years of age, but also in other cases.

You cannot donate a share in real estate to the following categories of citizens:

- employees of medical, educational, social institutions, if the donor is a student or citizen detained there;

- persons holding municipal or government positions, if the transaction is related to their official powers.

Employees of financial, state, and municipal organizations can be given gifts of up to 3,000 rubles. as part of official events. If the value of the gift exceeds the specified amount, it becomes the property of the institution and is transferred according to the appropriate act.

How to donate a share of an apartment: step-by-step instructions

What is needed to draw up a gift agreement:

- Check to see if the other owner's consent is required. If yes, draw it up and contact a notary for certification.

- Prepare a deed of gift. You can do this yourself, and then visit a notary, or order a registration service from him.

- Collect documents and visit the MFC to register the DD. Ownership will pass to the donee. The appearance of the donor and the other party is required.

- In conclusion, the recipient, 10 days after the application, should come to the MFC to receive an extract from the Unified State Register, where he will be indicated as the new owner.

Sample agreement for donating a share of an apartment

The transaction must be in writing. The DD itself is drawn up in three copies: one remains with the donor, the second with the donee, and the third is transferred to Rosreestr for state registration and subsequent storage in the archive.

The contract must contain the following clauses:

- FULL NAME. parties, passport details;

- information about the property: address, area, size of the alienated share, floor, year of construction of the house;

- information about the remaining owners: full name, consent details;

- effective date;

- signature and date of preparation.

Legal advice: If you wish, you can draw up a gift deed in the future. In this case, immediately indicate in the document when it comes into force - the period of transfer of ownership to the donee depends on this.

Elena Plokhuta

Lawyer, website author (Civil law, 7 years of experience)

Sample agreement for donation of a share of an apartment (deed of gift): alt: Agreement of donation of a share of an apartment (deed of gift)

Consultation on document preparation

State duty

In addition to the deed of gift notary fee, you need to pay a state fee for registration with Rosreestr. Its size is 2,000 rubles. for individuals, 22,000 rub. – for organizations.

The amount is paid before submitting documents.

You won’t need a receipt, but it’s better to take one: the registration office staff checks the information about the payment on their own, but if problems arise, you can confirm that you paid the money on time.

Documentation

When applying to the MFC or Rosreestr, the same documents are provided as to a notary, but in addition you need to bring a deed of gift.

The general list of documents looks like this:

| Name | Issued by |

| Statement | To be filled on site |

| Passports of the donor and recipient | MFC, Department of Internal Affairs of the Ministry of Internal Affairs |

| Gift deed | Certified by a notary |

| Written statement of consent from the remaining owners (if required) | |

| Extract from the Unified State Register of Real Estate | MFC, Rosreestr |

| Technical passport, floor plan | BTI, MFC |

| Certificates confirming the relationship of the parties (for example, birth certificate, marriage certificate, etc.) | MARRIAGE REGISTRY |

Note! If another person acts on behalf of the donee or donor, a notarized power of attorney will be required.

Documentation of donating a share of an apartment to a child

An agreement to donate a share in an apartment to children is subject to mandatory notarial registration. The notary checks the legal capacity of the parties to the transaction, assists in formulating the content if necessary from a legal position, and carries out certification.

Participants in the transaction are required to submit the following set of documentation:

- identification documents of the donor and the authorized representative of the interests of the minor beneficiary;

- child's birth certificate and passport upon reaching the age of 14;

- document of title for part of the apartment (grounds for entering into inheritance rights, purchase and sale agreement, deed of gift from the previous donor, agreement of equity participation when purchased on the primary real estate market, certificate of privatization);

- supporting document - in 2021, an extract from the Unified State Register of Real Estate, a pre-existing certificate of ownership is subject to exchange upon concluding transactions;

- cadastral and technical passport issued by the technical inventory bureau, with visualization of a specific part of the owned property;

- extract about registered persons;

- certificates from utility services confirming that there are no outstanding payments regarding the allocated portion;

- notarized consent of the second half of the marriage union upon alienation of part of the property acquired during the marriage;

- receipts from a banking institution for payment of notary services and state fees for state registration of the transaction in Rosreestr.

If the child has reached the age of 14, then appearing before a notary to sign a donation agreement for a share of the apartment is a prerequisite. If the age of the donee is less than 14 years, the document is signed in the presence of a notary by a parent or other legal representative of the interests of the minor.

: Sample agreement for donating a share of an apartment to a minor child (71.0 KiB, 1,003 hits)

Agreement for donating an apartment to a minor (70.0 KiB, 293 hits)